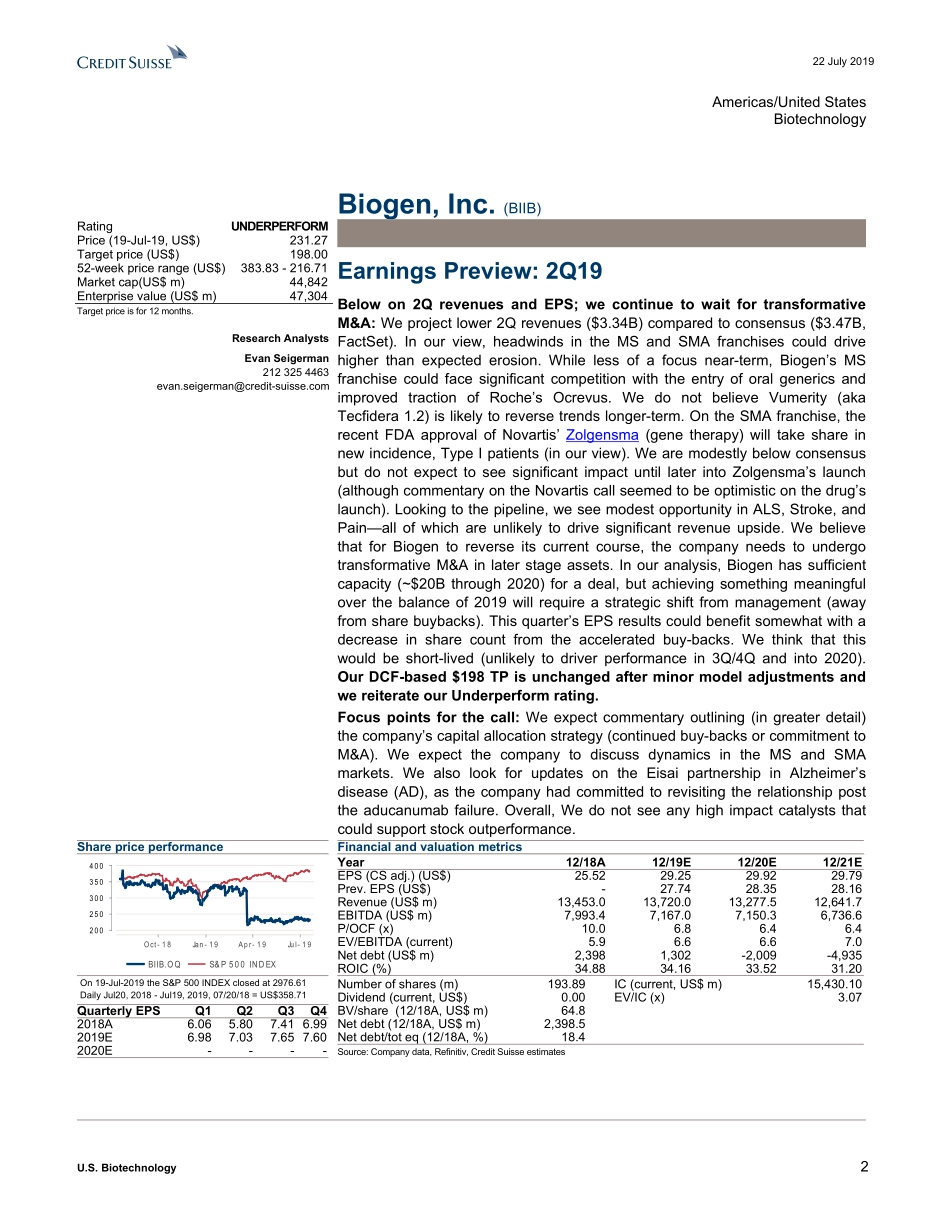

DISCLOSUREAPPENDIXATTHEBACKOFTHISREPORTCONTAINSIMPORTANTDISCLOSURES,ANALYSTCERTIFICATIONS,LEGALENTITYDISCLOSUREANDTHESTATUSOFNON-USANALYSTS.USDisclosure:CreditSuissedoesandseekstodobusinesswithcompaniescoveredinitsresearchreports.Asaresult,investorsshouldbeawarethattheFirmmayhaveaconflictofinterestthatcouldaffecttheobjectivityofthisreport.Investorsshouldconsiderthisreportasonlyasinglefactorinmakingtheirinvestmentdecision.22July2019Americas/UnitedStatesEquityResearchBiotechnologyU.S.BiotechnologyCOMMENTResearchAnalystsEvanSeigerman2123254463evan.seigerman@credit-suisse.comEarningsPreview:2Q2019SentimentinUSLargeCapBiotechremainspoor,asmacroandcompany-specificoverhangsremainafocusforinvestors:Year-to-datetheIBB(-10.5%)andXBI(-0.7%)haveunderperformedtheS&P500(+18.5%YTD).Inourview,investorsremainconcernedoverdrugpricing,growth,andrecentphase3failures.TherecentdecisionbytheTrumpAdministrationtokeepthestatusquowithMedicarePartDrebatesdoesnotfullyresolveconcernsoverdrugpricereform,asthefocusshiftmayshifttoIPIforreimbursementinPartB.Therearealsokeylegaloverhangs,particularlytheongoinglawsuitbetweenAmgenv.Novartis/SandozoverEnbrelandtheIPRfiledbyMylanregardingTecfideraIP.Thedistrictcourtisexpectedanyday,ascompanymanagementhadguidedtoamid-2019ruling.Alternatively,wecouldseeasettlementbetweenthecompanies.Againstthisbackdropofdrugpricing,somelegaloverhangsregardingIP,weseecontinuednegativesentimentinthesector:Still,withtherecentGilead/GalapagosdealandtheAbbVie/Allergandeal,transactionscontinue,whichcouldhelpreversesomesentimenttrendsintotheremainderof2019.Overall,wethinkthat2Qresultsacrossnamesshouldbefine(asresultsaretypicallybetterthanin1Q),althoughwehighlightareaswherenamescouldbestronger(VertexandNeurocrine)orweaker(BiogenandRegeneron).Todiscussourviewonthesectorgoinginto2Qearnings,wearehostingacallwithourGlobalBiopharmaColleagues:Today,Monday,July22@10AMET,Dial-in:US(866)591-6858,OUS(706)758-9648,ID:4981367IncreaseinM&AwouldmostlikelyimprovesentimentinBiotech(morereflec...