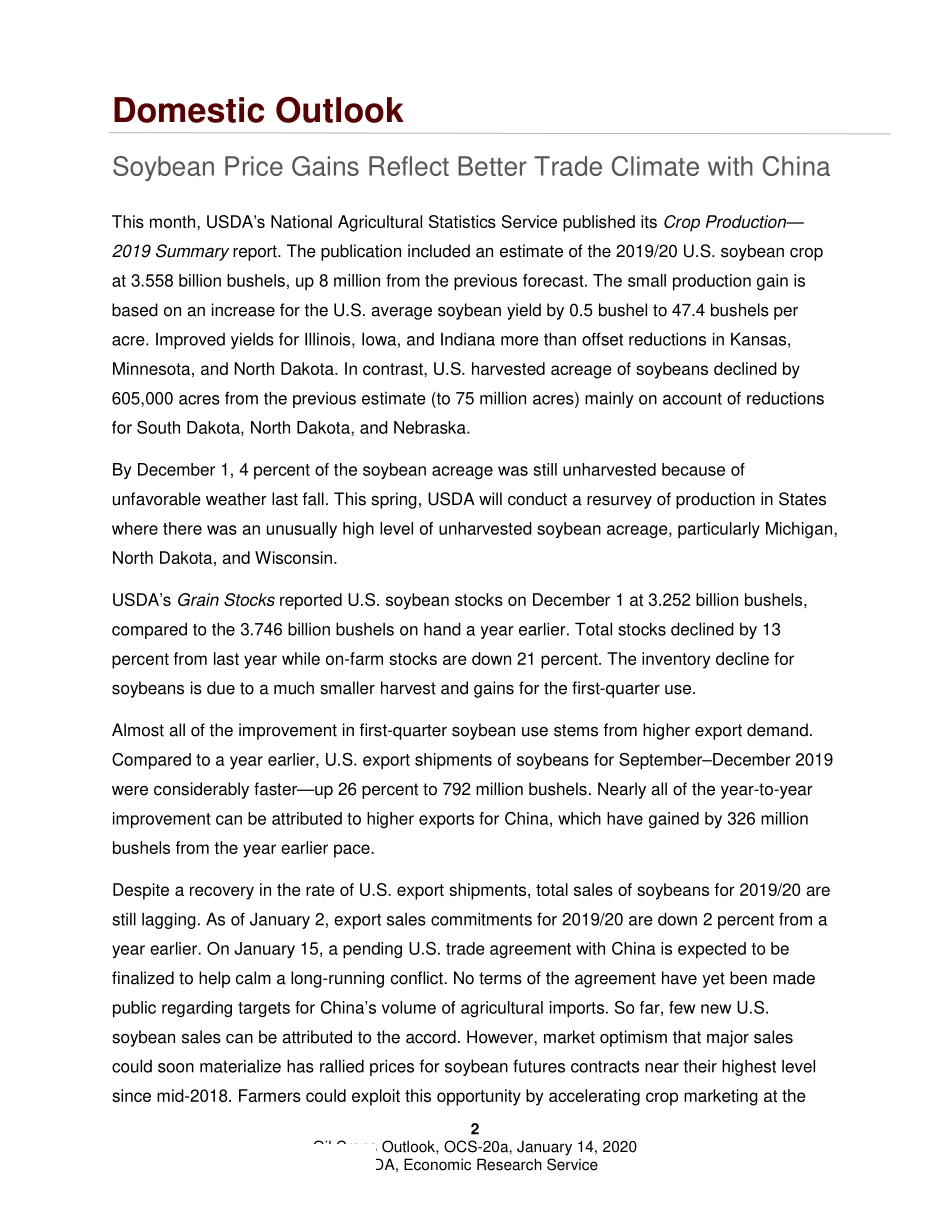

ApprovedbyUSDA’sWorldAgriculturalOutlookBoardOilCropsOutlookMarkAshSoybeanPricesSupportedbyStrengtheningSoybeanOilMarketInitsCropProduction—2019Summaryreport,USDApublishedanestimateofthe2019/20U.S.soybeancropat3.558billionbushels,up8millionfromthepreviousforecast.ThesmallproductiongainforsoybeansisbasedonanincreasefortheU.S.averageyieldby0.5bushelto47.4bushelsperacre.USDA’sforecastofU.S.soybeanexportsfor2019/20isunchangedat1.775billionbushels.Withtheforecastofdomesticcrushalsounchanged,season-endingsoybeanstocksarestillseenat475millionbushels.25303540Dec-16Apr-17Aug-17Dec-17Apr-18Aug-18Dec-18Apr-19Aug-19Dec-19Cents/poundSource:USDA,AgriculturalMarketingService,CentralIllinoisSoybeanProcessorBids.CentralIllinoissoybeanoilpricesclimbtoa3-yearhighEconomicResearchService|SituationandOutlookReportNextreleaseisFebruary13,2020OCS-20a|January14,20202OilCropsOutlook,OCS-20a,January14,2020USDA,EconomicResearchServiceDomesticOutlookSoybeanPriceGainsReflectBetterTradeClimatewithChinaThismonth,USDA’sNationalAgriculturalStatisticsServicepublisheditsCropProduction—2019Summaryreport.Thepublicationincludedanestimateofthe2019/20U.S.soybeancropat3.558billionbushels,up8millionfromthepreviousforecast.ThesmallproductiongainisbasedonanincreasefortheU.S.averagesoybeanyieldby0.5bushelto47.4bushelsperacre.ImprovedyieldsforIllinois,Iowa,andIndianamorethanoffsetreductionsinKansas,Minnesota,andNorthDakota.Incontrast,U.S.harvestedacreageofsoybeansdeclinedby605,000acresfromthepreviousestimate(to75millionacres)mainlyonaccountofreductionsforSouthDakota,NorthDakota,andNebraska.ByDecember1,4percentofthesoybeanacreagewasstillunharvestedbecauseofunfavorableweatherlastfall.Thisspring,USDAwillconductaresurveyofproductioninStateswheretherewasanunusuallyhighlevelofunharvestedsoybeanacreage,particularlyMichigan,NorthDakota,andWisconsin.USDA’sGrainStocksreportedU.S.soybeanstocksonDecember1at3.252billionbushels,comparedtothe3.746billionbushelsonhandayearearlier.Totalstocksdeclinedby13percentfromlasty...