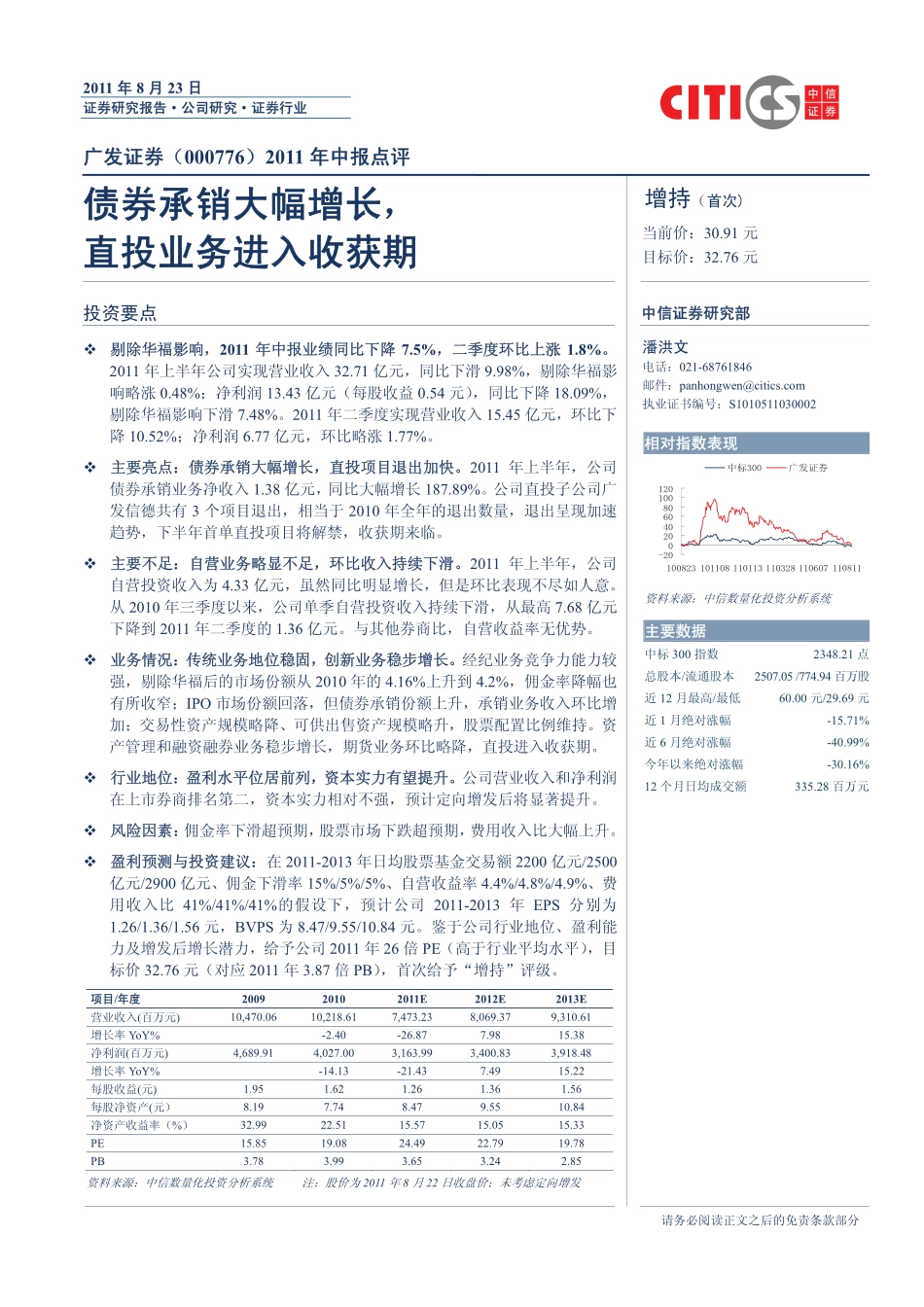

����������������2011�8�23����������������������000776�2011������������������������������������30.91�����32.76���������������������2011���������7.5%��������1.8%�2011������������32.71�������9.98%���������0.48%����13.43�������0.54�������18.09%���������7.48%�2011����������15.45�������10.52%����6.77�������1.77%�������������������������2011����������������1.38���������187.89%��������������3���������2010�������������������������������������������������������������2011��������������4.33�������������������������2010�������������������������7.68�����2011�����1.36������������������������������������������������������������������2010��4.16%���4.2%������������IPO������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������2011-2013����������2200��/2500��/2900��������15%/5%/5%������4.4%/4.8%/4.9%������41%/41%/41%���������2011-2013�EPS���1.26/1.36/1.56��BVPS�8.47/9.55/10.84����������������������������2011�26�PE��������������32.76����2011�3.87�PB���������������/��200920102011E2012E2013E����(���)10,470.0610,218.617,473.238,069.379,...