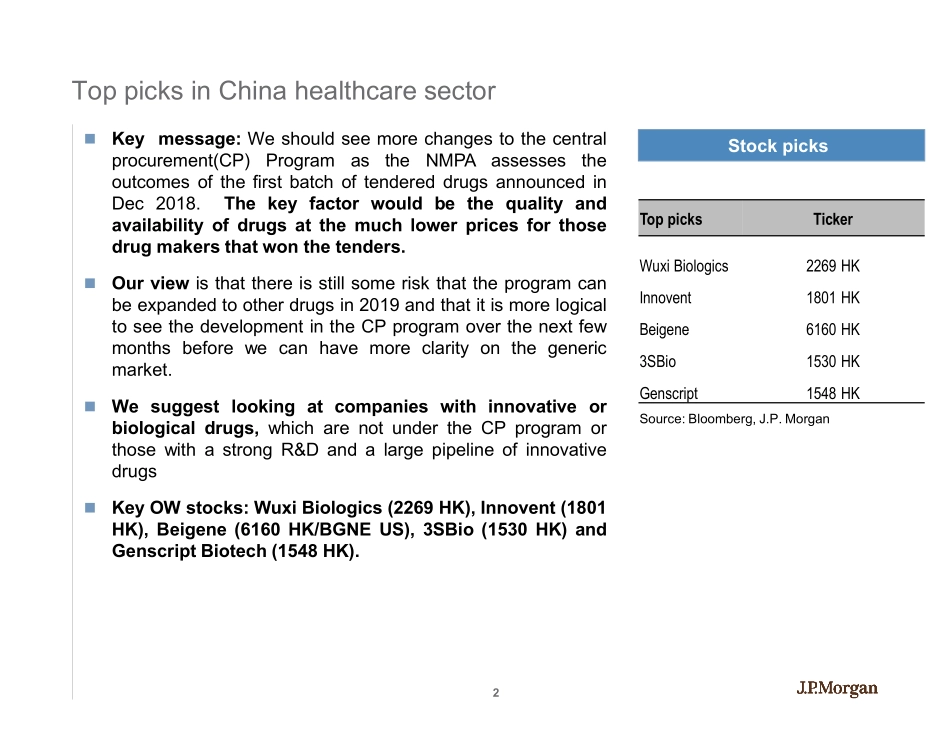

Seetheendpagesofthispresentationforanalystcertificationandimportantdisclosures,includingnon-USanalystdisclosures.J.P.Morgandoesandseekstodobusinesswithcompaniescoveredinitsresearchreports.Asaresult,investorsshouldbeawarethatthefirmmayhaveaconflictofinterestthatcouldaffecttheobjectivityofthisreport.Investorsshouldconsiderthisreportasonlyasinglefactorinmakingtheirinvestmentdecision.AsiaPacificEquityResearchMarch2019HealthcareLeonChik,CFAAC(852)28008590leon.hk.chik@jpmorgan.comJ.P.MorganSecurities(AsiaPacific)LimitedHealthcareChristineWang+85228008528christine.wang@jpmchase.comJ.P.MorganSecurities(AsiaPacific)LimitedHealthcareAlexTso,CFA+85228000496Alex.tso@jpmorgan.comJ.P.MorganSecurities(AsiaPacific)LimitedHealthcareDavidLi(852)28008546david.xy.li@jpmorgan.comJ.P.MorganSecurities(AsiaPacific)LimitedHealthcareLingWang(852)28008599ling.wang@jpmorgan.comJ.P.MorganSecurities(AsiaPacific)LimitedHealthcareSherryYin(852)28008681sherry.yin@jpmorgan.comJ.P.MorganSecurities(AsiaPacific)LimitedChinaHealthcareSectorPrivateandpublicmeasurestoimprovehealthcare2ToppicksinChinahealthcaresectorStockpicksToppicksTickerWuxiBiologics2269HKInnovent1801HKBeigene6160HK3SBio1530HKGenscript1548HKKeymessage:Weshouldseemorechangestothecentralprocurement(CP)ProgramastheNMPAassessestheoutcomesofthefirstbatchoftendereddrugsannouncedinDec2018.Thekeyfactorwouldbethequalityandavailabilityofdrugsatthemuchlowerpricesforthosedrugmakersthatwonthetenders.Ourviewisthatthereisstillsomeriskthattheprogramcanbeexpandedtootherdrugsin2019andthatitismorelogicaltoseethedevelopmentintheCPprogramoverthenextfewmonthsbeforewecanhavemoreclarityonthegenericmarket.Wesuggestlookingatcompanieswithinnovativeorbiologicaldrugs,whicharenotundertheCPprogramorthosewithastrongR&DandalargepipelineofinnovativedrugsKeyOWstocks:WuxiBiologics(2269HK),Innovent(1801HK),Beigene(6160HK/BGNEUS),3SBio(1530HK)andGenscriptBiotech(1548HK).Source:Bloomberg,J.P.Morgan3MarkethasdoubledigitgrowthpotentialSource:Beigenecompanyreports.Pw...