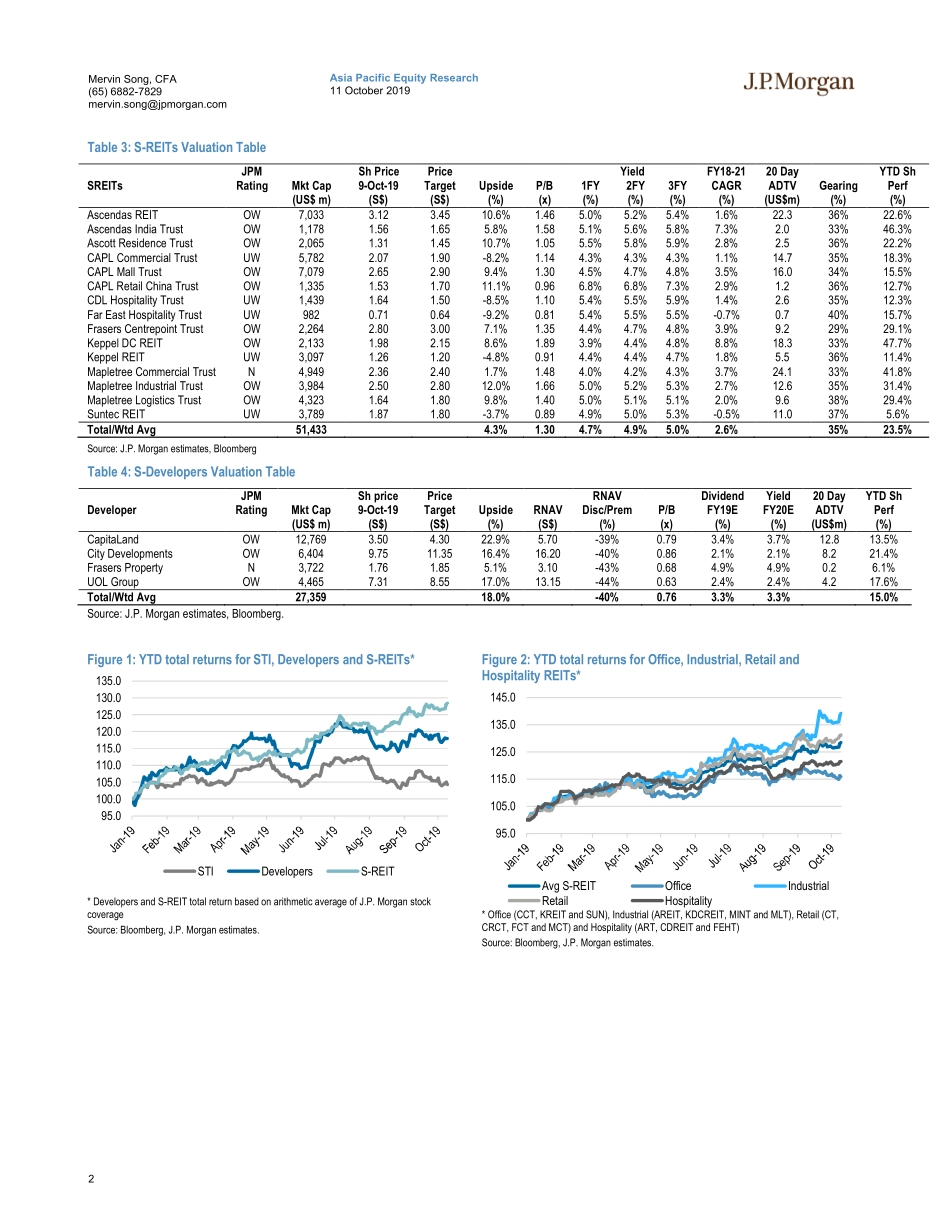

AsiaPacificEquityResearch11October2019SingaporePropertyandREITsDivergingpathsahead–choosewiselyConglomeratesandPropertyMervinSong,CFAAC(65)6882-7829mervin.song@jpmorgan.comJ.P.MorganSecuritiesSingaporePrivateLimitedTerenceMKhiAC(65)6882-1518terence.ml.khi@jpmchase.comBloombergJPMATKHIJ.P.MorganSecuritiesSingaporePrivateLimitedCussonLeung,CFA(852)2800-8526cusson.leung@jpmorgan.comJ.P.MorganSecurities(AsiaPacific)LimitedAjayMirchandani(65)6882-2419ajay.mirchandani@jpmorgan.comJ.P.MorganSecuritiesSingaporePrivateLimitedSeepage275foranalystcertificationandimportantdisclosures,includingnon-USanalystdisclosures.J.P.Morgandoesandseekstodobusinesswithcompaniescoveredinitsresearchreports.Asaresult,investorsshouldbeawarethatthefirmmayhaveaconflictofinterestthatcouldaffecttheobjectivityofthisreport.Investorsshouldconsiderthisreportasonlyasinglefactorinmakingtheirinvestmentdecision.www.jpmorganmarkets.comWeassumecoverageoftheSingaporepropertysectorwithapreferenceforIndustrialREITsanddevelopers.AfterabroadsectorrallyYTD,investorsmayneedtonavigatemoredivergentDeveloperandREITsubsectorperformancepathsfromhere.WeexpectIndustrialREITstodeliversustainedoutperformanceviayield+growthaspipelinesforaccretiveacquisitionscanoffsetflattishrentals.Developersoffernear-termpotentialupsideashigherresidentialsalesreinforcepricesandmargins,withcorporateactionsbolsteringearnings.Ournon-consensusUWratingsonOfficeandHospitalityREITsarepremisedonglobalgrowthweaknesscreatingdownsideriskstoStreetestimatesandfallingofficerentsfrom2020.OurPTsreflectourthesisthatIndustrialREITyieldscanre-rateclosertoofficeREITs.Toppicks:AREIT,MINT,CITandCAPL;avoidoffice&hospitalityREITs.IndustrialREITsbestpositionedtodeliver.IndustrialREITs(25-58%totalreturn)havebeatentheSTI(c.5%YTD)duetotradingyieldsatorbelowassetyieldsprovidingscopetogrowDPUviaacquisitionsdespiteaflattishrentaloutlook.Yieldsarestillthehighest(>5%)amongstlarge-caps,despitesubstantialNAVpremiums(~1.5P/B).Improvedassetqualityandfreeholdexposureto...