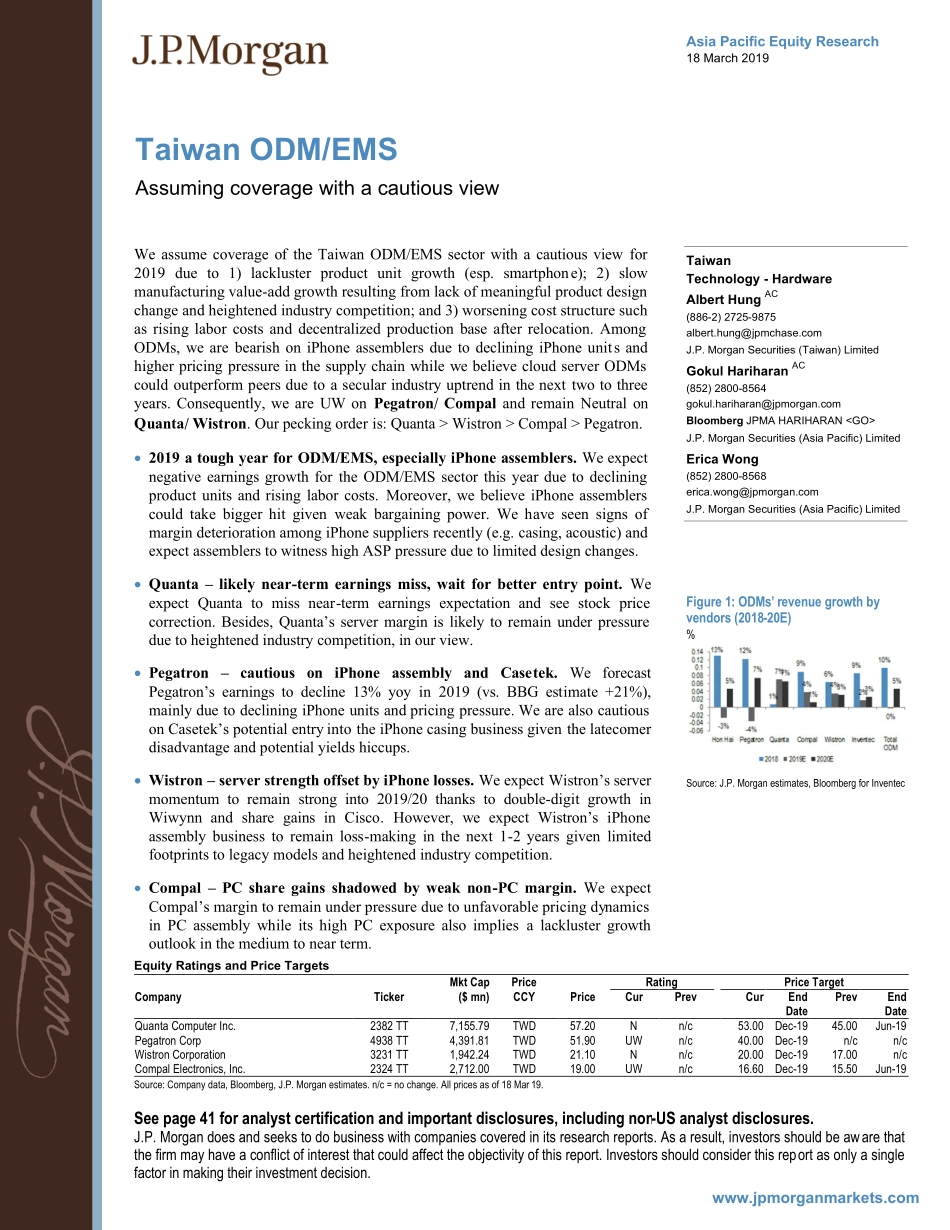

www.jpmorganmarkets.comAsiaPacificEquityResearch18March2019EquityRatingsandPriceTargetsMktCapPriceRatingPriceTargetCompanyTicker($mn)CCYPriceCurPrevCurEndDatePrevEndDateQuantaComputerInc.2382TT7,155.79TWD57.20Nn/c53.00Dec-1945.00Jun-19PegatronCorp4938TT4,391.81TWD51.90UWn/c40.00Dec-19n/cn/cWistronCorporation3231TT1,942.24TWD21.10Nn/c20.00Dec-1917.00n/cCompalElectronics,Inc.2324TT2,712.00TWD19.00UWn/c16.60Dec-1915.50Jun-19Source:Companydata,Bloomberg,J.P.Morganestimates.n/c=nochange.Allpricesasof18Mar19.TaiwanODM/EMSAssumingcoveragewithacautiousviewTaiwanTechnology-HardwareAlbertHungAC(886-2)2725-9875albert.hung@jpmchase.comJ.P.MorganSecurities(Taiwan)LimitedGokulHariharanAC(852)2800-8564gokul.hariharan@jpmorgan.comBloombergJPMAHARIHARANJ.P.MorganSecurities(AsiaPacific)LimitedEricaWong(852)2800-8568erica.wong@jpmorgan.comJ.P.MorganSecurities(AsiaPacific)LimitedSeepage41foranalystcertificationandimportantdisclosures,includingnon-USanalystdisclosures.J.P.Morgandoesandseekstodobusinesswithcompaniescoveredinitsresearchreports.Asaresult,investorsshouldbeawarethatthefirmmayhaveaconflictofinterestthatcouldaffecttheobjectivityofthisreport.Investorsshouldconsiderthisreportasonlyasinglefactorinmakingtheirinvestmentdecision.WeassumecoverageoftheTaiwanODM/EMSsectorwithacautiousviewfor2019dueto1)lacklusterproductunitgrowth(esp.smartphone);2)slowmanufacturingvalue-addgrowthresultingfromlackofmeaningfulproductdesignchangeandheightenedindustrycompetition;and3)worseningcoststructuresuchasrisinglaborcostsanddecentralizedproductionbaseafterrelocation.AmongODMs,wearebearishoniPhoneassemblersduetodecliningiPhoneunitsandhigherpricingpressureinthesupplychainwhilewebelievecloudserverODMscouldoutperformpeersduetoasecularindustryuptrendinthenexttwotothreeyears.Consequently,weareUWonPegatron/CompalandremainNeutralonQuanta/Wistron.Ourpeckingorderis:Quanta>Wistron>Compal>Pegatron.2019atoughyearforODM/EMS,especiallyiPhoneassemblers.WeexpectnegativeearningsgrowthfortheODM/EMSsectorthisyea...