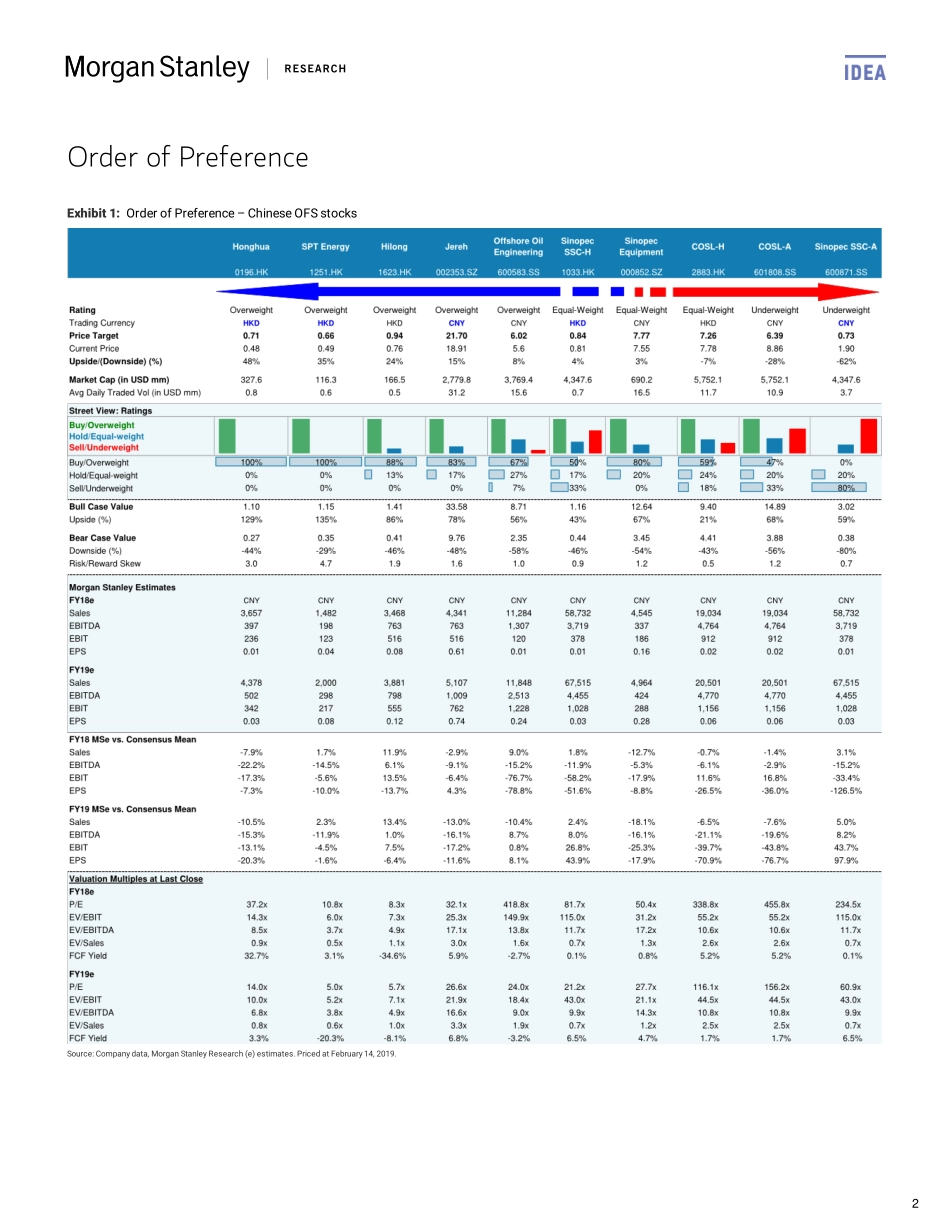

Andy.Meng@morganstanley.comJack.Lu@morganstanley.comAlbert.Li@morganstanley.comAttractiveMORGANSTANLEYASIALIMITED+AndyMeng,CFAEQUITYANALYST+8522239-7689JackLuEQUITYANALYST+8522848-5044AlbertLiRESEARCHASSOCIATE+8523963-3610MorganStanleyappreciatesyoursupportinthe2019InstitutionalInvestorAll-AsiaResearchTeamSurvey.Requestyourballot.ChinaEnergy&ChemicalsAsiaPacificIndustryViewWhat'sChangedFROMTOYantaiJerehOilfieldServicesGroup(002353.SZ)RatingEqual-weightOverweightPriceTargetRmb16.96Rmb21.70HonghuaGroupLtd.(0196.HK)PriceTargetHK$0.67HK$0.71SPTEnergyGroupInc(1251.HK)PriceTargetHK$0.64HK$0.66SinopecOilfieldServiceCorp(1033.HK)PriceTargetHK$0.67HK$0.84SinopecOilfieldServiceCorp(600871.SS)PriceTargetRmb0.59Rmb0.73ChinaEnergy&Chemicals–OilfieldServicesChinaEnergy&Chemicals–OilfieldServices||AsiaAsiaPacificPacificShaleOilRevolutioninChina?WebelievetheJimsarshaleoildiscoveryislikelytotriggerChina'sshaleoilrevolution.Weexpectafurthercapexrisein2019,whichcouldmakeonshoreOFSnamesthekeybeneficiaries.WeupgradeJerehtoOWandreiterateourOWratingsonHonghuaandSPTEnergy.What'snew:WhileinvestorsareawareofshalegasinChina(withSinopecFuling,PetroChinaChangning&Weiyuan,andsoon),mostinvestorsarenotawareofshaleoilinthecountry.AfterthenewdiscoveryinXinjiang,weexpectashaleoilrevolutioninChina.OnshoreOFSnamesarethekeybeneficiaries:Webelieveonshoreoilfieldservices(OFS)companieswillbecomethekeybeneficiaries.ThenewshaleoilopportunitycouldencourageChineseoil&gascompaniestoinvestmorecapexintotheupstreamE&Psegments,whichcouldintroducelargerrevenueopportunities.Besidesthis,theshaleoildrillingusuallyinvolveshorizontaldrillingandfracturing,whichislikelytointroducehigheroilserviceworkloads.WebelievealltheonshoreOFSnameswillbecomethekeybeneficiaries.Fracturingequipmentdemandtorise;upgradeJerehtoOW:Ourchannelchecksuggeststhatfracturingequipmenthasalreadyexperiencedtightsupplyinthedomesticmarket,mainlythankstoSinopec'sandPetroChina'sproactiveshalegasactivitiesin2018.Consideringtheincrementaldemandfromshal...