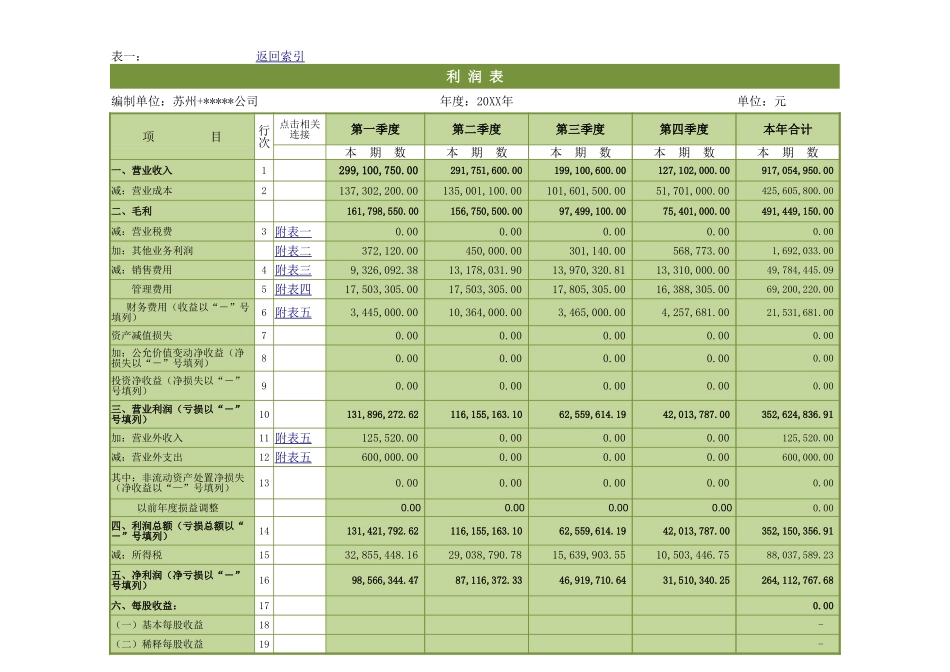

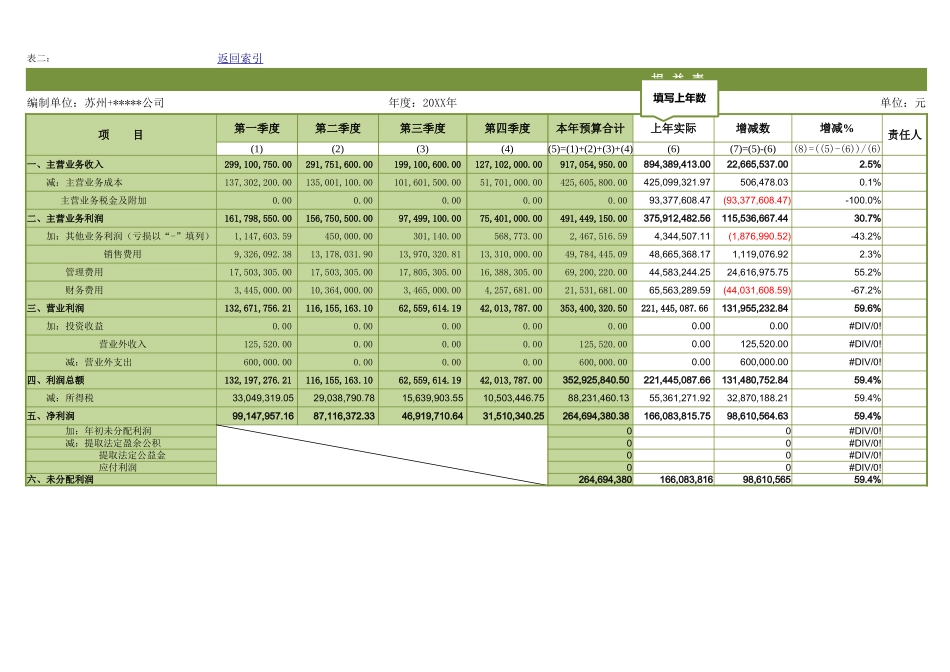

20XX年财务总结报表目录索引编制单位:苏州+*****公司年度:20XX年一、利润表损益表税金及附加表其他业务利润表销售费用明细表管理费用明细表财务费用明细表营业外收支明细表二、资产负债表三、财务指标计算表四、非财务指标计算表五、企业所得税¤说明:点击表格名称即可连接到相关表格填写单位以及年度表一:利润表单位:元项目第一季度第二季度第三季度第四季度本年合计本期数本期数本期数本期数本期数一、营业收入1299,100,750.00291,751,600.00199,100,600.00127,102,000.00917,054,950.00减:营业成本2137,302,200.00135,001,100.00101,601,500.0051,701,000.00425,605,800.00二、毛利161,798,550.00156,750,500.0097,499,100.0075,401,000.00491,449,150.00减:营业税费30.000.000.000.000.00加:其他业务利润372,120.00450,000.00301,140.00568,773.001,692,033.00减:销售费用49,326,092.3813,178,031.9013,970,320.8113,310,000.0049,784,445.09管理费用517,503,305.0017,503,305.0017,805,305.0016,388,305.0069,200,220.0063,445,000.0010,364,000.003,465,000.004,257,681.0021,531,681.00资产减值损失70.000.000.000.000.0080.000.000.000.000.0090.000.000.000.000.0010131,896,272.62116,155,163.1062,559,614.1942,013,787.00352,624,836.91加:营业外收入11125,520.000.000.000.00125,520.00减:营业外支出12600,000.000.000.000.00600,000.00130.000.000.000.000.00以前年度损益调整0.000.000.000.000.0014131,421,792.62116,155,163.1062,559,614.1942,013,787.00352,150,356.91减:所得税1532,855,448.1629,038,790.7815,639,903.5510,503,446.7588,037,589.231698,566,344.4787,116,372.3346,919,710.6431,510,340.25264,112,767.68六、每股收益:170.00(一)基本每股收益18-(二)稀释每股收益19-返回索引编制单位:苏州+*****公司年度:20XX年行次点击相关连接附表一附表二附表三附表四财务费用(收益以“-”号填列)附表五加:公允价值变动净收益(净损失以“-”号填列)投资净收益(净损失以“-”号填列)三、营业利润(亏损以“-”号填列)附表五附表五其中:非流动资产处置净损失(净收益以“—”号填列)四、利润总额(亏损总额以“-”号填列)五、净利润(净亏损以“-”号填列)表二:单位:元项目第一季度第二季度第三季度第四季度本年预算合计上年实际增减数责任人(1)(2)(3)(4)(5)=(1)+(2)+(3)+(4)(6)(7)=(...