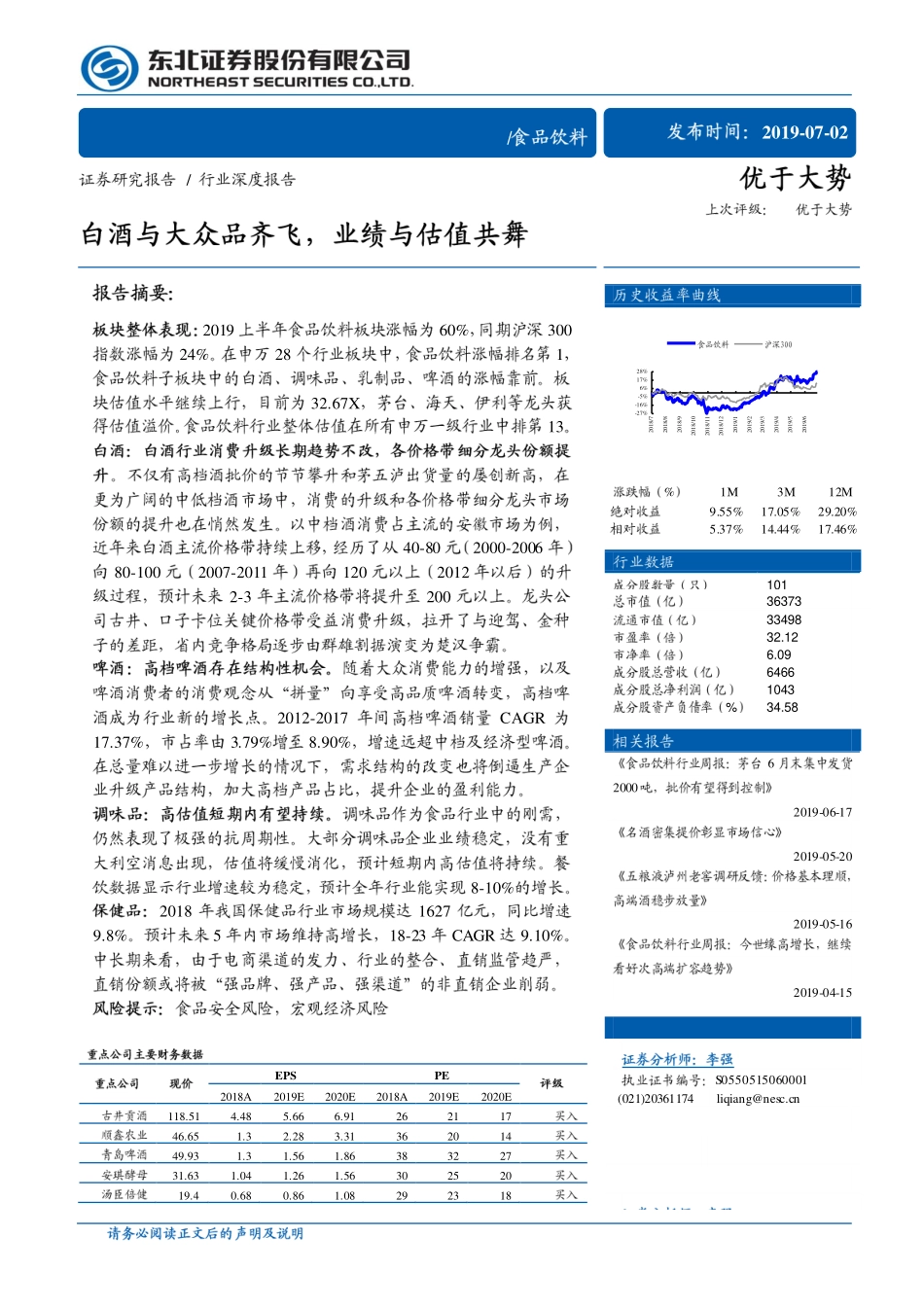

[Table_MainInfo][Table_Title]/[Table_Summary]201960%30024%28132.67X1340-802000-200680-1002007-201112020122-32002012-2017CAGR17.37%3.79%8.90%8-10%201816279.8%518-23CAGR9.10%[Table_CompanyFinance]EPSPE2018A2019E2020E2018A2019E2020E118.514.485.666.9126211746.651.32.283.3136201449.931.31.561.8638322731.631.041.261.5630252019.40.680.861.08292318[Table_Invest][Table_PicQuote]-27%-16%-5%6%17%28%2018/72018/82018/92018/102018/112018/122019/12019/22019/32019/42019/52019/6[Table_Trend]%1M3M12M9.55%17.05%29.20%5.37%14.44%17.46%[Table_IndustryMarket]101363733349832.126.0964661043%34.58[Table_Report]620002019-06-172019-05-202019-05-162019-04-15[Table_Author]S0550515060001(021)20361174liqiang@nesc.cnS0550515060001(021)20361174liqiang@nesc.cnS0550518120001S0550518120001/2019-07-0221382582/36139/2019070216:322/30[Table_PageTop]1.2019............................................................................51.1............................................................................................51.2....................................................................................................72..............82.1........................................................82.1.1.......................................................................82.1.2.........................................................92.1.3.2502021320..........................................112.1.4...........................................................132.2..........................................142.2.1.....................................................................142.2.2.........................................................................163.........................................................163.1..............................................163.2..................................................................183.2.1.........................................184.........................................................204.1.........................................................