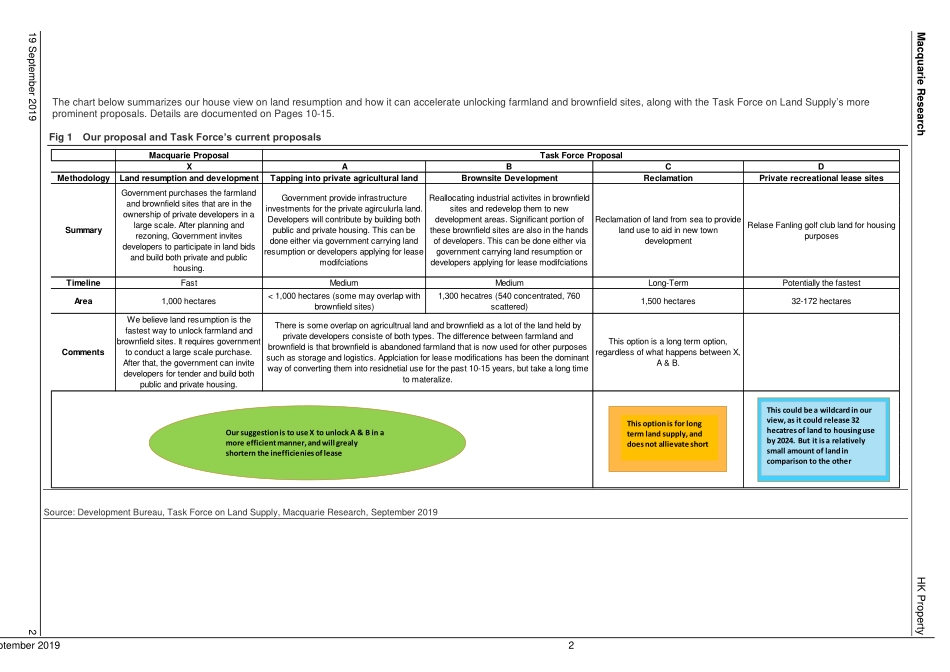

Pleaserefertopage23forimportantdisclosuresandanalystcertification,oronourwebsitewww.macquarie.com/research/disclosures.19September2019HongKongEQUITIESPotentialpositiveimpactondevelopersSource:MacquarieResearch,September2019Landsupplyanddemandupto2026Source:TaskForceonLandSupply,MacquarieResearch,September2019Netadditionofbuilt-uplandduring1993-2016Source:DevelopmentBureau,MacquarieResearch,September2019CentalinepropertypriceindexCCLCCLMid/smallapartmentsCCL-LargeapartmentsPricechangeYTD6.1%11.6%12.0%WoW-0.3%-0.3%-0.1%20175.3%4.9%7.5%201613.2%13.8%10.4%20157.7%8.1%5.4%20142.6%2.8%4.3%Vs.prevpeak-2.0%-2.2%-2.5%PriceindexLatest184.96185.26183.43Dec-17174.37174.05176.00Source:Centaline,MacquarieResearch,September2019AnalystsMacquarieCapitalLimitedDavidNg,CFA+85239221291david.ng@macquarie.comNicholasTing+85239221398nicholas.ting@macquarie.comHKPropertyLandeverywhere…butnodevelopmentKeypointsLandresumptionisapoorlyunderstoodmechanismthatcouldsolvetheseriouslandsupplyissuefacingHK.Inthisdeepdiveweshowresumptionscenarios,which,ifimplemented,couldbenefitdevelopers.Ourbasecaseisthatnormalcygraduallyreturnswithnosupplyshock.LandResumption:apoorlyunderstoodmechanismLandresumptionbenefitsdevelopers.Weestimatefairvalueupsideof10-37%forfourmajordevelopersiftheirfarmlandisboughtoutbyHKSAR,asmostoftheareawaspurchasedyearsagobelowHK$100psfversusthelatestcompensationforresumedlandatHK$1,350psfforessentialprojects.Ifdeveloperschoosetoparticipateinthedevelopmentoftheseresumedsitesintopublic/privatehousing,weexpectadditionalupsideof33-82%,resultingin1.2munitsfor2mpopulationoverthenext25years,accordingtoourscenarioanalysis.However,suchheroiceffortsrequirestrongconsensusamongstakeholdersandtrustinauthorities,makingitextremelychallengingtoexecuteinthenearterm.Interferenceinassetpriceeitherprovokesowners(pricetoolow)orattractscorruptionaccusations(pricetoohigh).Betweenthetwo,thelatterislessdamagingtothecurrenttornsociety.Whilenoneofthefivedemandsbyprotestersmentionshousingissue...