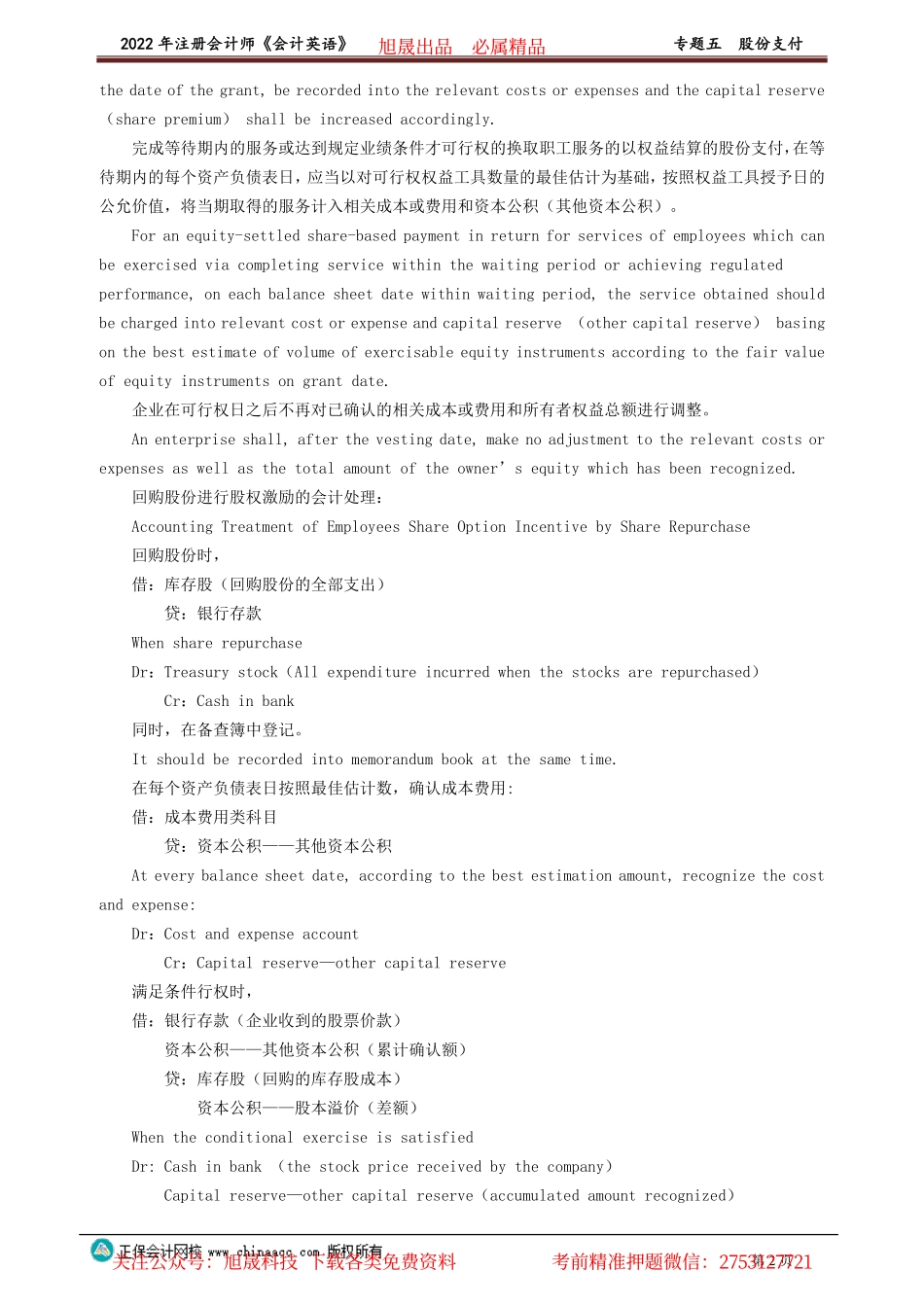

2022年注册会计师《会计英语》专题五股份支付第1页目录01考情分析02词汇归纳总结03重点、难点讲解04同步系统训练考情分析随着各公司股权激励机制的推行,股份支付的会计处理成为近年考试的热点。从历年专业阶段考试情况来看,主要会考查两种股份支付方式下对报表项目的影响,具有一定的综合性。在复习时应重点把握权益结算的股份支付和现金结算的股份支付以及集团内股份支付的处理。词汇归纳总结权益结算的股份支付Equity-settledshare-basedpayment行权Exercisetheright等待期Waitingperiod资产负债表日Balancesheetdate可行权权益工具Vestedequityinstrument授予日Grantdate行权日Vestingdate现金结算的股份支付Cash-settledshare-basedpayment承担负债Assumeliability结算日Settlementdate集团股份支付Groupshare-basedpayment结算企业Settlemententity接受服务企业Entityreceivingservice股本/资本溢价Share/Capitalpremium重点、难点讲解考点一:权益结算的股份支付的确认和计量RecognitionandMeasurementofEquity-settledShare-basedPayments以权益结算的股份支付换取职工提供服务的,应当以授予职工权益工具的公允价值计量。Theequity-settledshare-basedpaymentinreturnforemployeeservicesshallbemeasuredatthefairvalueoftheequityinstrumentsgrantedtotheemployees.授予后立即可行权的换取职工服务的权益结算的股份支付,应当在授予日按照权益工具的公允价值计入相关成本或费用,相应增加资本公积(股本溢价)。Foranequity-settledshare-basedpaymentinreturnforservicesofemployees,whichcanbeexercisedimmediatelyafterthegrant,thefairvalueoftheequityinstrumentsshall,on旭晟出品必属精品关注公众号:旭晟科技下载各类免费资料考前精准押题微信:27531277212022年注册会计师《会计英语》专题五股份支付第2页thedateofthegrant,berecordedintotherelevantcostsorexpensesandthecapitalreserve(sharepremium)shallbeincreasedaccordingly.完成等待期内的服务或达到规定业绩条件才可行权的换取职工服务的以权益结算的股份支付,在等待期内的每个资产负债表日,应当以对可行权权益工具数量的最佳估计为基础,按照权益工具授予日的公允价值,将当期取得的服务计入相关成本或费用和资本公积(其他资本公积)。Foranequity-settledshare-basedpaymentinreturnforservicesofemployeeswhichcanbeexercisedviacompletingservicewithinthew...