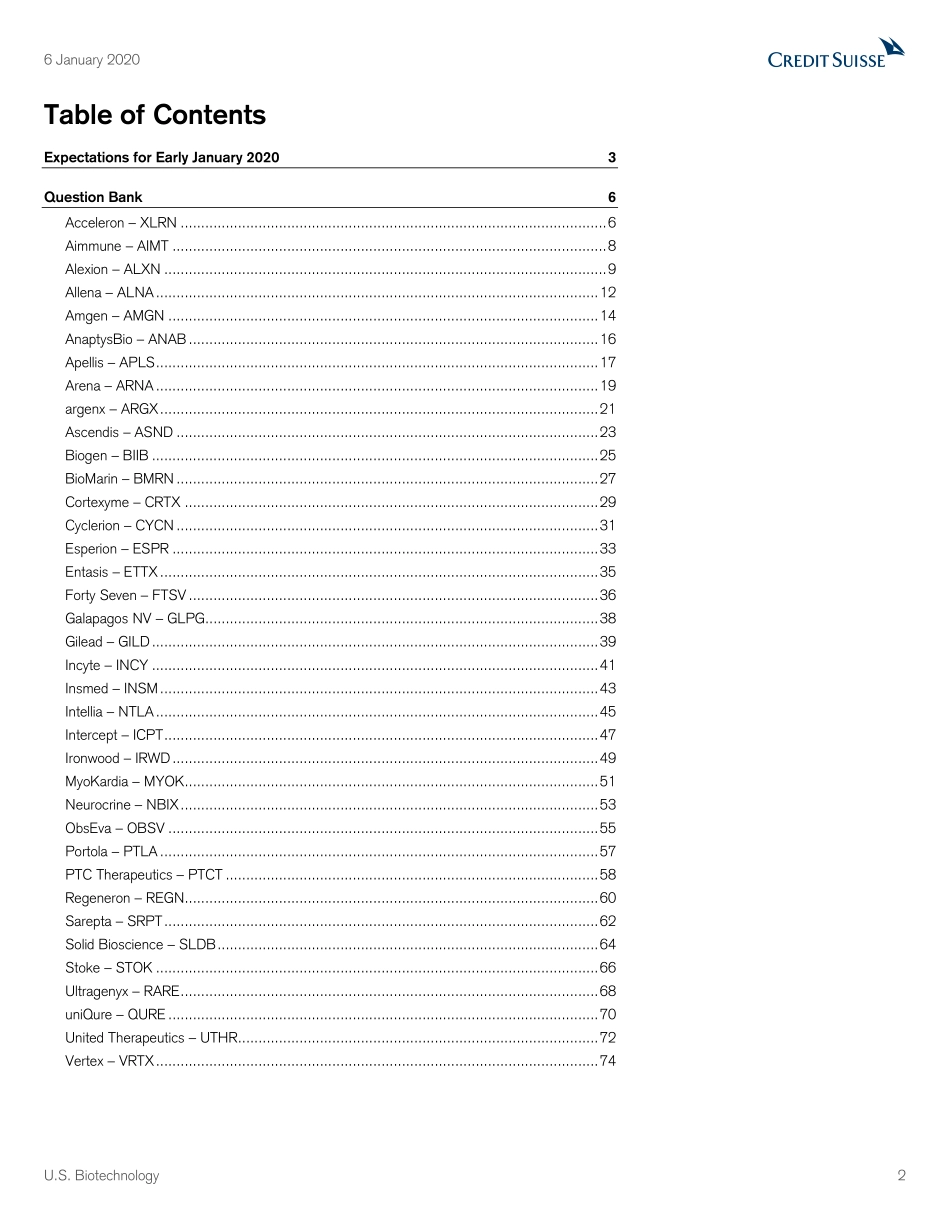

U.S.BiotechnologyPrepMaterialsforNextWeek’sBiotechCircusinSF:WhattoExpectattheConferenceandKeyQuestionsforManagementTeamsBiotechnology|CommentAheadofnextweek’smajorhealthcareconferencetheUSBiotechTeam(bothSeigermanandAuster)haveputtogetheracomprehensivelistofwhattoexpectforeachcompanythatwecoverthatwillbepresenting.Wehavealsoincludedacomprehensivequestionbankforcompanymanagement.Belowyouwillfindasummaryofwhattoexpectfromourcoveredcompanies,includingwhoislikelytopre-reportofearnings,provideguidance,commerciallaunchupdates,pipelineupdates,and/orotherprogramstatusupdates.PossibleUpdatesHighlightsEarly2020Pre-reportingofEarningsor2020GuidanceCommercialLaunchUpdatesSignificantPipelineUpdatesProgramStatusUpdates6January2020EquityResearchAmericas|UnitedStatesDISCLOSUREAPPENDIXATTHEBACKOFTHISREPORTCONTAINSIMPORTANTDISCLOSURES,ANALYSTCERTIFICATIONS,LEGALENTITYDISCLOSUREANDTHESTATUSOFNON-USANALYSTS.USDisclosure:CreditSuissedoesandseekstodobusinesswithcompaniescoveredinitsresearchreports.Asaresult,investorsshouldbeawarethattheFirmmayhaveaconflictofinterestthatcouldaffecttheobjectivityofthisreport.Investorsshouldconsiderthisreportasonlyasinglefactorinmakingtheirinvestmentdecision.ResearchAnalystsMartinAuster,M.D.2123256573martin.auster@credit-suisse.comEvanSeigerman2123254463evan.seigerman@credit-suisse.comTiagoFauth2123257569tiago.fauth@credit-suisse.comMarkConnolly2123257576mark.connolly@credit-suisse.comThomasDeal2123253719thomasavery.deal@credit-suisse.comMatthewTerwelp,MD2123253493matthew.terwelp@credit-suisse.com6January2020U.S.Biotechnology2TableofContentsExpectationsforEarlyJanuary20203QuestionBank6Acceleron–XLRN........................................................................................................6Aimmune–AIMT..........................................................................................................8Alexion–ALXN............................................................................................................9Allena–ALN...