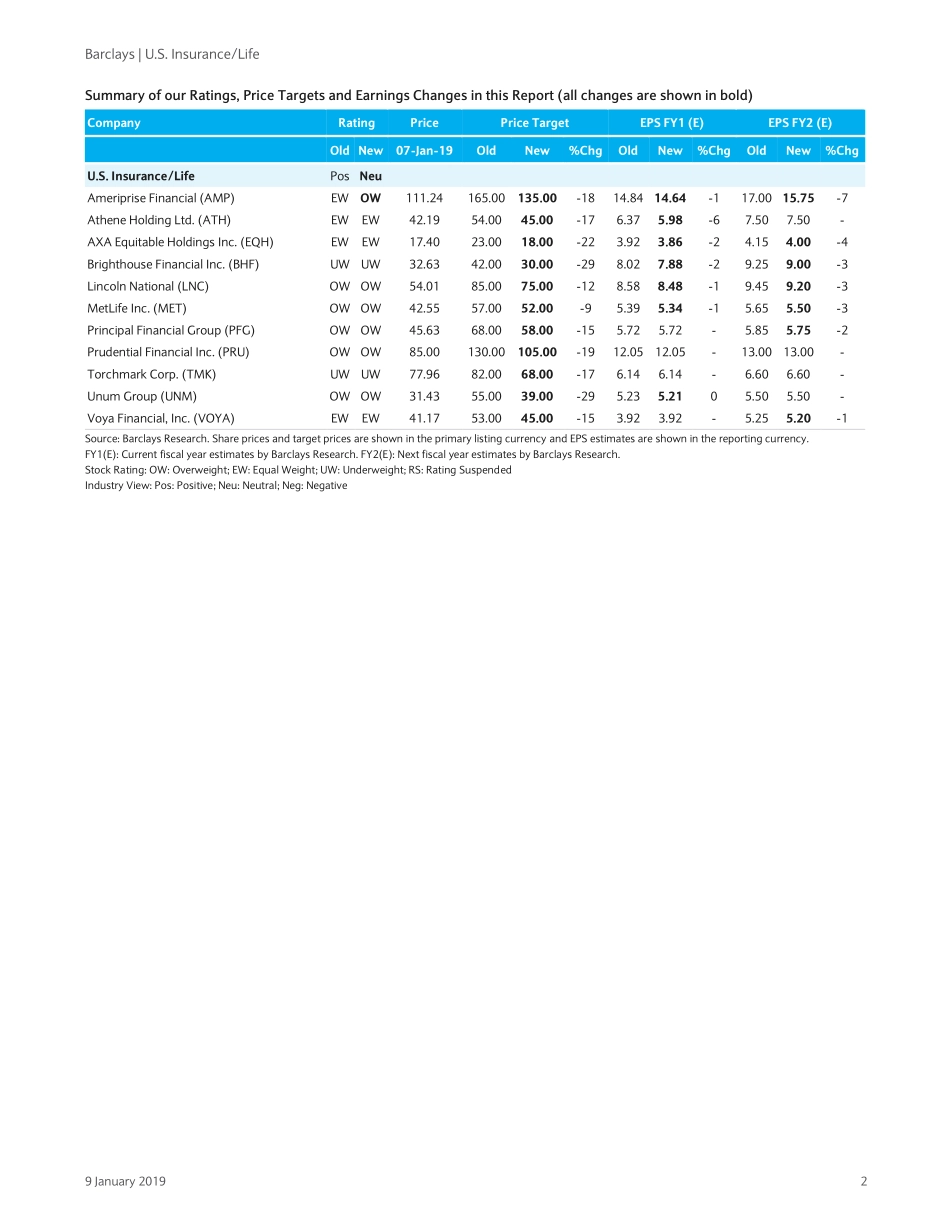

EquityResearch9January2019COREBarclaysCapitalInc.and/oroneofitsaffiliatesdoesandseekstodobusinesswithcompaniescoveredinitsresearchreports.Asaresult,investorsshouldbeawarethatthefirmmayhaveaconflictofinterestthatcouldaffecttheobjectivityofthisreport.Investorsshouldconsiderthisreportasonlyasinglefactorinmakingtheirinvestmentdecision.PLEASESEEANALYSTCERTIFICATION(S)ANDIMPORTANTDISCLOSURESBEGINNINGONPAGE58.U.S.Insurance/Life2019/2020Outlook:DowngradeLifeSectortoNeutralfromPositiveLifeInsuranceStocksLikelyRange-bound.WelowerourratingontheLifeInsurancesectortoNeutralfromPositivebecausewedoubtvaluationswillimproveinavolatileenvironment.Forexample,asub-3%yieldon10-yearUSTreasuries,aflatyieldcurve,decliningequitymarkets,long-termcareinsurancerisks,andhighbetaareviewedasfactorsinthesubstantialde-ratingoflifeinsurervaluations.AlthoughourindustryratingsarenowNeutralforbothLifeandP&Cinsurance,weprefertheP&Csectorbasedonitslowerbetaandlessexposuretoavolatilemacroenvironment.WelowerourEPSestimatestoreflectrecentequitymarketvolatility.Wealsoreducemostofourlifeinsurerpricetargetstoresetthebarinachallengingmacroenvironment.IstheBadNewsAlreadyPricedin?Manylifestockshavealreadydeclinedtofive-year-lowsharepricesandvaluations.However,it’sdifficulttofindfundamentalcatalyststhatwouldcausethelifestockstore-ratehigherorboostestimates.WealsodoubtlifeinsurervaluationmultipleswouldexpandasconsensusEPSestimatescouldfurtherdecline.Lookingahead,itcouldbeviewedasanegativesignaliflifeinsurerscurtailsharebuybacksorlimitdividendincreases.Alternatively,ifmacrofactors(rates,yieldcurve,equities)turnfavorableandlifestocksrally,wewouldlikelyviewitasanopportunitytotakeprofits.Anotherpossibility,inourview,isthatdepressedlifeinsurervaluationscouldresultinfinancialbuyersparticipatinginindustryconsolidation.TacticalOpportunity:UpgradeAMPtoOW.AMPisastrongcompanyandbrandatalowvaluation,inourview.EventhoughAMPhashighexposuretoequitymarkets(andanelevatedbeta),webelievethecompanyhasprovenitcancontrolexpensestohe...