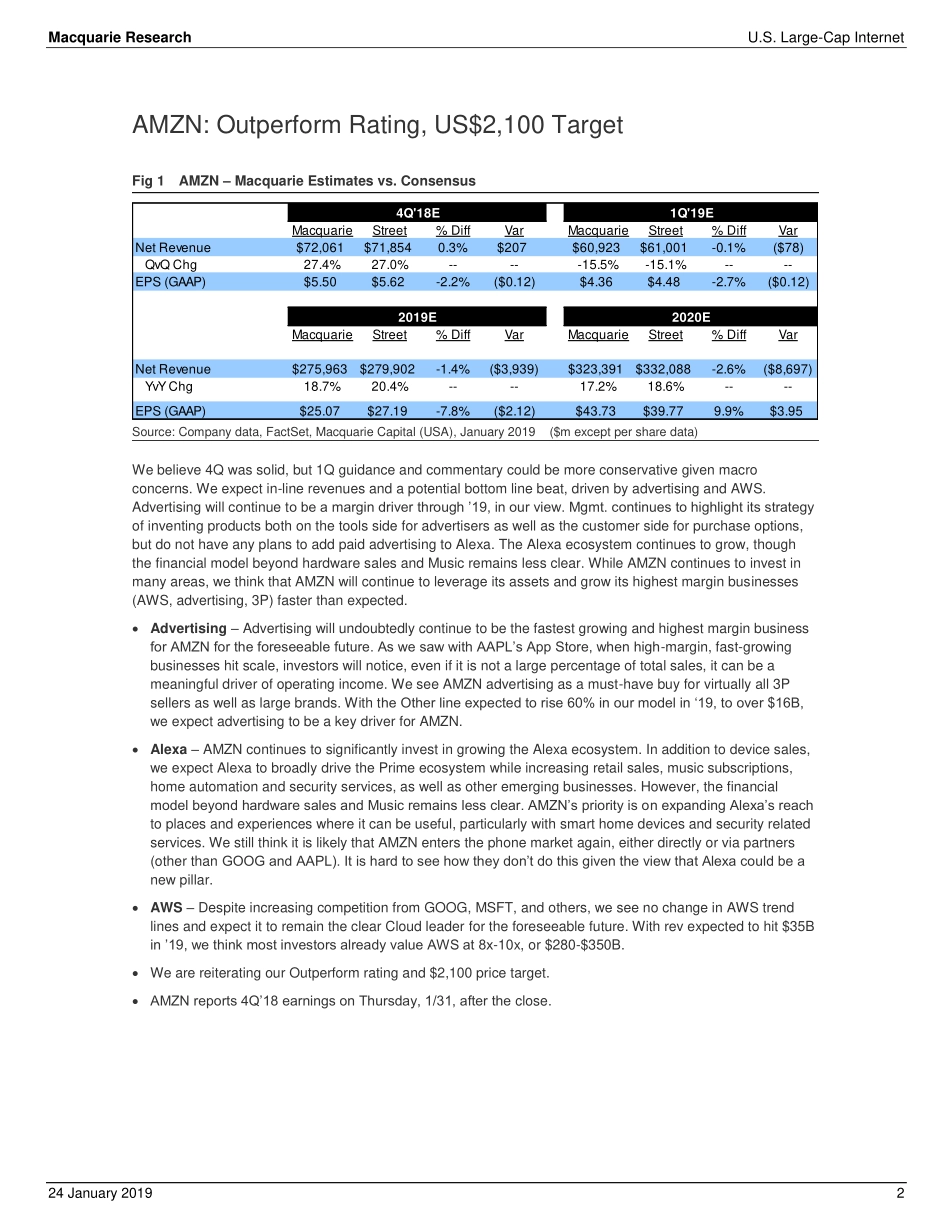

Pleaserefertopage21forimportantdisclosuresandanalystcertification,oronourwebsitewww.macquarie.com/research/disclosures.24January2019UnitedStatesEQUITIESSource:FactSet,MacquarieCapital(USA),January2019AnalystsMacquarieCapital(USA)Inc.BenjaminSchachter+12122310644ben.schachter@macquarie.comEdAlter+12122311272ed.alter@macquarie.comAngelaNewell+12122316600angela.newell@macquarie.comU.S.Large-CapInternet4Q’18Preview;MatchandSocialLookGoodKeypointsToppicksareMTCH,IACandFBheadinginto4Qearnings.WhilecautiousonTWTR,wethinkitissetupwellinto4Q.RemainNeutralonAAPL,concernson’19slowdowninServices’mosthigh-marginbusinesses.MacroconcernscouldweighonforwardcommentaryfromGOOG,AMZNandEBAY(activistnewsflowwillcontinuetobekeydriverforEBAYinNT).Event4Q’18U.S.Large-capinternetearningsbeginwithAAPLandEBAYon1/29.TheBottomLineWearemostbullishonMTCH,IACandFBheadinginto4Qearnings,andwhilewearecautiousonTWTRoverall,thinkitissetupwellinto4Q.WeremainNeutral-ratedonAAPL,givenourconcernsona’19slowdowninServices’mosthigh-marginbusinesses,whilemacroconcernscouldweighonforwardcommentaryfromGOOG,AMZNandEBAY(activistnewsflowwillalsocontinuetobeakeydriverforEBAYintheNT).WehavelimitedvisibilityintotrendsatANGI,thoughtheLTstoryremainsintact.OnMTCH,webelieveitcouldbeoneofthemoredefensivenamesinthespace.Tindershouldcontinuetobethekeydriver,whilebothemergingbusinessesandsomeofthelegacybusinessescouldalsohavesomemomentumin’19.IACwillbenefitfromMTCH’sstrength,aswellasitsnewdisclosureandcominginvestorrealizationthatVimeoisastoryworthfollowing(theconglomeratediscountstilldoesn’tmakesensetous).FBandTWTRshouldbothshowsolid4Qearningsanddespitemassiveheadlineriskandregulatoryconcerns,wethinkthefundamentalbusinessofputtingadsinfrontofuserswillremainstrongaslongastheusersarethere(andtheusersarestillthere!).WerecentlydowngradedAAPL,andcontinuetobelievethatjustasinvestorsfocusonServices,itsmostimportanthigh-margindrivers(AppStore,Licensing,andAppleCare)willallslowin’19.AMZNismoredifficulttopre...