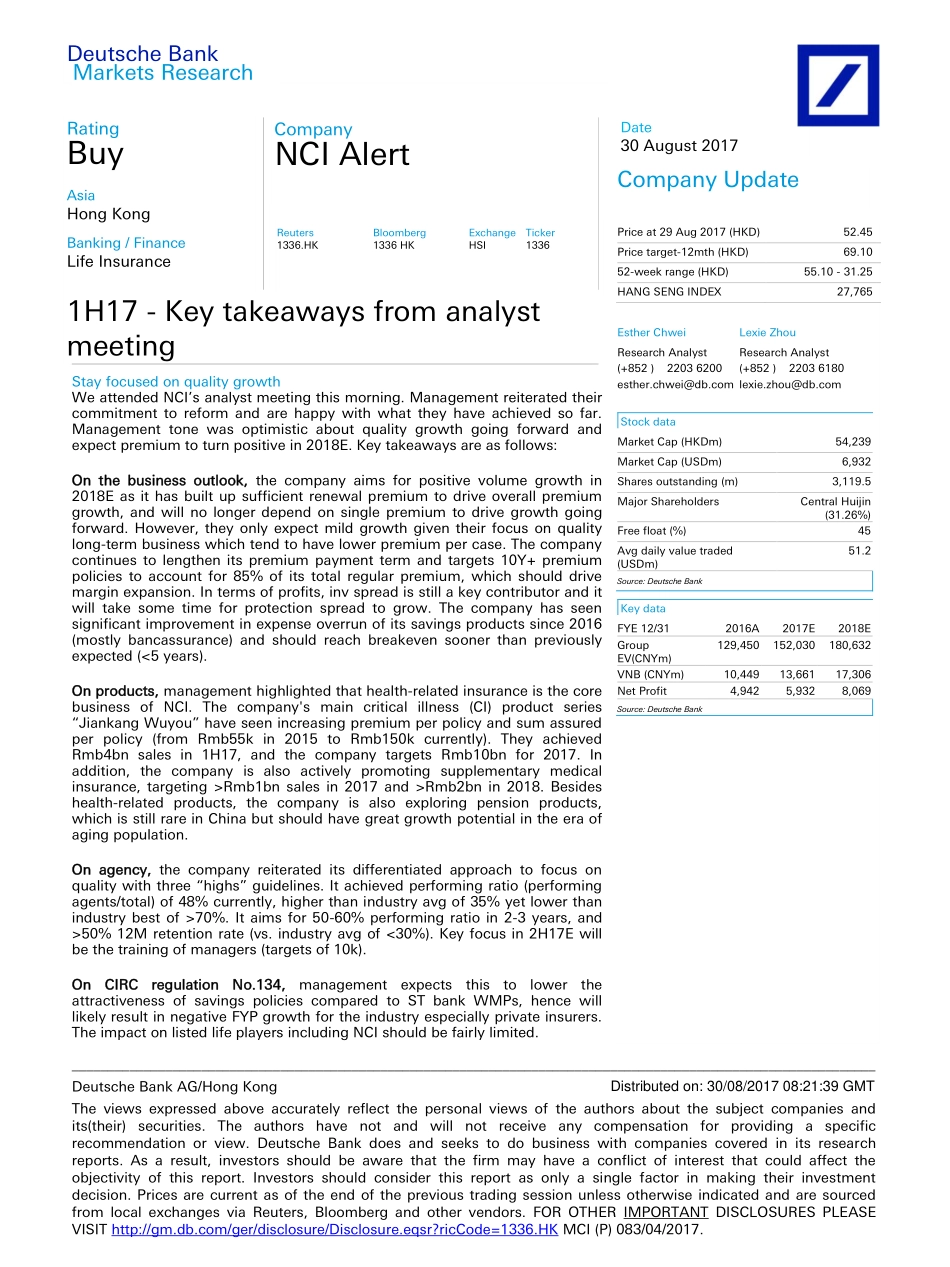

DeutscheBankMarketsResearchRatingBuyAsiaHongKongBanking/FinanceLifeInsuranceCompanyNCIAlertDate30August2017CompanyUpdate1H17-KeytakeawaysfromanalystmeetingReutersBloombergExchangeTicker1336.HK1336HKHSI1336________________________________________________________________________________________________________________DeutscheBankAG/HongKongTheviewsexpressedaboveaccuratelyreflectthepersonalviewsoftheauthorsaboutthesubjectcompaniesandits(their)securities.Theauthorshavenotandwillnotreceiveanycompensationforprovidingaspecificrecommendationorview.DeutscheBankdoesandseekstodobusinesswithcompaniescoveredinitsresearchreports.Asaresult,investorsshouldbeawarethatthefirmmayhaveaconflictofinterestthatcouldaffecttheobjectivityofthisreport.Investorsshouldconsiderthisreportasonlyasinglefactorinmakingtheirinvestmentdecision.PricesarecurrentasoftheendoftheprevioustradingsessionunlessotherwiseindicatedandaresourcedfromlocalexchangesviaReuters,Bloombergandothervendors.FOROTHERIMPORTANTDISCLOSURESPLEASEVISIThttp://gm.db.com/ger/disclosure/Disclosure.eqsr?ricCode=1336.HKMCI(P)083/04/2017.Priceat29Aug2017(HKD)52.45Pricetarget-12mth(HKD)69.1052-weekrange(HKD)55.10-31.25HANGSENGINDEX27,765EstherChweiResearchAnalyst(+852)22036200esther.chwei@db.comLexieZhouResearchAnalyst(+852)22036180lexie.zhou@db.comStockdataMarketCap(HKDm)54,239MarketCap(USDm)6,932Sharesoutstanding(m)3,119.5MajorShareholdersCentralHuijin(31.26%)Freefloat(%)45Avgdailyvaluetraded(USDm)51.2Source:DeutscheBankKeydataFYE12/312016A2017E2018EGroupEV(CNYm)129,450152,030180,632VNB(CNYm)10,44913,66117,306NetProfit4,9425,9328,069Source:DeutscheBankStayfocusedonqualitygrowthWeattendedNCI’sanalystmeetingthismorning.Managementreiteratedtheircommitmenttoreformandarehappywithwhattheyhaveachievedsofar.Managementtonewasoptimisticaboutqualitygrowthgoingforwardandexpectpremiumtoturnpositivein2018E.Keytakeawaysareasfollows:Onthebusinessoutlook,thecompanyaimsforpositivevolumegrowthin2018Easithasbuiltupsufficientrenewalpremiumtodriveoverallp...