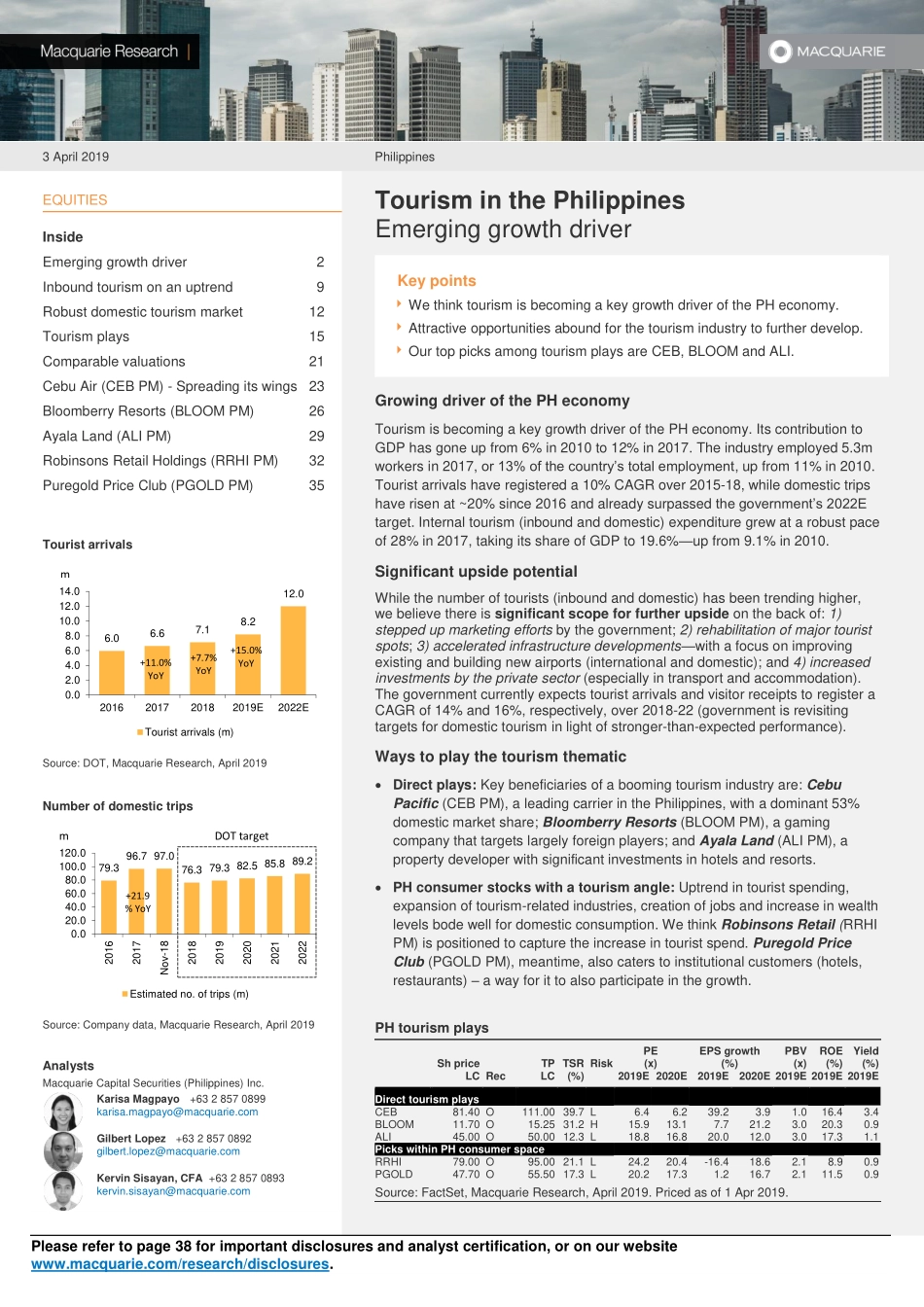

Pleaserefertopage38forimportantdisclosuresandanalystcertification,oronourwebsitewww.macquarie.com/research/disclosures.3April2019PhilippinesEQUITIESInsideEmerginggrowthdriver2Inboundtourismonanuptrend9Robustdomestictourismmarket12Tourismplays15Comparablevaluations21CebuAir(CEBPM)-Spreadingitswings23BloomberryResorts(BLOOMPM)26AyalaLand(ALIPM)29RobinsonsRetailHoldings(RRHIPM)32PuregoldPriceClub(PGOLDPM)35TouristarrivalsSource:DOT,MacquarieResearch,April2019NumberofdomestictripsSource:Companydata,MacquarieResearch,April2019AnalystsMacquarieCapitalSecurities(Philippines)Inc.KarisaMagpayo+6328570899karisa.magpayo@macquarie.comGilbertLopez+6328570892gilbert.lopez@macquarie.comKervinSisayan,CFA+6328570893kervin.sisayan@macquarie.comTourisminthePhilippinesEmerginggrowthdriverKeypointsWethinktourismisbecomingakeygrowthdriverofthePHeconomy.Attractiveopportunitiesaboundforthetourismindustrytofurtherdevelop.OurtoppicksamongtourismplaysareCEB,BLOOMandALI.GrowingdriverofthePHeconomyTourismisbecomingakeygrowthdriverofthePHeconomy.ItscontributiontoGDPhasgoneupfrom6%in2010to12%in2017.Theindustryemployed5.3mworkersin2017,or13%ofthecountry’stotalemployment,upfrom11%in2010.Touristarrivalshaveregistereda10%CAGRover2015-18,whiledomestictripshaverisenat~20%since2016andalreadysurpassedthegovernment’s2022Etarget.Internaltourism(inboundanddomestic)expendituregrewatarobustpaceof28%in2017,takingitsshareofGDPto19.6%—upfrom9.1%in2010.SignificantupsidepotentialWhilethenumberoftourists(inboundanddomestic)hasbeentrendinghigher,webelievethereissignificantscopeforfurtherupsideonthebackof:1)steppedupmarketingeffortsbythegovernment;2)rehabilitationofmajortouristspots;3)acceleratedinfrastructuredevelopments—withafocusonimprovingexistingandbuildingnewairports(internationalanddomestic);and4)increasedinvestmentsbytheprivatesector(especiallyintransportandaccommodation).ThegovernmentcurrentlyexpectstouristarrivalsandvisitorreceiptstoregisteraCAGRof14%and16%,respectively,over2018-22(governmentis...