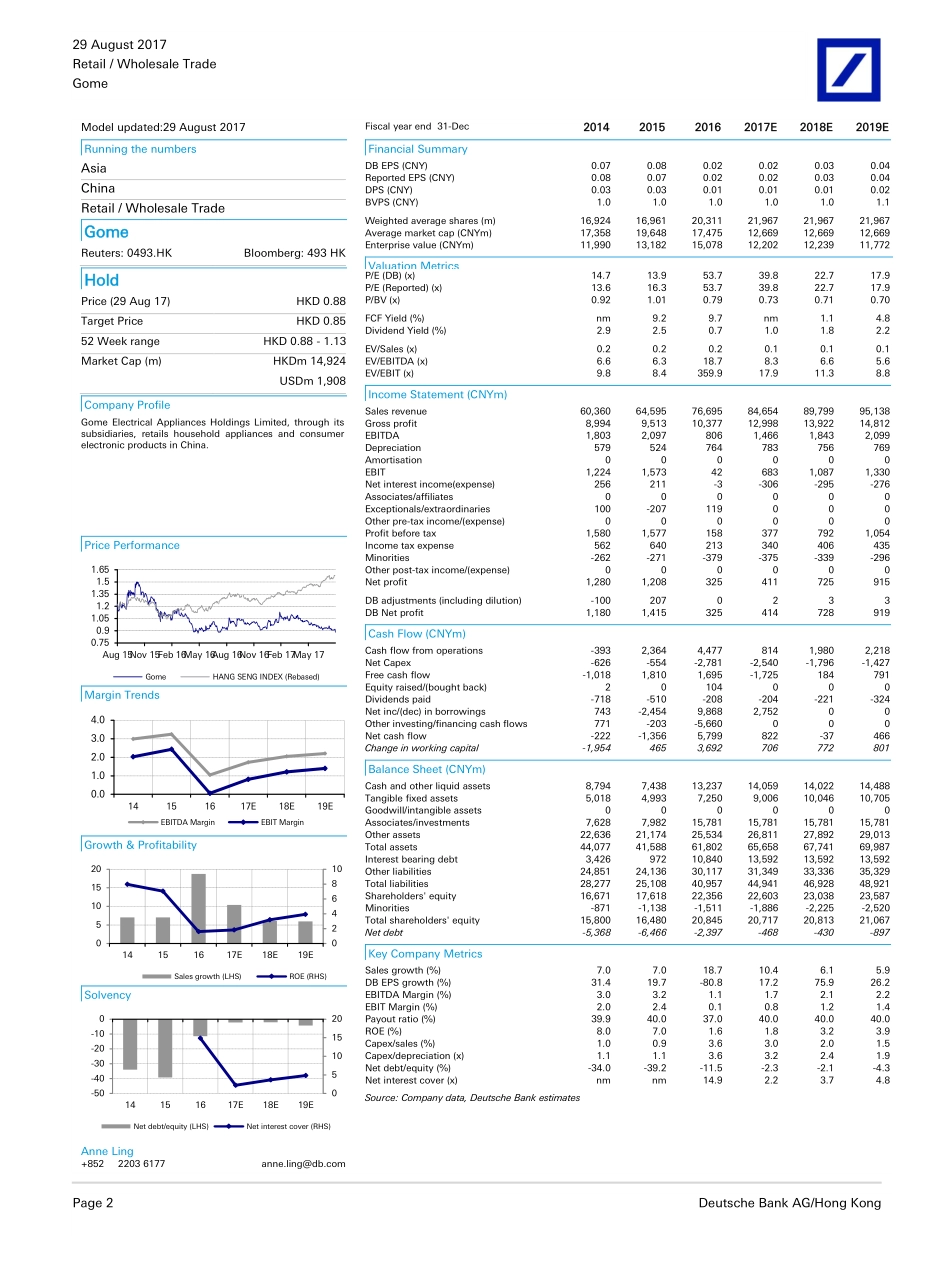

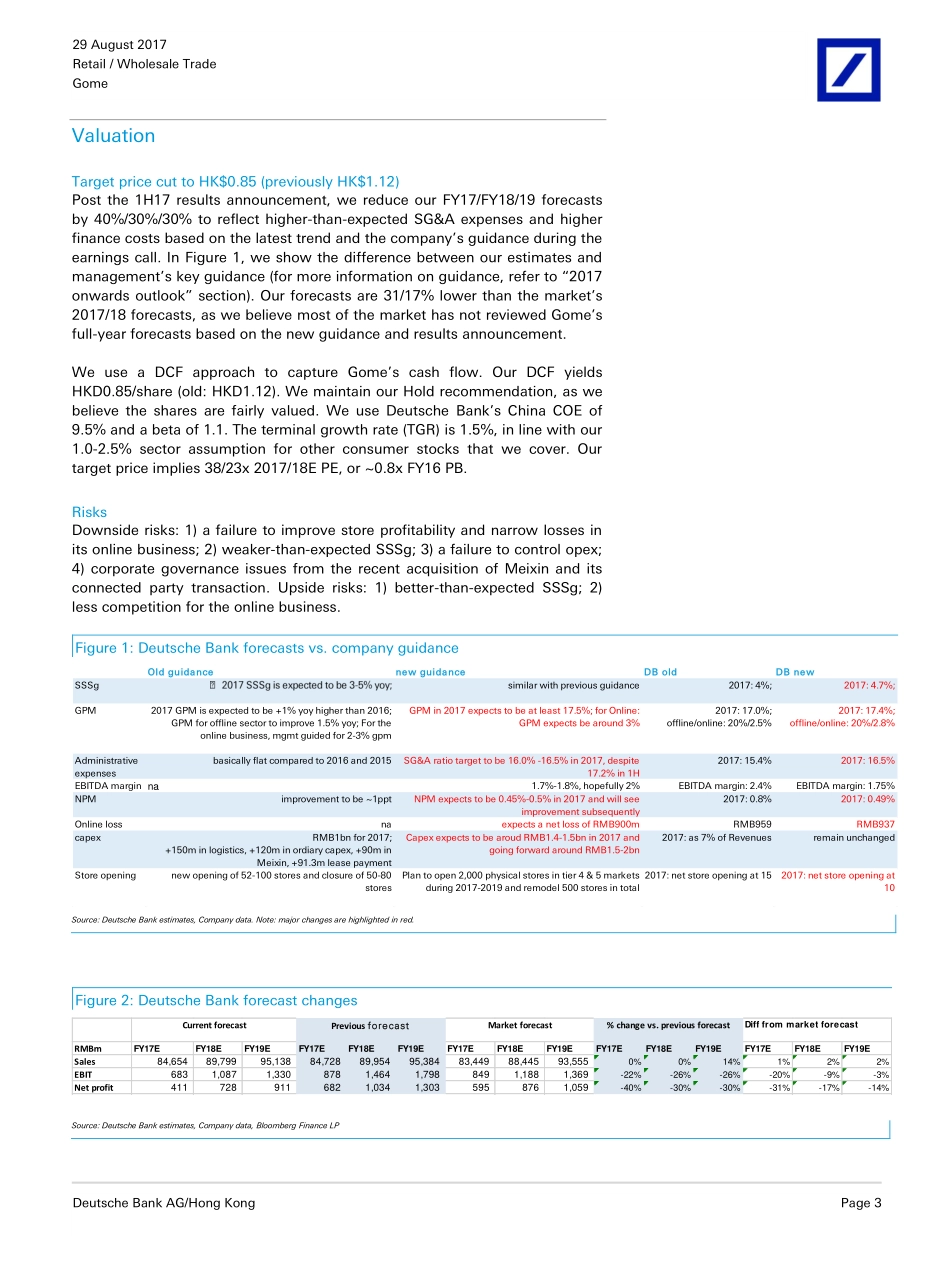

DeutscheBankMarketsResearchRatingHoldAsiaChinaConsumerRetail/WholesaleTradeCompanyGomeDate29August2017ForecastChangeHigherSG&Acoststriggeredbybusinesstransformation;HoldReutersBloombergExchangeTicker0493.HK493HKHSI0493ADRTickerISINGMELYUS3817351097ForecastsAndRatiosYearEndDec312015A2016A2017E2018E2019ESales(CNYm)64,595.176,695.084,654.589,799.395,138.1EBITDA(CNYm)2,097.4805.61,466.41,843.32,099.0ReportedNPAT(CNYm)1,208.0325.1411.5724.7915.4ReportedEPSFD(CNY)0.070.020.020.030.04DBEPSFD(CNY)0.080.020.020.030.04OLDDBEPSFD(CNY)0.080.020.030.050.06%Change0.0%0.0%-39.6%-29.9%-29.7%DBEPSgrowth(%)19.7-80.817.275.926.2PER(x)13.953.739.822.717.9EV/EBITDA(x)6.318.78.36.65.6DPS(net)(CNY)0.030.010.010.010.02Yield(net)(%)2.50.71.01.82.2Source:DeutscheBankestimates,companydata1DBEPSisfullydilutedandexcludesnon-recurringitems2Multiplesandyieldscalculationsuseaveragehistoricalpricesforpastyearsandspotpricesforcurrentandfutureyears,exceptP/BwhichusestheyearendcloseLoweringTPby24%toreflectlowerNPforecastsin2017/18/19.Hold.