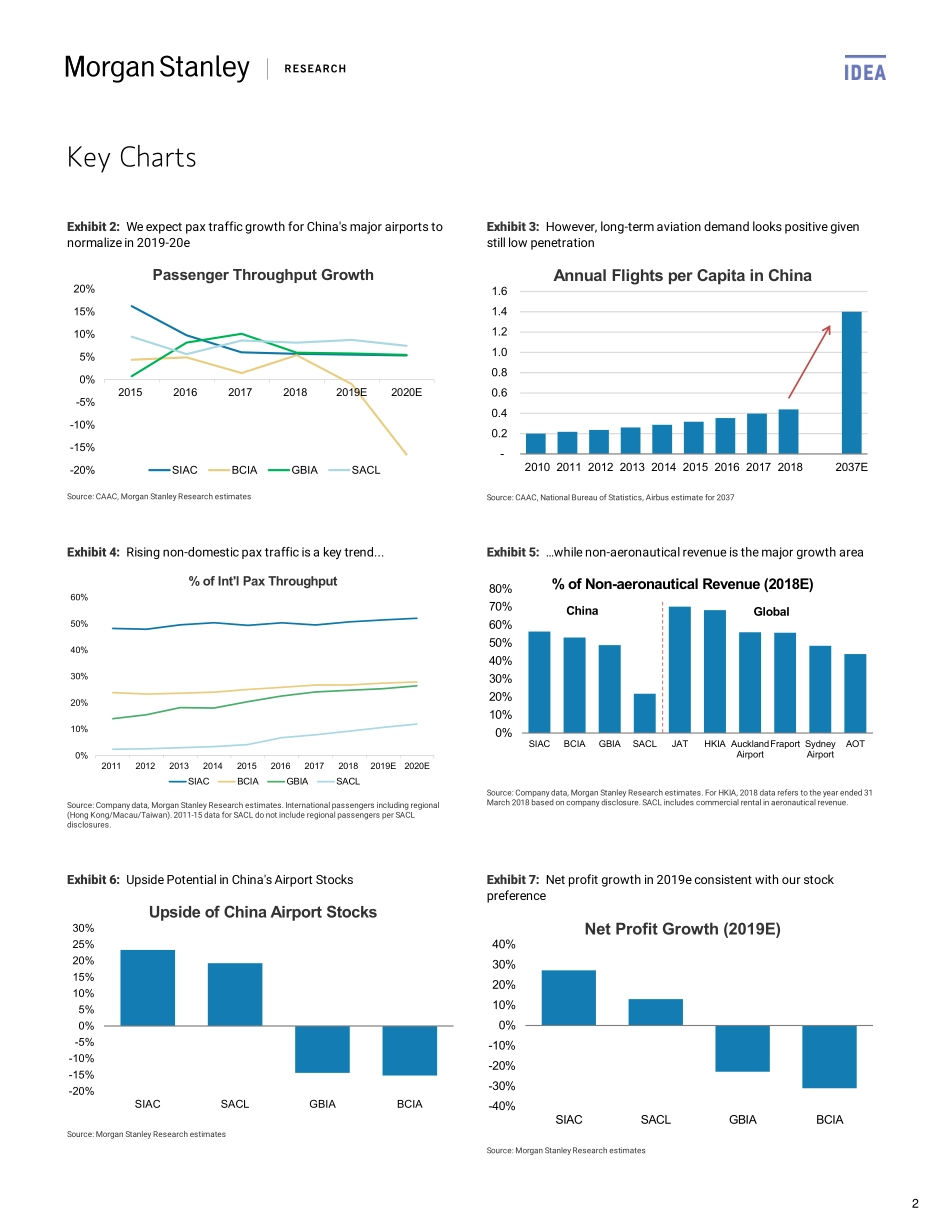

Grace.Li@morganstanley.comEdward.Xu@morganstanley.comJunYi.Yu@morganstanley.comIn-LineMORGANSTANLEYASIALIMITED+GraceLiRESEARCHASSOCIATE+8523963-2843EdwardHXu,CFAEQUITYANALYST+8522239-1521JunYiYuRESEARCHASSOCIATE+8522239-7817MorganStanleyappreciatesyoursupportinthe2019InstitutionalInvestorAll-AsiaResearchTeamSurvey.Requestyourballot.HongKong/ChinaTransportation&InfrastructureAsiaPacificIndustryViewChina–AirportsChina–Airports||AsiaPacificAsiaPacificOverweight–SIACandSACL;Underweight–GBIAandBCIADespiteslowerGDPgrowthandcapacityconstraintsnear-term,weremainpositiveonlong-termdemandtrendsforChina'sairportsandseepotentialupsidefromsustainedtrafficmiximprovementandnon-aeronauticalbusiness.Fornow,wepreferSIACandSACLonfundamentalandvaluationgrounds.Weremainpositiveonlong-termdemand...Airportshaveawideeconomicmoatwithanaturalmonopolyinlocalmarkets.AmidgeneralconcernsofslowingGDPgrowthinChina,weexpectaviationdemandtodecreasemildlyatmajorairportsin2019-20.However,penetrationisstilllowandpercapitaincomeisincreasing.Trafficmixshouldcontinuetoimprovewithhigherinternationalpaxtraffic,soweseefurtherroomforbothASPandmarginexpansionforSIAC,SACL,andGBIA....eventhoughweseeongoingnear-termcapacityconstraints:TheCivilAviationAdministrationofChina(CAAC)continuestocontrolslotgrowthinordertoimprovepunctualityatmajorairports.However,theuseoflargeraircraftandhigherloadfactorswouldbepositiveforairportsagainstthecapacitybottleneck.Non-aeronauticalbusinessafuturedriver:WebelievetheabilitytomonetizepassengertrafficisakeydriverforthefuturegrowthofChina'sairports.Theirpercentagesofbothnon-aeronauticalrevenueandpercapitaspendingaresmallrelativetomajorglobalairports.Thus,weseemuchpotentialforfurtherearningsupsideinthegroup.Weraiseourforecastsofnon-aeronauticalrevenueformajorairportsbyanaverageof4%p.a.in2018-20.Keyrisksfromcapex:ThereislimitedcapexpressureforSIACafterthelaunchofitssatelliteterminalin2H19,butweseecapexrisksforSACLfromtheconstructionofitssatelliteterminal,forGBIAfromitsPhase3expa...