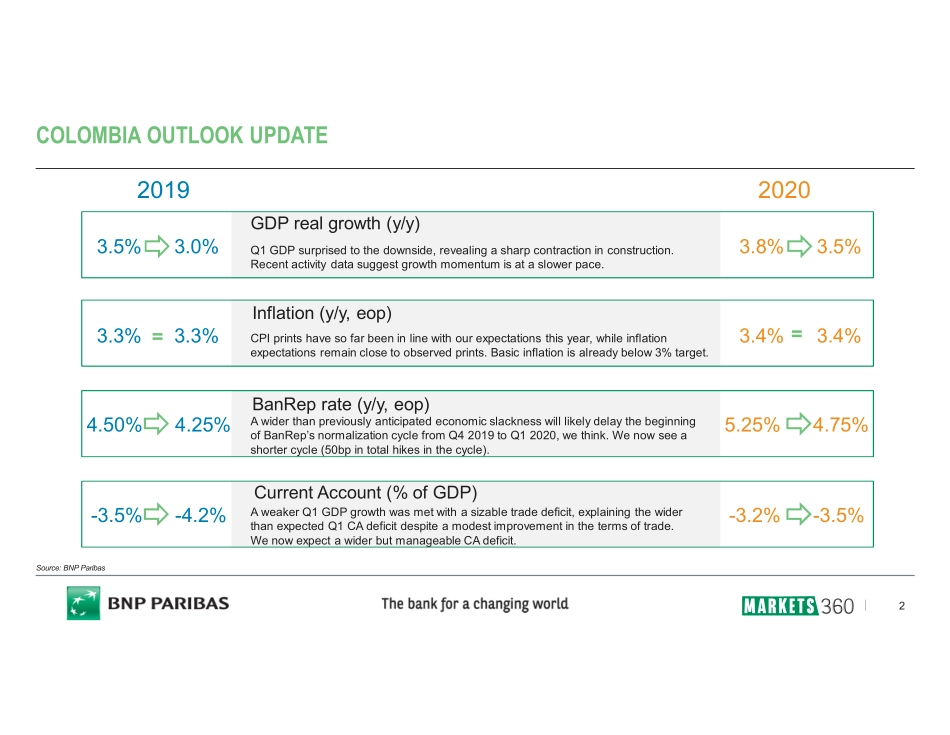

PleaserefertoimportantinformationattheendofthisreportCOLOMBIAMACROTRACKER:SIXANSWERSTOSIXTOUGHQUESTIONSJune2019JoelVirgenRojano,Economist|BNPParibasSecuritiesCorp.™DEEPDIVE2COLOMBIAOUTLOOKUPDATEGDPrealgrowth(y/y)Q1GDPsurprisedtothedownside,revealingasharpcontractioninconstruction.Recentactivitydatasuggestgrowthmomentumisataslowerpace.Inflation(y/y,eop)CPIprintshavesofarbeeninlinewithourexpectationsthisyear,whileinflationexpectationsremainclosetoobservedprints.Basicinflationisalreadybelow3%target.BanReprate(y/y,eop)AwiderthanpreviouslyanticipatedeconomicslacknesswilllikelydelaythebeginningofBanRep’snormalizationcyclefromQ42019toQ12020,wethink.Wenowseeashortercycle(50bpintotalhikesinthecycle).CurrentAccount(%ofGDP)AweakerQ1GDPgrowthwasmetwithasizabletradedeficit,explainingthewiderthanexpectedQ1CAdeficitdespiteamodestimprovementinthetermsoftrade.WenowexpectawiderbutmanageableCAdeficit.201920203.5%3.0%3.8%3.5%3.3%3.3%3.4%3.4%4.50%4.25%5.25%4.75%-3.5%-4.2%-3.2%-3.5%==Source:BNPParibasCOLOMBIAMACROTRACKER:SIXANSWERSTOSIXTOUGHQUESTIONS3ISCOLOMBIAIMMUNETOAGLOBALDECELERATION?1ISECONOMICSLACKNESSNARROWING?2MONETARYPOLICY:NORMALIZATIONNOW?3ISABALANCE-OF-PAYMENTSCRISISAROUNDTHECORNER?4TODOWNGRADEORNOTTODOWNGRADE?56FISCALRULE:ISTHISTIMEFORREAL?41ISCOLOMBIAIMMUNETOAGLOBALDECELERATION?NO,ITISNOT.GLOBALCONDITIONSMATTERBNPPEMGDPgrowthvsexportsgrowthtrackers(%q/qs.a.growth)Sources:Macrobond,WTO,BNPParibasBNPPEMex-ChinaexportsgrowthtrackervsChineseimports(%y/ygrowth,3mma)FromourEMoutlookQ32019–DifferentiationmattersOurtrademonitorsuggestsexportsfromEMshaveyettorecover,posingadownsidebiasforeconomicactivity.Ourtrackerpointstoa0.3ppdecelerationinEMsquarterlyGDPgrowthinQ1.5ISCOLOMBIAIMMUNETOAGLOBALDECELERATION?TRADEDISPUTESMATTERWeightoftheUSandChinaineachcountry’stotalexports(value)3334568891212131314161721223278111131321379152712273415818620%10%20%30%40%50%60%70%80%90%100%CzechRepublicPolandRomaniaHungaryRussiaTurkeySaudiArabiaArgentinaSouthAfricaIndonesiaSouthKoreaThailandBrazi...