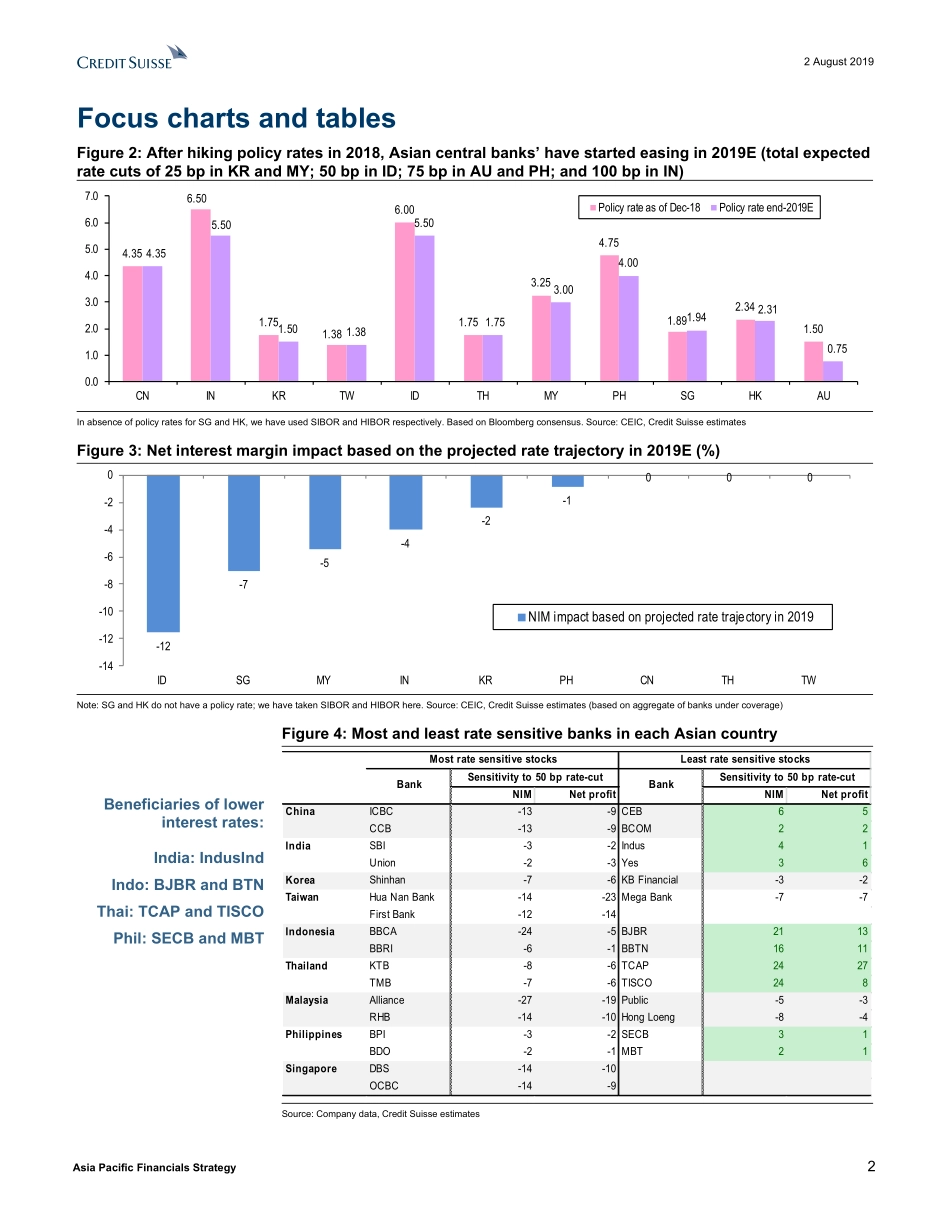

DISCLOSUREAPPENDIXATTHEBACKOFTHISREPORTCONTAINSIMPORTANTDISCLOSURES,ANALYSTCERTIFICATIONS,LEGALENTITYDISCLOSUREANDTHESTATUSOFNON-USANALYSTS.USDisclosure:CreditSuissedoesandseekstodobusinesswithcompaniescoveredinitsresearchreports.Asaresult,investorsshouldbeawarethattheFirmmayhaveaconflictofinterestthatcouldaffecttheobjectivityofthisreport.Investorsshouldconsiderthisreportasonlyasinglefactorinmakingtheirinvestmentdecision.2August2019AsiaPacificEquityResearchRegionalBanksAsiaPacificFinancialsStrategyTHEMEResearchAnalystsAshishGupta912267773895ashish.gupta@credit-suisse.comRikinShah6562123098rikin.shah@credit-suisse.comAsiaFinancialsTeamAshishGupta(HeadofAPACFinancialsResearch,India)CharlesZhou(Regional,ChinaInsurance)ChungHsu(China/Taiwan)DannyGoh(Malaysia)NicholasTeh(Singapore)JeehoonPark(Korea)AtulSethi(Thailand)LaurensiusTeiseran(Indonesia)DanieloPicache(Philippines)FarhanRizvi(Pakistan)RikinShah(Vietnam)JarrodMartin(Australia)MakotoKuroda(Japan)EasingpolicyratestoweighonmarginsFigure1:Bankswithlargefixedratebooktobenefitfromlowerrates-24-14-8-7-3-32416212424-30-20-100102030BCADBSKTBShinhanBPISBIMBTIndusIndBTNBJBRTCAPTISCONIMimpactbasedona50bpcutinthepolicyrate(inbp)Source:Companydata,CreditSuisseestimates■EasingmonetarypolicyinAsia.Weakexports,uncertaintyfromtradewar,subduedinflation,andthedovishFEDandECBhaveledAsiancentralbankstoeasemonetarypolicyYTD(rate-cutsof25-75bpsofarinIN,KR,ID,MY,PHandAU).However,realpolicyratesarestillrunningaheadoflong-termaverageacrossmostoftheAsianmarkets,whichcoulddrivefurthereasingof25-50bpinIN,ID,PHandAUthisyear.■Impactonbanks’margins.NetinterestmarginsinAsia(unliketheUSbanks)displayafarstrongercorrelationwithshort-termratesratherthantheyieldcurvespread,whichmeansdecreaseinpolicyrates,shouldleadtomargincontractionandviceversa.Bankswithhigherproportionoffixedrateloans(IndusInd,BJBR,BTN,TCAP,TiscoandMBT)andinvestmentsecurities(giventypicallylongduration)intheirinterestearningassetsshouldgainfromlowerrates.BankswithlowerCASA(CEB,...