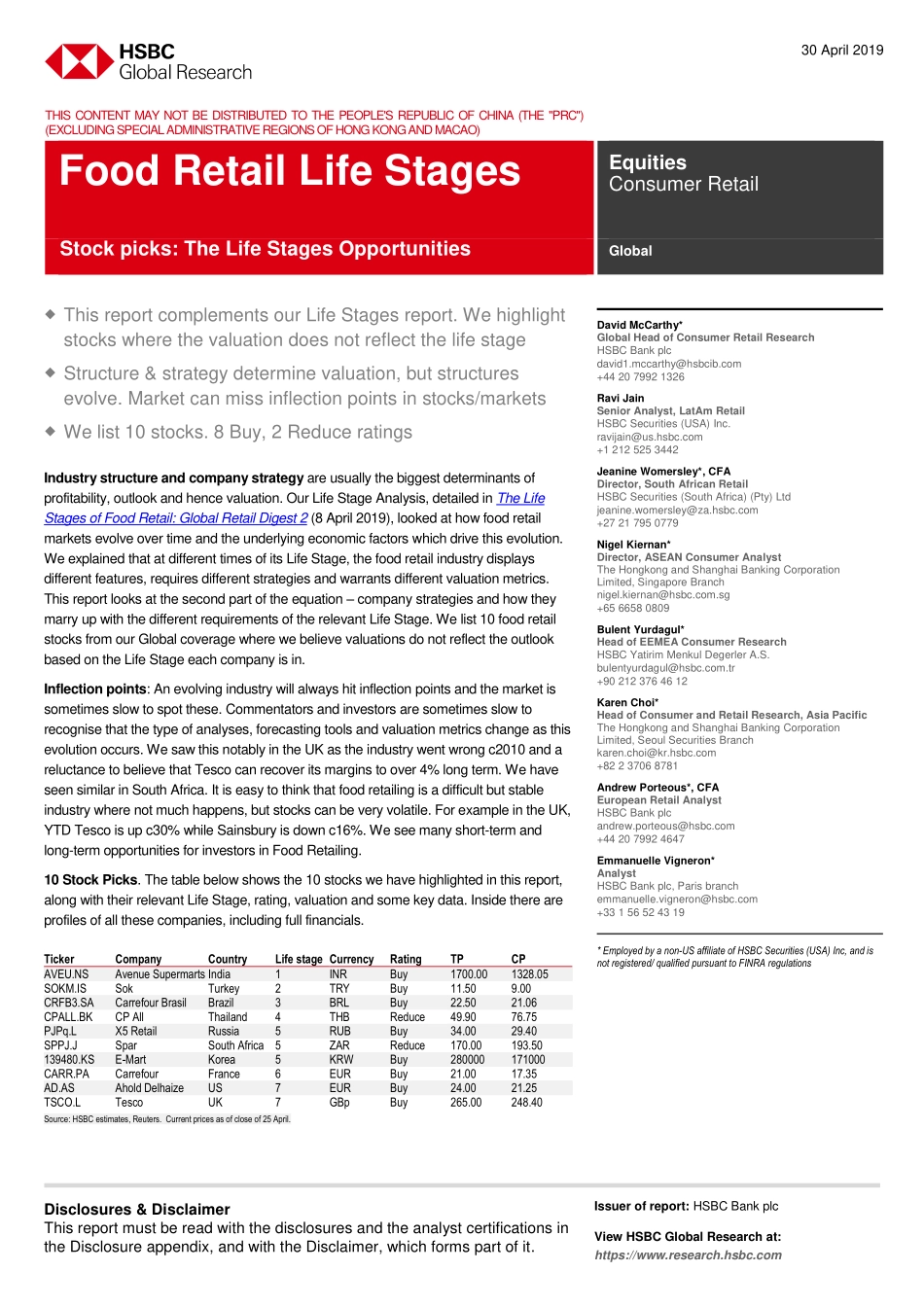

Disclosures&DisclaimerThisreportmustbereadwiththedisclosuresandtheanalystcertificationsintheDisclosureappendix,andwiththeDisclaimer,whichformspartofit.Issuerofreport:HSBCBankplcViewHSBCGlobalResearchat:https://www.research.hsbc.comTHISCONTENTMAYNOTBEDISTRIBUTEDTOTHEPEOPLE'SREPUBLICOFCHINA(THE"PRC")(EXCLUDINGSPECIALADMINISTRATIVEREGIONSOFHONGKONGANDMACAO)Industrystructureandcompanystrategyareusuallythebiggestdeterminantsofprofitability,outlookandhencevaluation.OurLifeStageAnalysis,detailedinTheLifeStagesofFoodRetail:GlobalRetailDigest2(8April2019),lookedathowfoodretailmarketsevolveovertimeandtheunderlyingeconomicfactorswhichdrivethisevolution.WeexplainedthatatdifferenttimesofitsLifeStage,thefoodretailindustrydisplaysdifferentfeatures,requiresdifferentstrategiesandwarrantsdifferentvaluationmetrics.Thisreportlooksatthesecondpartoftheequation–companystrategiesandhowtheymarryupwiththedifferentrequirementsoftherelevantLifeStage.Welist10foodretailstocksfromourGlobalcoveragewherewebelievevaluationsdonotreflecttheoutlookbasedontheLifeStageeachcompanyisin.Inflectionpoints:Anevolvingindustrywillalwayshitinflectionpointsandthemarketissometimesslowtospotthese.Commentatorsandinvestorsaresometimesslowtorecognisethatthetypeofanalyses,forecastingtoolsandvaluationmetricschangeasthisevolutionoccurs.WesawthisnotablyintheUKastheindustrywentwrongc2010andareluctancetobelievethatTescocanrecoveritsmarginstoover4%longterm.WehaveseensimilarinSouthAfrica.Itiseasytothinkthatfoodretailingisadifficultbutstableindustrywherenotmuchhappens,butstockscanbeveryvolatile.ForexampleintheUK,YTDTescoisupc30%whileSainsburyisdownc16%.Weseemanyshort-termandlong-termopportunitiesforinvestorsinFoodRetailing.10StockPicks.Thetablebelowshowsthe10stockswehavehighlightedinthisreport,alongwiththeirrelevantLifeStage,rating,valuationandsomekeydata.Insidethereareprofilesofallthesecompanies,includingfullfinancials.TickerCompanyCountryLifestageCurrencyRatingTPCPAVEU.NSAvenueSupermartsIndia1INRBuy1700.001328.05SOKM.ISSo...