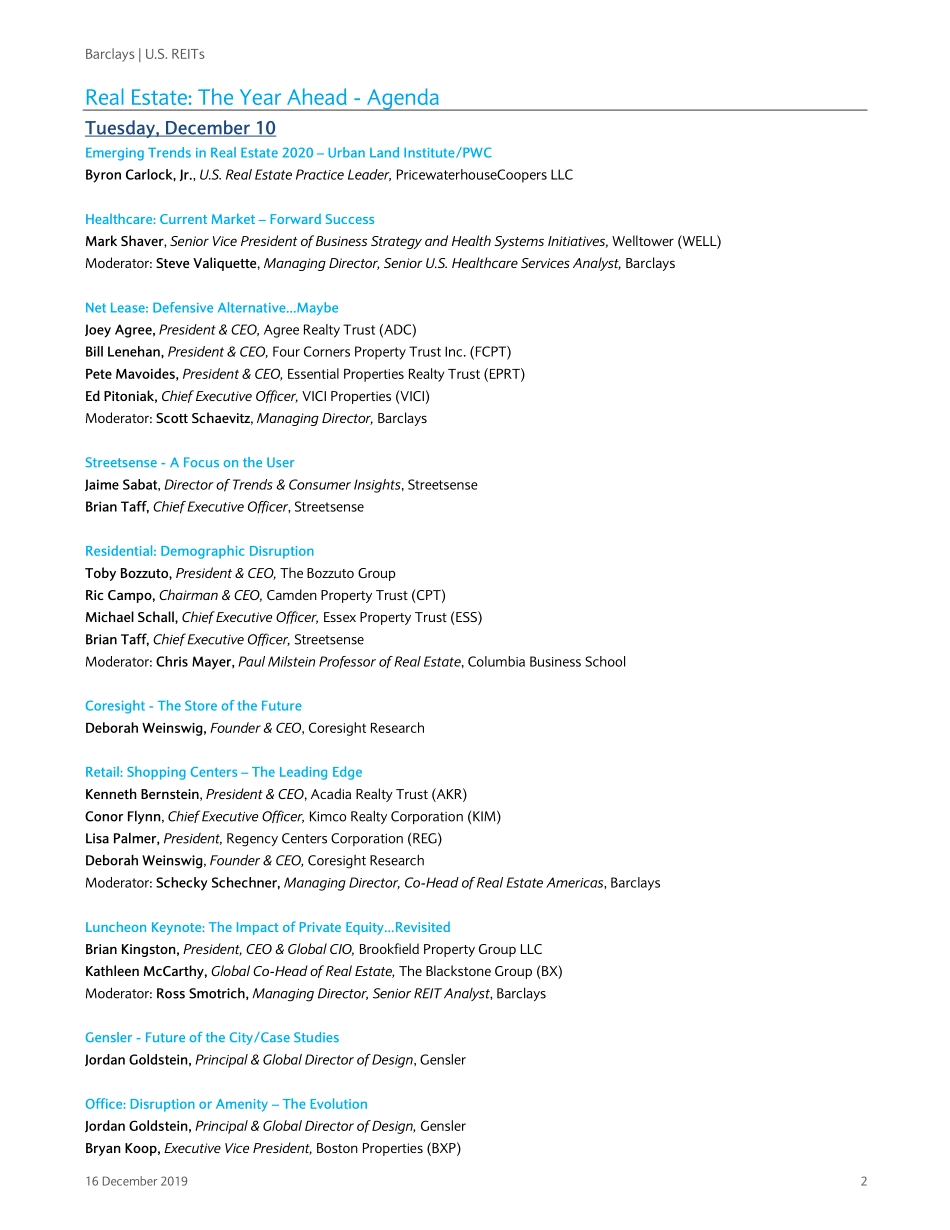

EquityResearch16December2019COREBarclaysCapitalInc.and/oroneofitsaffiliatesdoesandseekstodobusinesswithcompaniescoveredinitsresearchreports.Asaresult,investorsshouldbeawarethatthefirmmayhaveaconflictofinterestthatcouldaffecttheobjectivityofthisreport.Investorsshouldconsiderthisreportasonlyasinglefactorinmakingtheirinvestmentdecision.PLEASESEEANALYSTCERTIFICATION(S)ANDIMPORTANTDISCLOSURESBEGINNINGONPAGE16.Restricted-InternalU.S.REITsRealEstate:TheYearAheadKeyTakeaways-2020OnDecember10and11,2019weheldour16thannualrealestateconference–RealEstate:TheYearAhead.Theprogramconsistedoftwelvethematicpanelsprecededbyaseriesofforwardlookingpresentationsovertwodays,includinganewhalf-dayPropTechtrack.Thepanelswerecomprisedofseniormanagementfrom45public/privatecompanies,andincludedkeynotesontheimpactofprivateequity(Blackstone/Brookfield)aswellasAViewfromtheTop(SPG/PLD).Onceagain,webeganwithapresentationoftheULI/PwCEmergingTrendsinRealEstate2020report.Inthisnote,weprovideasummaryofthehighlightsfromeachpresentation/panel.Keythemesheadinginto2020include:Longrunway.Whilelateinthecycle,consensussuggeststhatrealestatefundamentalsremainsound,cashflows/earningsshouldacceleratemodestly,andthereisasignificantamountofinvestablecapital.Theimplicationislikelycapratespreadcompressionandgreaterchallengescreatingalpha.Thebigaregettingbigger.BothintheREITspaceandinprivateequity–scaleisagrowingcompetitiveadvantage.Factorssuchasstrongerbalancesheets,theuseoftechnology(dataanalytics),andgreateroperatingflexibilitywilldrivedivergencebetweenHavesandHaveNots.Convergence.Propertyformats–andinfact,successdriversacrossassetclasses,areconverging.Thebenefitsofclientcentricity,experientialamenities,andtheimperativetocreatecommunityareincreasinglyevidentacrossthemultifamily,retail,office,andlogisticssectors.Likescale–theabilitytodeliverthosesuccessfactorswilldrivegreaterdivergence.Acceleratingchange.ThePropTechtrackshowedhowquicklyrealestateischanging–drivenbytechnologyanddemographicdemands,and...