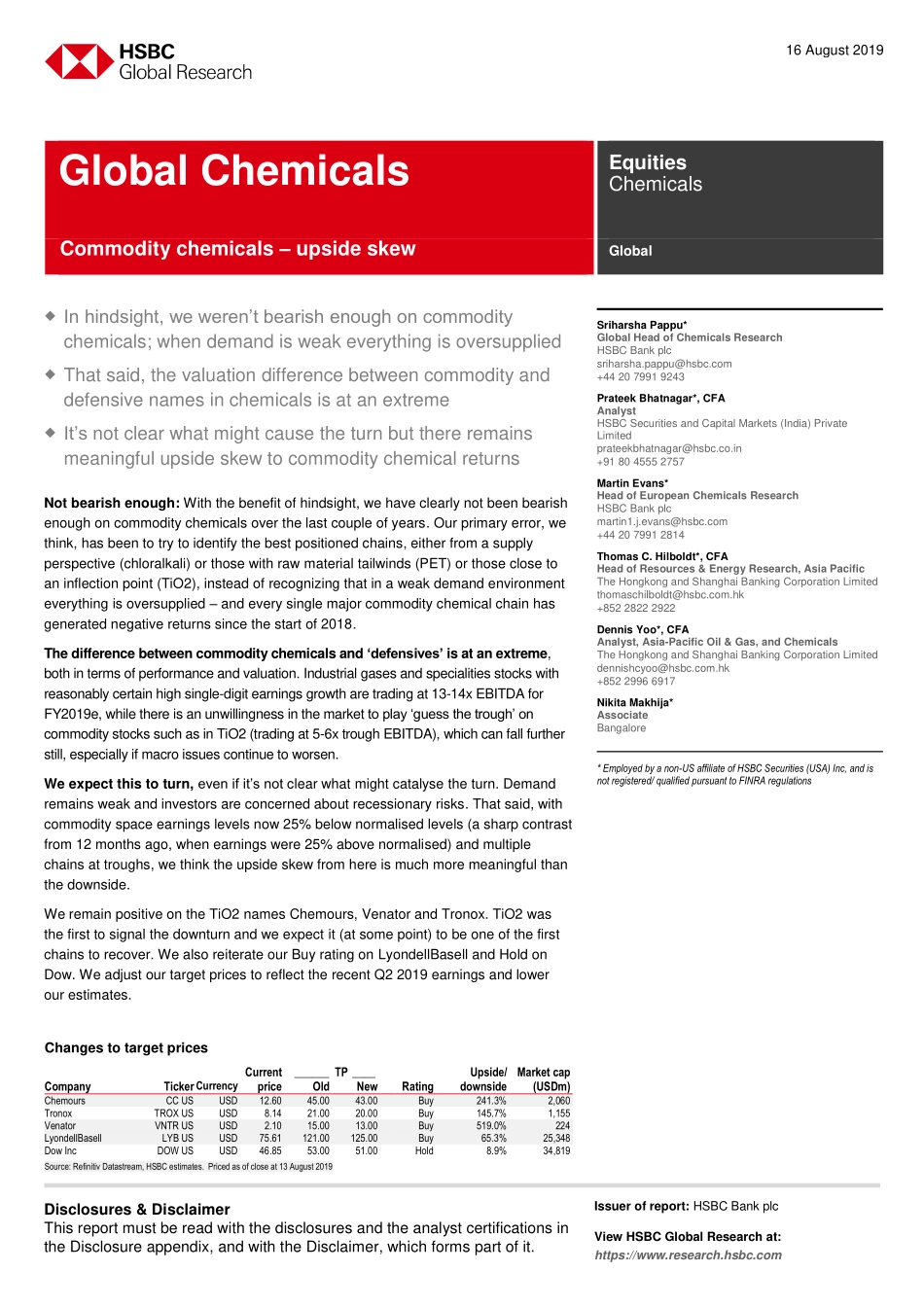

Disclosures&DisclaimerThisreportmustbereadwiththedisclosuresandtheanalystcertificationsintheDisclosureappendix,andwiththeDisclaimer,whichformspartofit.Issuerofreport:HSBCBankplcViewHSBCGlobalResearchat:https://www.research.hsbc.comInhindsight,weweren’tbearishenoughoncommoditychemicals;whendemandisweakeverythingisoversuppliedThatsaid,thevaluationdifferencebetweencommodityanddefensivenamesinchemicalsisatanextremeIt’snotclearwhatmightcausetheturnbutthereremainsmeaningfulupsideskewtocommoditychemicalreturnsNotbearishenough:Withthebenefitofhindsight,wehaveclearlynotbeenbearishenoughoncommoditychemicalsoverthelastcoupleofyears.Ourprimaryerror,wethink,hasbeentotrytoidentifythebestpositionedchains,eitherfromasupplyperspective(chloralkali)orthosewithrawmaterialtailwinds(PET)orthoseclosetoaninflectionpoint(TiO2),insteadofrecognizingthatinaweakdemandenvironmenteverythingisoversupplied–andeverysinglemajorcommoditychemicalchainhasgeneratednegativereturnssincethestartof2018.Thedifferencebetweencommoditychemicalsand‘defensives’isatanextreme,bothintermsofperformanceandvaluation.Industrialgasesandspecialitiesstockswithreasonablycertainhighsingle-digitearningsgrowtharetradingat13-14xEBITDAforFY2019e,whilethereisanunwillingnessinthemarkettoplay‘guessthetrough’oncommoditystockssuchasinTiO2(tradingat5-6xtroughEBITDA),whichcanfallfurtherstill,especiallyifmacroissuescontinuetoworsen.Weexpectthistoturn,evenifit’snotclearwhatmightcatalysetheturn.Demandremainsweakandinvestorsareconcernedaboutrecessionaryrisks.Thatsaid,withcommodityspaceearningslevelsnow25%belownormalisedlevels(asharpcontrastfrom12monthsago,whenearningswere25%abovenormalised)andmultiplechainsattroughs,wethinktheupsideskewfromhereismuchmoremeaningfulthanthedownside.WeremainpositiveontheTiO2namesChemours,VenatorandTronox.TiO2wasthefirsttosignalthedownturnandweexpectit(atsomepoint)tobeoneofthefirstchainstorecover.WealsoreiterateourBuyratingonLyondellBasellandHoldonDow.WeadjustourtargetpricestoreflecttherecentQ22...