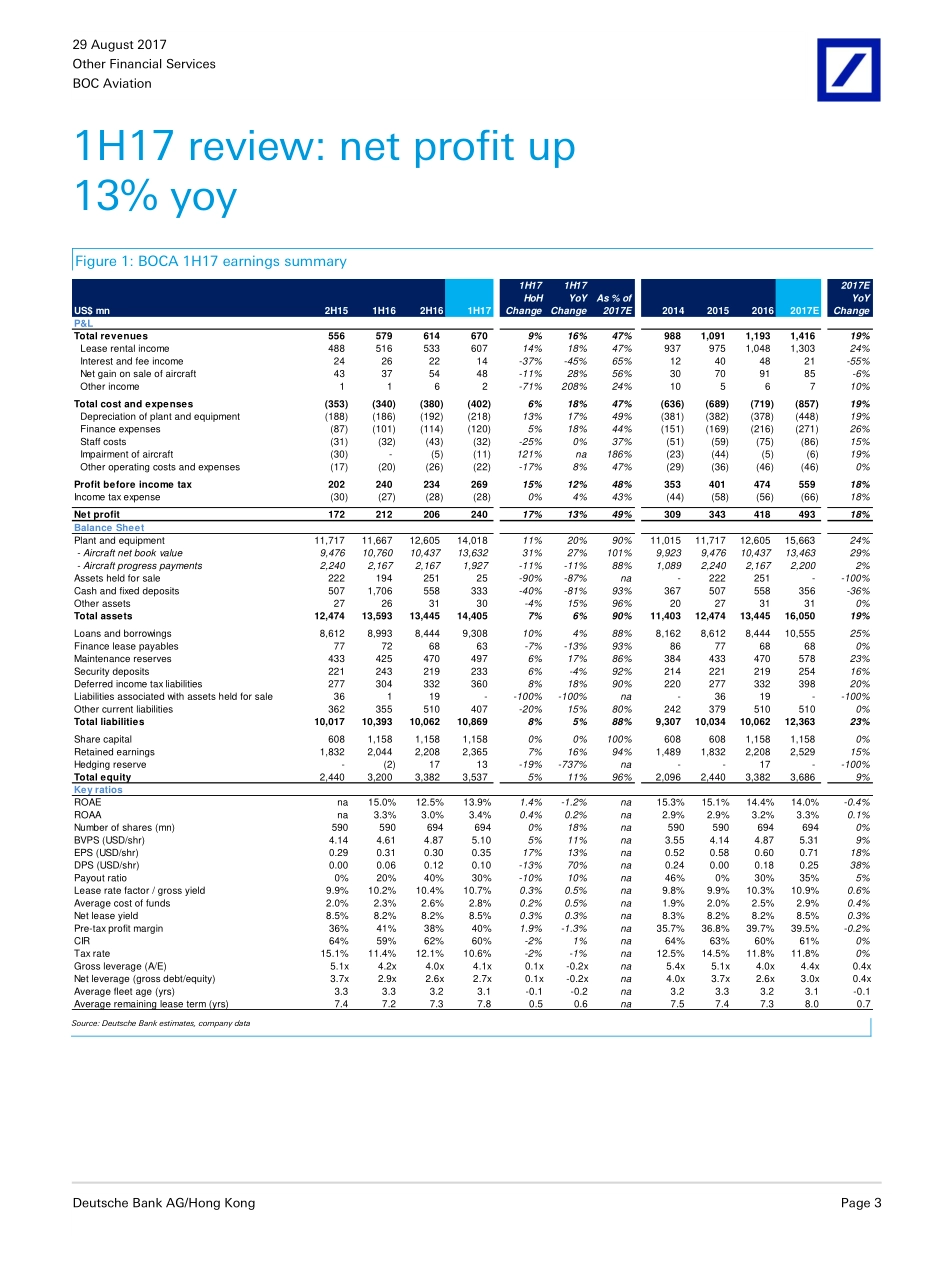

DeutscheBankMarketsResearchRatingBuyAsiaSingaporeBanking/FinanceOtherFinancialServicesCompanyBOCAviationDate29August2017ResultsGoodqualityresultswithpayoutratioguidancelifted;BuyReutersBloombergExchangeTicker2588.HK2588HKHSI2588Visiblegrowth,expandingnetyieldandhigherpayoutratio;liftingTPtoHK$49________________________________________________________________________________________________________________DeutscheBankAG/HongKongDeutscheBankdoesandseekstodobusinesswithcompaniescoveredinitsresearchreports.Thus,investorsshouldbeawarethatthefirmmayhaveaconflictofinterestthatcouldaffecttheobjectivityofthisreport.Investorsshouldconsiderthisreportasonlyasinglefactorinmakingtheirinvestmentdecision.DISCLOSURESANDANALYSTCERTIFICATIONSARELOCATEDINAPPENDIX1.MCI(P)083/04/2017.Priceat29Aug2017(HKD)41.00Pricetarget-12mth(HKD)49.0052-weekrange(HKD)43.30-37.50HANGSENGINDEX27,863JackyZuoResearchAnalyst(+852)22036255jacky.zuo@db.comHansFan,CFAResearchAnalyst(+852)22036353hans.fan@db.comKeychangesTP48.00to49.00↑2.1%Netprofit(FYE)483.0to493.4↑2.2%Source:DeutscheBankPrice/pricerelative3640444852566/1612/166/17BOCAviationHANGSENGINDEX(Rebased)Performance(%)1m3m12mAbsolute1.03.98.9HANGSENGINDEX3.38.422.1Source:DeutscheBankBOCAreported1H17resultswithnetprofitofUS$240mn,up13%yoy/17%hohandinlinewithourforecast.Despitelower-than-expectedsalesgains,thelessormanagedtoexpandnetyieldto8.5%in1H17from8.2%in2016.2H17willbeanotherbusyhalfyearforthecompanywith41aircraftdeliveriesscheduled(vs.37in1H17).Thecompanyliftedits1H17payoutratioto30%from20%in1H16andrevisedfullyearpayoutguidancefrom30%to35%.Weviewthisasapositivemovetoimproveshareholders’return.Thestocktradesat1.0x2017EP/Bwith14-15%ROEand4-5%yield.BuywithHK$49TP.Keyresultshighlightsin1H17Revenuegrewby16%yoy,drivenbyleaseincome(+18%yoy)andaircraftsalesgains(+28%yoy).Itsold19aircraftin1H17vs.22in1H16.Interestandfeeincomedroppedby45%yoyduetolowerpre-deliverypayments.Netleaseyieldexpandedto8.5%from8.2%in2016,withfasterrepricingofassetyield(10...