________________________________________________________________________________________________________________DeutscheBankAG/HongKongDeutscheBankdoesandseekstodobusinesswithcompaniescoveredinitsresearchreports.Thus,investorsshouldbeawarethatthefirmmayhaveaconflictofinterestthatcouldaffecttheobjectivityofthisreport.Investorsshouldconsiderthisreportasonlyasinglefactorinmakingtheirinvestmentdecision.DISCLOSURESANDANALYSTCERTIFICATIONSARELOCATEDINAPPENDIX1.MCI(P)083/04/2017.Priceat29Aug2017(HKD)0.88Pricetarget-12mth(HKD)0.8552-weekrange(HKD)1.13-0.88HANGSENGINDEX27,863AnneLingResearchAnalyst(+852)22036177anne.ling@db.comKeychangesTP1.12to0.85↓-24.1%Sales(FYE)84,728to84,654↓-0.1%Opprofmargin(FYE)1.0to0.8↓-22.2%Netprofit(FYE)681.8to411.5↓-39.7%Source:DeutscheBankPrice/pricerelative0.750.91.051.21.351.51.658/152/168/162/17GomeHANGSENGINDEX(Rebased)Performance(%)1m3m12mAbsolute-5.4-12.9-4.3HANGSENGINDEX3.38.422.1Source:DeutscheBankWelowerour2017/18/19netprofitforeca...