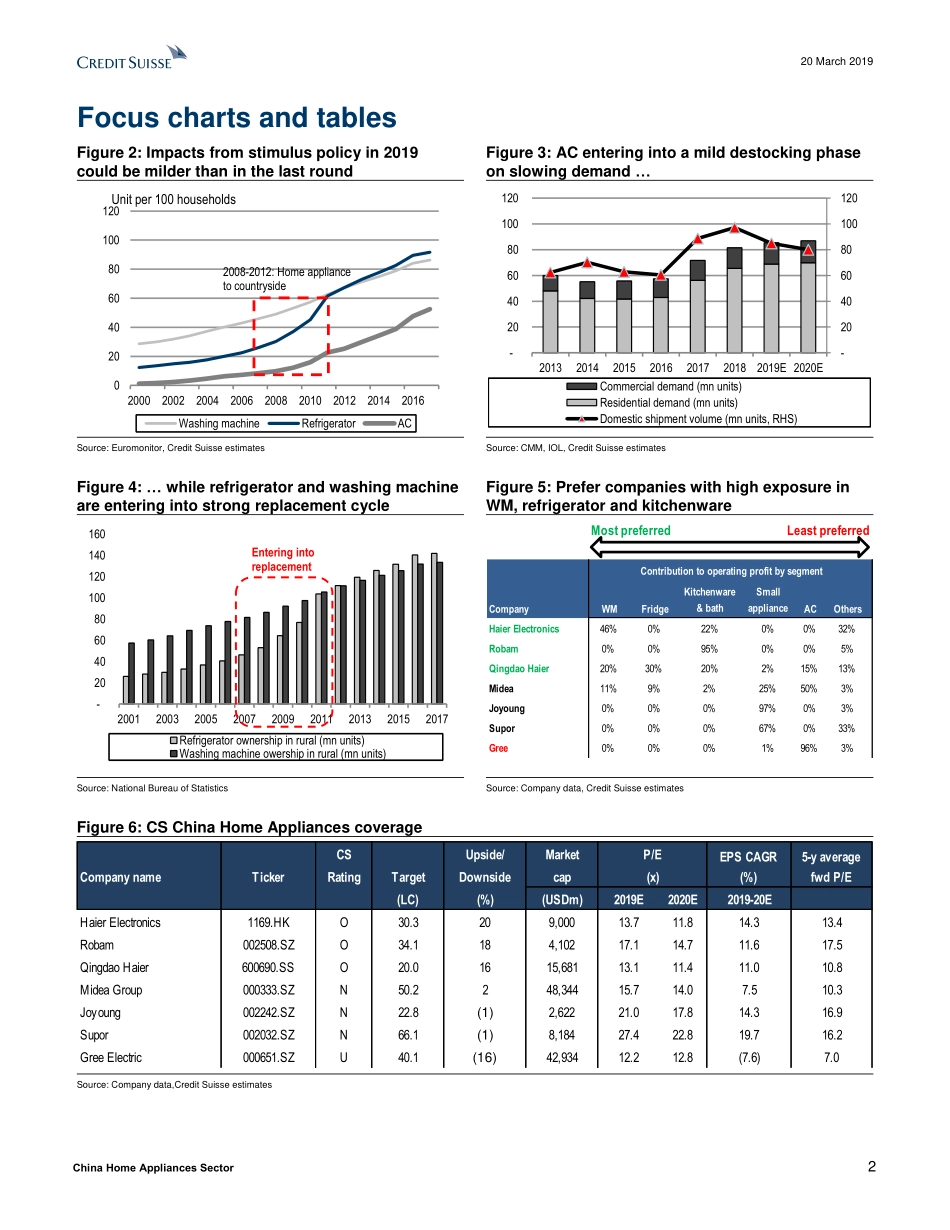

DISCLOSUREAPPENDIXATTHEBACKOFTHISREPORTCONTAINSIMPORTANTDISCLOSURES,ANALYSTCERTIFICATIONS,LEGALENTITYDISCLOSUREANDTHESTATUSOFNON-USANALYSTS.USDisclosure:CreditSuissedoesandseekstodobusinesswithcompaniescoveredinitsresearchreports.Asaresult,investorsshouldbeawarethattheFirmmayhaveaconflictofinterestthatcouldaffecttheobjectivityofthisreport.Investorsshouldconsiderthisreportasonlyasinglefactorinmakingtheirinvestmentdecision.20March2019AsiaPacific/ChinaEquityResearchConsumerDiscretionaryChinaHomeAppliancesSectorResearchAnalystsTonyWang85221016728tony.wang@credit-suisse.comMichaelShen85221016711michael.shen@credit-suisse.comHarrietLiu85221016591harriet.liu@credit-suisse.comINITIATIONChooseyournewhomeappliancescarefullyFigure1:Retailsalesgrowthtodivergeacrosssegmentsin2019-20ESource:Euromonitor,CMM,CreditSuisseestimates■Initiatingcoveragewithaselectiveview.Weexpectdomesticwhitegoodssalesgrowthtofurtherdecelerateto2%/4%YoYin2019/20Efrom21%/6%YoYin2017/18duetolimitedstimulusimpactsandaweakerpropertymarket.Whileweseefurtherdownsideforairconditioners(AC),washingmachines(WM)andrefrigeratorswouldcontinuetodeliversolidgrowthonmultiplestructuraldrivers.Thereturnofapremiumisationtrendcouldbeanotherthemetowatchoutforin2H19,withpremiumkitchenwarebrandsexpectedtobethemajorbeneficiary.■StructuraldriversemerginginWMandrefrigerator.WeexpectWMandrefrigeratorsalestosee5-7%CAGRover2019/20E,drivenbyastrongerreplacementcycle(75%oftotaldemand)offsettingthenegativeimpactofthepropertymarket,anda5%ASPincreaseperannumdrivenbyongoingproductupgrading.WearemorebearishonACduetodestockingpressure(channelinventoryatsixmonthsofsalesvsanormalisedlevelofthreetofourmonths)andapotentialpricewarin2019.■Cyclicalrecoveryinpremiumkitchenware.Webelieve,afterachallenging2018,theworstcouldbeoverforpremiumkitchenwarebrands.Weexpectthetopbrandstoresumegrowthin2H19/2020at5-7%froma10%declinein2018,thanksto:(1)propertyrelaxationpoliciesintop-tiercities;(2)fasterindustryconsolidation;and(3)newproductcategoryexpans...