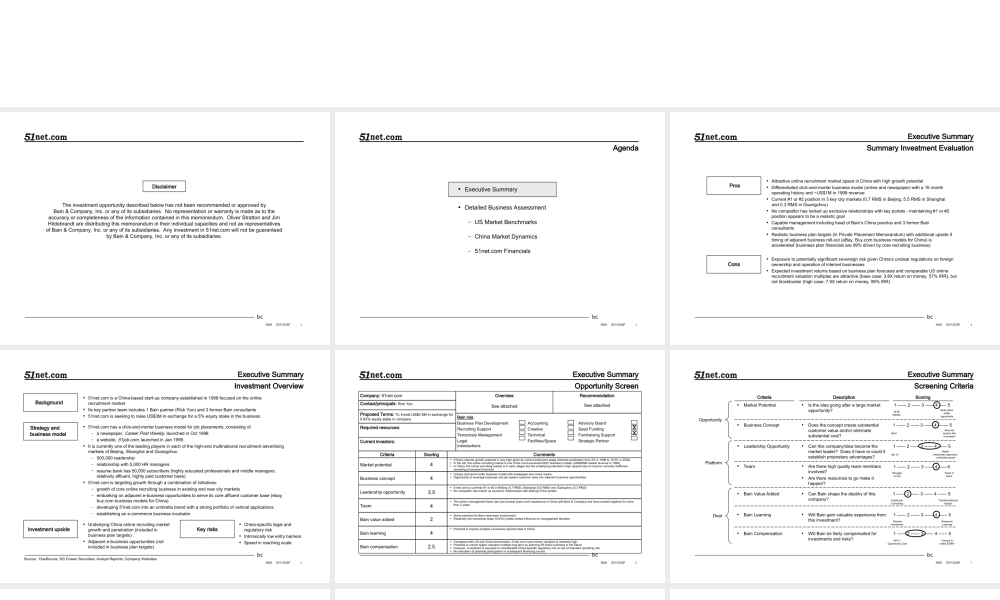

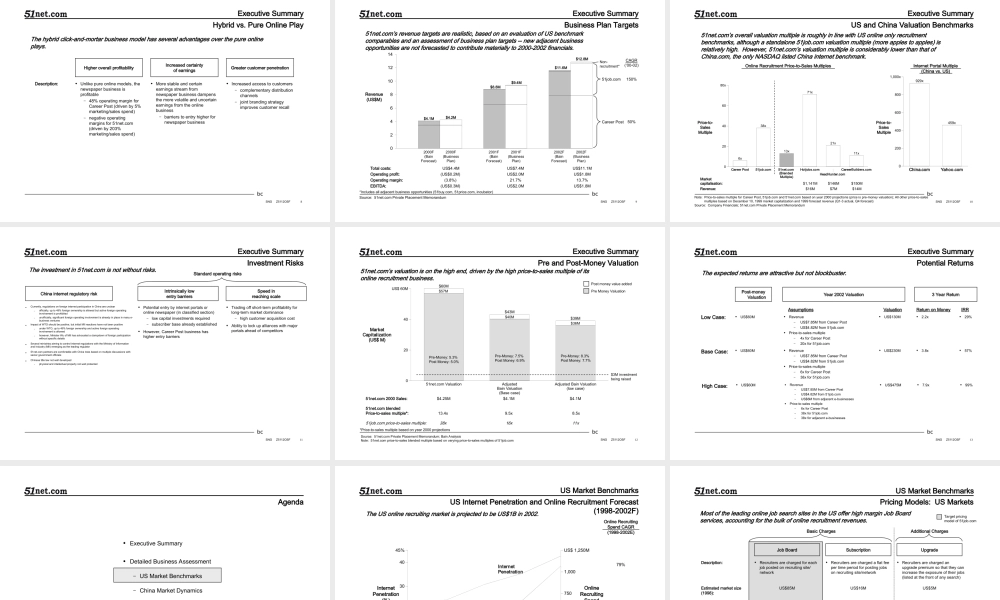

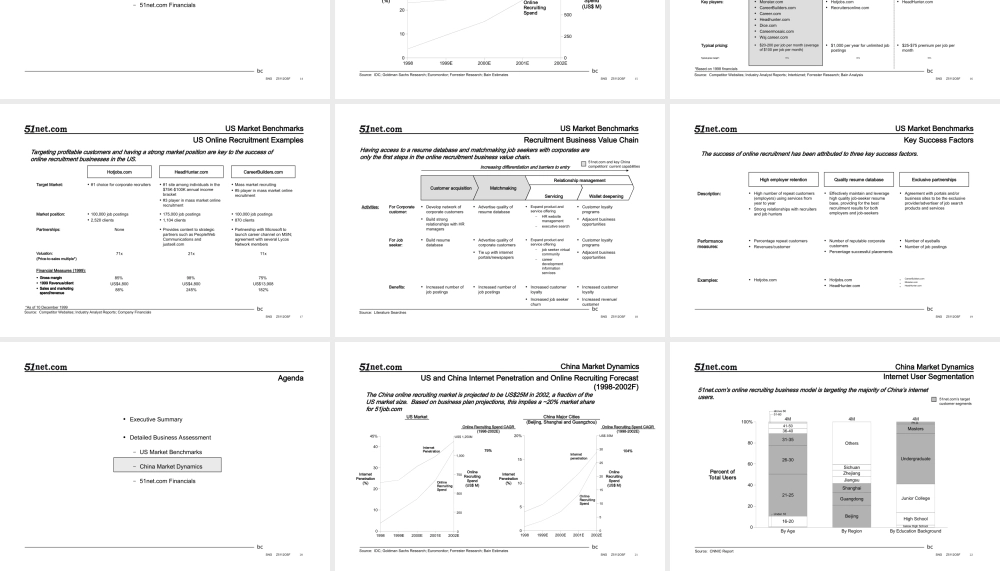

BcInvestmentDueDiligenceAssessment23December19992Z5112OSFbcSNGDisclaimerTheinvestmentopportunitydescribedbelowhasnotbeenrecommendedorapprovedbyBain&Company,Inc.oranyofitssubsidiaries.Norepresentationorwarrantyismadeastotheaccuracyorcompletenessoftheinformationcontainedinthismemorandum.OliverStrattonandJimHildebrandtaredistributingthismemorandumintheirindividualcapacitiesandnotasrepresentativesofBain&Company,Inc.oranyofitssubsidiaries.Anyinvestmentin51net.comwillnotbeguaranteedbyBain&Company,Inc.oranyofitssubsidiaries.3Z5112OSFbcSNGAgenda•ExecutiveSummary•DetailedBusinessAssessment–USMarketBenchmarks–ChinaMarketDynamics–51net.comFinancials4Z5112OSFbcSNG•AttractiveonlinerecruitmentmarketspaceinChinawithhighgrowthpotential•Differentiatedclick-and-mortarbusinessmodel(onlineandnewspaper)witha16monthoperatinghistoryand~US$1Min1999revenue•Current#1or#2positionin3keycitymarkets(0.7RMSinBeijing,5.5RMSinShanghaiand0.3RMSinGuangzhou)•Nocompetitorhaslockedupexclusiverelationshipswithkeyportals-maintaining#1or#2positionappearstobearealisticgoal•CapablemanagementincludingheadofBain’sChinapracticeand3formerBainconsultants•Realisticbusinessplantargets(inPrivatePlacementMemorandum)withadditionalupsideiftimingofadjacentbusinessroll-out(eBay,Buy.combusinessmodelsforChina)isaccelerated(businessplanfinancialsare99%drivenbycorerecruitingbusiness)•ExposuretopotentiallysignificantsovereignriskgivenChina’sunclearregulationsonforeignownershipandoperationofinternetbusinesses•ExpectedinvestmentreturnsbasedonbusinessplanforecastsandcomparableUSonlinerecruitmentvaluationmultiplesareattractive(basecase:3.8Xreturnonmoney,57%IRR),butnotblockbuster(highcase:7.9Xreturnonmoney,99%IRR)ProsConsSummaryInvestmentEvaluationExecutiveSummary5Z5112OSFbcSNGExecutiveSummarySource:OneSource;SGCowenSecurities;AnalystReports;CompanyWebsites•51net.comisaChina-basedstart-upcompanyestablishedin1998focusedontheonlinerecruitmentmarket•Itskeypartnerteamincludes1Bainpartner(RickYan)and3formerBainconsu...