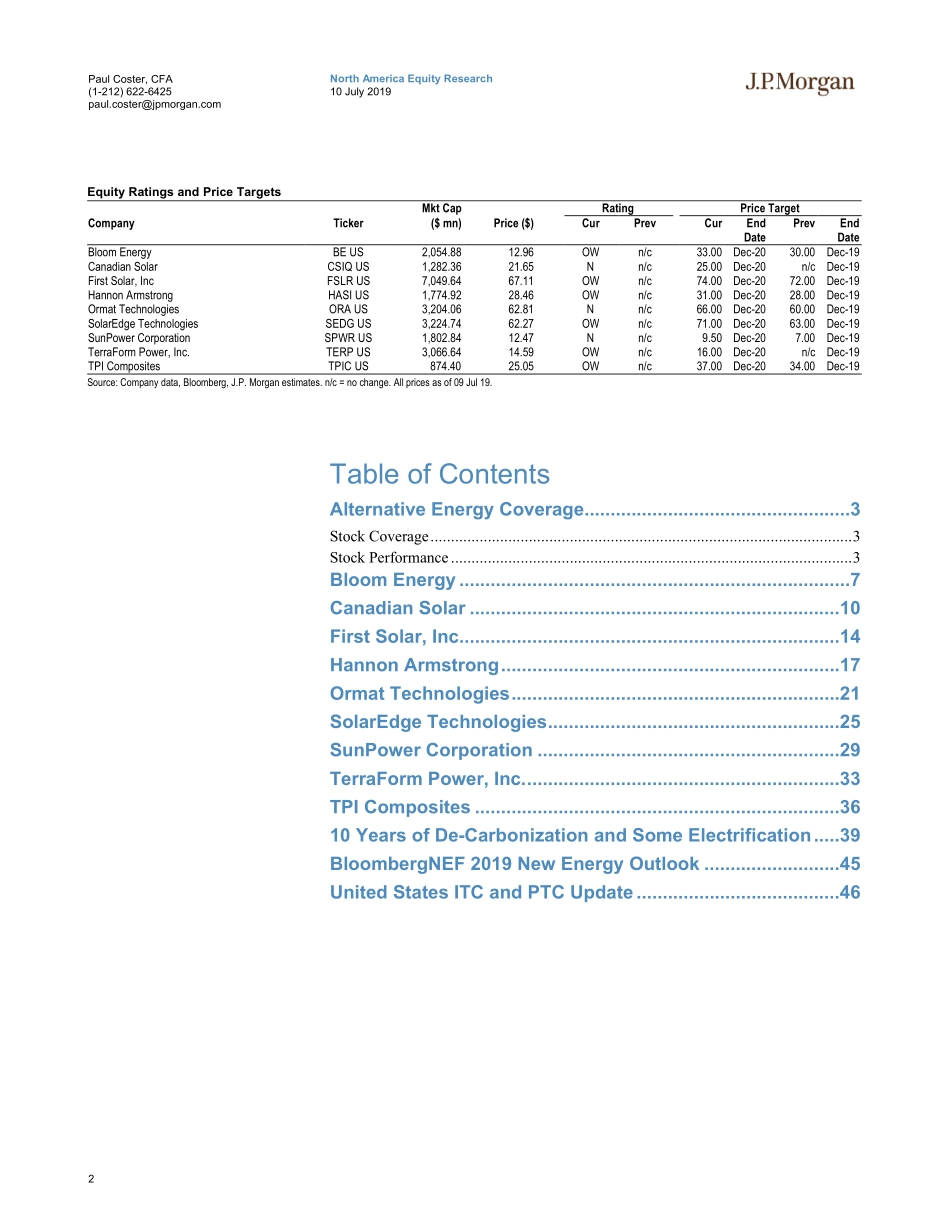

www.jpmorganmarkets.comNorthAmericaEquityResearch10July2019AlternativeEnergyIntothe2Q19Print:TopPicksRemainFSLR,TPIC,HASI,andBEITHardware,AlternativeEnergyPaulCoster,CFAAC(1-212)622-6425paul.coster@jpmorgan.comBloombergJPMACOSTERMarkStrouse,CFA(1-212)622-8244mark.w.strouse@jpmorgan.comPaulJChung(1-212)622-5552paul.j.chung@jpmorgan.comJ.P.MorganSecuritiesLLCSeepage47foranalystcertificationandimportantdisclosures.J.P.Morgandoesandseekstodobusinesswithcompaniescoveredinitsresearchreports.Asaresult,investorsshouldbeawarethatthefirmmayhaveaconflictofinterestthatcouldaffecttheobjectivityofthisreport.Investorsshouldconsiderthisreportasonlyasinglefactorinmakingtheirinvestmentdecision.WeremainconstructiveregardingAltEnergyfundamentalsandreiterateourfavoriteideasheadingintothe2Qprint.AltEnergystocksundercoveragehaveoutperformedYTD(up52%onaveragevs.S&P500up19%)owingtostrongglobaldemand,stableASPs,decentexecution,andimprovedclarityregardinggovernmentpolicy(especiallyinChina).Toppicksintothe2Q19printareFSLR,TPIC,HASI,andBE,allOverweightrated.Withthisnote,weareintroducingCY21estimatesandintroducingDec2020pricetargetsforAltEnergystocksundercoverage.FirstSolar(FSLR/OW/AFL).WebelievethatthecompanyisheadingtowardastrongearningsinflectiononthebackoftheSeries6rampthatisnotfully-pricedintothestockandwhichcoulddeliverEPSupsidein2020,relativetocurrentexpectations.FSLRstockisup~58%YTD(S&Pup19%),andwehavehighconvictionthatthestockcancontinuetooutperformifthe2H19Series6-relatedearningssurgeplaysoutasforecast.2H19estimatedEPSof~$3.13representsamorenormalizedearningspowerforthecompanyandpointstopotentialformassiveupsidetoconsensus2020EPFEPSof$3.68.WeareestablishingaDec2020pricetargetof$74fromaDec2019pricetargetof$72.TPIComposites(TPIC/OW/AFL),theleadingglobalwindbladecontractmanufacturer,isupjust2%YTDowingtoone-timenegativeeventsthatoccurredduring1Q.Weexpect2Qresultstopointtoeasingheadwindsassociatedwiththe1QeventsandformanagementcommentarypointingtonormalizedoperationsbyYE19,settin...