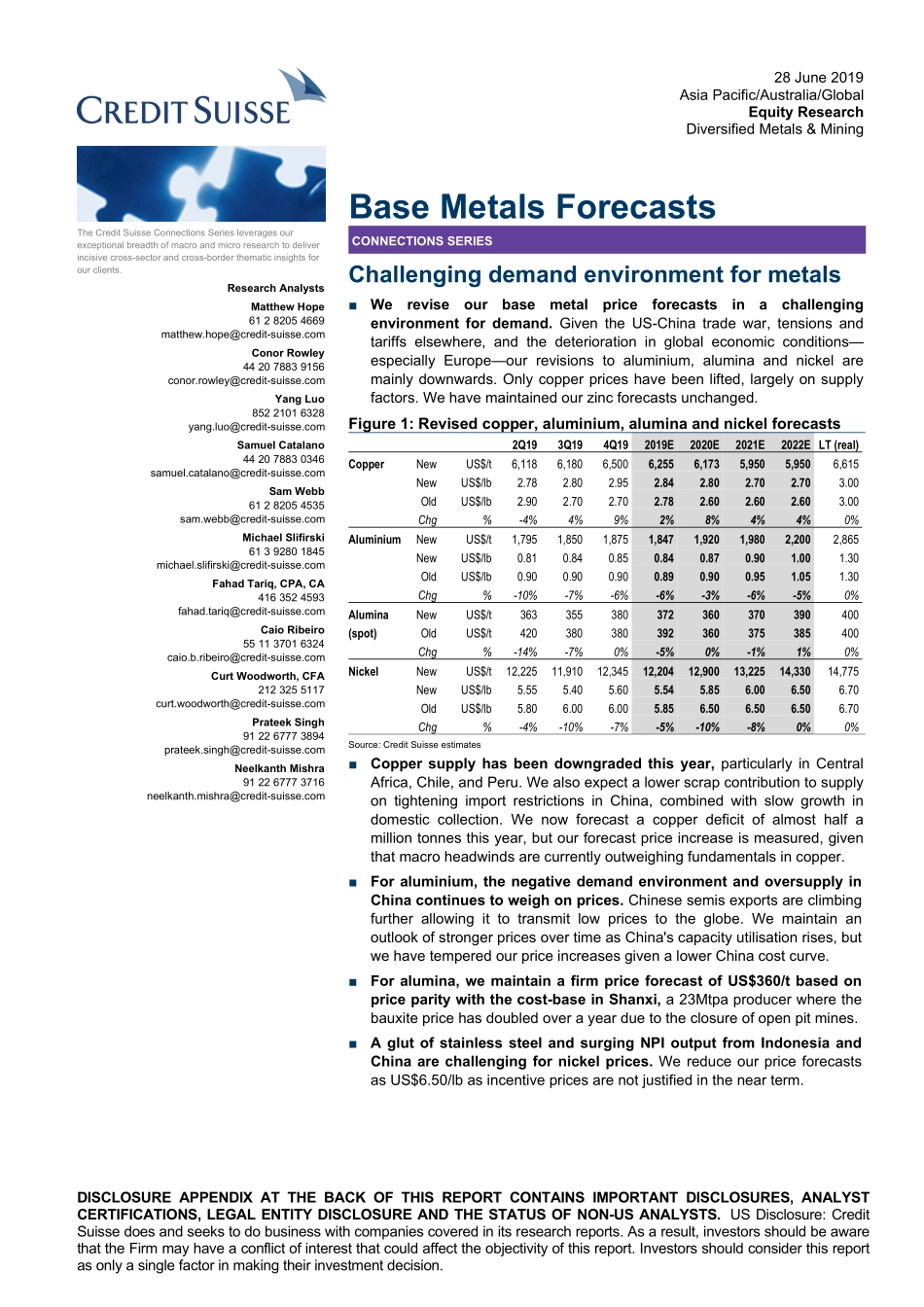

DISCLOSUREAPPENDIXATTHEBACKOFTHISREPORTCONTAINSIMPORTANTDISCLOSURES,ANALYSTCERTIFICATIONS,LEGALENTITYDISCLOSUREANDTHESTATUSOFNON-USANALYSTS.USDisclosure:CreditSuissedoesandseekstodobusinesswithcompaniescoveredinitsresearchreports.Asaresult,investorsshouldbeawarethattheFirmmayhaveaconflictofinterestthatcouldaffecttheobjectivityofthisreport.Investorsshouldconsiderthisreportasonlyasinglefactorinmakingtheirinvestmentdecision.28June2019AsiaPacific/Australia/GlobalEquityResearchDiversifiedMetals&MiningBaseMetalsForecastsCONNECTIONSSERIESTheCreditSuisseConnectionsSeriesleveragesourexceptionalbreadthofmacroandmicroresearchtodeliverincisivecross-sectorandcross-borderthematicinsightsforourclients.ResearchAnalystsMatthewHope61282054669matthew.hope@credit-suisse.comConorRowley442078839156conor.rowley@credit-suisse.comYangLuo85221016328yang.luo@credit-suisse.comSamuelCatalano442078830346samuel.catalano@credit-suisse.comSamWebb61282054535sam.webb@credit-suisse.comMichaelSlifirski61392801845michael.slifirski@credit-suisse.comFahadTariq,CPA,CA4163524593fahad.tariq@credit-suisse.comCaioRibeiro551137016324caio.b.ribeiro@credit-suisse.comCurtWoodworth,CFA2123255117curt.woodworth@credit-suisse.comPrateekSingh912267773894prateek.singh@credit-suisse.comNeelkanthMishra912267773716neelkanth.mishra@credit-suisse.comChallengingdemandenvironmentformetals■Wereviseourbasemetalpriceforecastsinachallengingenvironmentfordemand.GiventheUS-Chinatradewar,tensionsandtariffselsewhere,andthedeteriorationinglobaleconomicconditions—especiallyEurope—ourrevisionstoaluminium,aluminaandnickelaremainlydownwards.Onlycopperpriceshavebeenlifted,largelyonsupplyfactors.Wehavemaintainedourzincforecastsunchanged.Figure1:Revisedcopper,aluminium,aluminaandnickelforecasts2Q193Q194Q192019E2020E2021E2022ELT(real)CopperNewUS$/t6,1186,1806,5006,2556,1735,9505,9506,615NewUS$/lb2.782.802.952.842.802.702.703.00OldUS$/lb2.902.702.702.782.602.602.603.00Chg%-4%4%9%2%8%4%4%0%AluminiumNewUS$/t1,7951,8501,8751,8471,9201,9802,2...