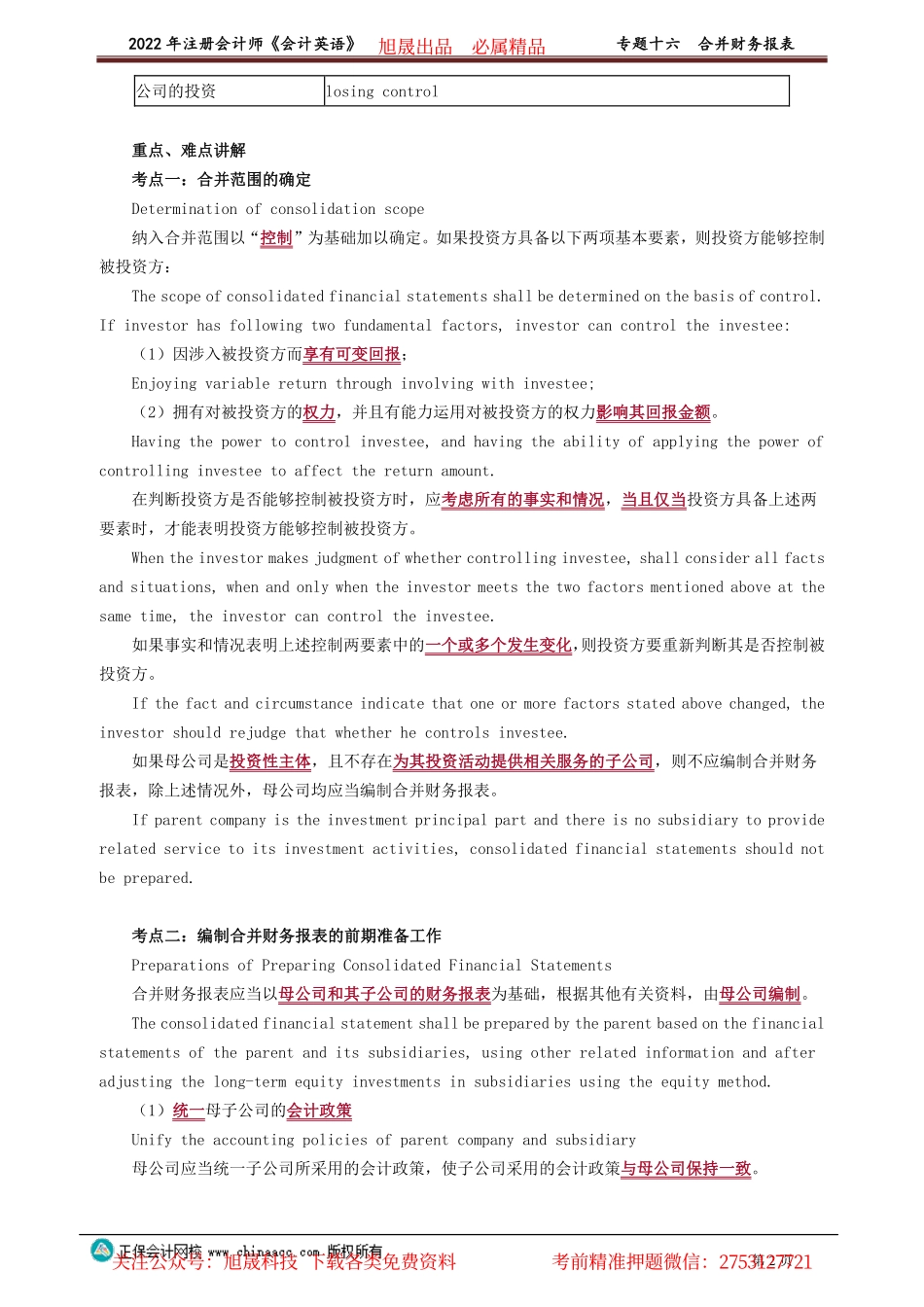

2022年注册会计师《会计英语》专题十六合并财务报表第1页目录01考情分析02词汇归纳总结03重点、难点讲解04同步系统训练考情分析本部分属于非常重要的内容,在专业阶段的主观题中经常涉及。本部分内容较多但涉及的各个事项均具有一定规律,在做调整抵销分录时要注重总结归纳,平时做题中要养成按照总结好的思路去做题的习惯,这样在考试中遇到类似问题就可以迎刃而解。在复习时要重点关注合并范围的确定、内部存货交易的抵销、购买子公司少数股权和不丧失控制权处置子公司部分股权、丧失控制权处置子公司投资等。词汇归纳总结合并范围Consolidationscope母公司Parentcompany子公司Subsidiarycompany会计账簿Accountingbook合并财务报表Consolidatedfinancialstatement合并资产负债表Consolidatedbalancesheet合并利润表Consolidatedincomestatement合并现金流量表Consolidatedcashflowstatement合并股东权益变动表Consolidatedstatementofchangesinequity内部销售Internalsales少数股东权益Minorityinterests利润分配Profitappropriation/distribution股本Sharecapital年初余额Balanceatthebeginningofyear年末余额Balanceattheendofyear财务报告Financialreporting任意盈余公积Discretionarysurplusreserve法定盈余公积Statutorysurplusreserve其他资本公积Othercapitalreserve购买子公司少数股权Acquisitionofnon-controllinginterestinasubsidiarycompany不丧失控制权情况下处置部分对子公司投资Disposalofpartialinterestinasubsidiarycompanywithoutlosingcontrol丧失控制权情况下处置子Disposalofpartialinterestinasubsidiarycompanywith旭晟出品必属精品关注公众号:旭晟科技下载各类免费资料考前精准押题微信:27531277212022年注册会计师《会计英语》专题十六合并财务报表第2页公司的投资losingcontrol重点、难点讲解考点一:合并范围的确定Determinationofconsolidationscope纳入合并范围以“控制”为基础加以确定。如果投资方具备以下两项基本要素,则投资方能够控制被投资方:Thescopeofconsolidatedfinancialstatementsshallbedeterminedonthebasisofcontrol.Ifinvestorhasfollowingtwofundamentalfactors,investorcancontroltheinvestee:(1)因涉入被投资方而享有可变回报;Enjoyingvariablereturnthroughinvolvingwithinvestee;(2)拥有对被投资方的权力,并且有能力运用对被投资方的权力影响其回报金额。Havingthepowertocontrol...