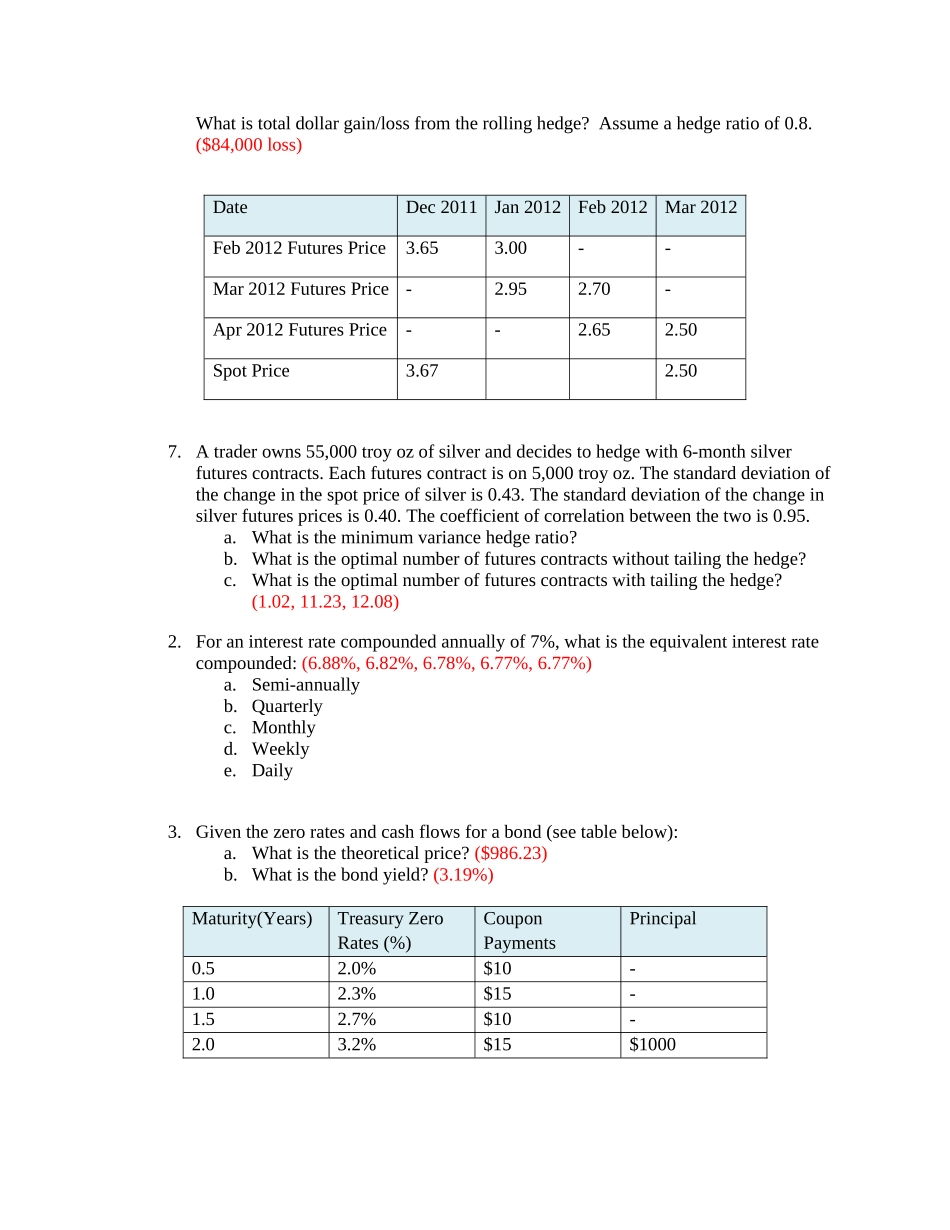

EXTRAPROBLEMSNewto8thEdition1.InJuly,asmallchocolatefactoryreceivesalargeorderforchocolatebarstobedeliveredinNovember.ThespotpriceforCocoais$2,400permetricton.Itwillneed10metrictonsofCocoainSeptembertofillthisorder.Becauseoflimitedstoragecapacityandvolatilityintheworldcocoaprices,thecompanydecidesthebeststrategyistobuy10calloptionsfor$53eachwithstrikepriceof$2,400(equaltothecurrentprice)withamaturitydateofSeptember2012.WhentheoptionsexpireinSeptember,howmuchwillthecompanypay(includingthecostoftheoptions)forcocoaifthespotpriceinSeptemberprovestobe:a)$2,300,andb)$2,600?($23,530,$24,530)2.AtraderinvestsinFacebookbybuying1000sharesinJunefor$27pershare.Shealsobuys1000putoptionsfor$5eachasinsuranceincasethestockdropssharply.Theputoptionshaveastrikepriceof$27andamaturitydateofDecember.WhatisthegainorlossifthespotpriceonDecemberis:a)$20,b)$27,c)$32andd)$37?($5,000loss,$5,000loss,$0,$5,000gain)3.ThespotpriceforGooglestockis$578onJune6.Atraderconsiderstwoalternatives:buy100sharesofthestock,orbuy100EuropeancalloptionsonGooglefor$38eachwithastrikepriceof$575andmaturitydateofSeptember2012.Foreachalternative,whatis:a)theupfrontcost?b)thetotalgainifthestockpriceatmaturityis$650?c)thetotallossifthestockpriceis$500atmaturity?($57,800and$3,800;$7,200and$3,700;-$7,800and-$3,800)4.Atradertakesthelongpositionandahedgefundtakesashortpositiononten1-monthS&P500futurescontractsat1300.AsingleS&P500futurescontractequals($250)x(IndexValue).Theinitialmarginis$325,000andthemaintenancemarginis$245,000forbothaccounts.Tentradingdayslater,thefuturespriceoftheindexdropsto1,260triggeringamargincallforthetrader.Whatisthechangemarginaccountbalance(indicategainorloss)for:a)thetraderandb)thehedgefund?Whatisthemargincallforthetrader?(trader:$100,000loss,hedgefund:$100,000gain,margincall:$100,000)5.AspeculatorsellsaJuly2013wheatfuturescontractat721centsperbushel.Eachfuturescontractisfor5,000bushels.Thefuturespricedropsto676onDecember31,2012andrisesto712inMay2013whensheclosesthecontract.Whatisthegainorlos...