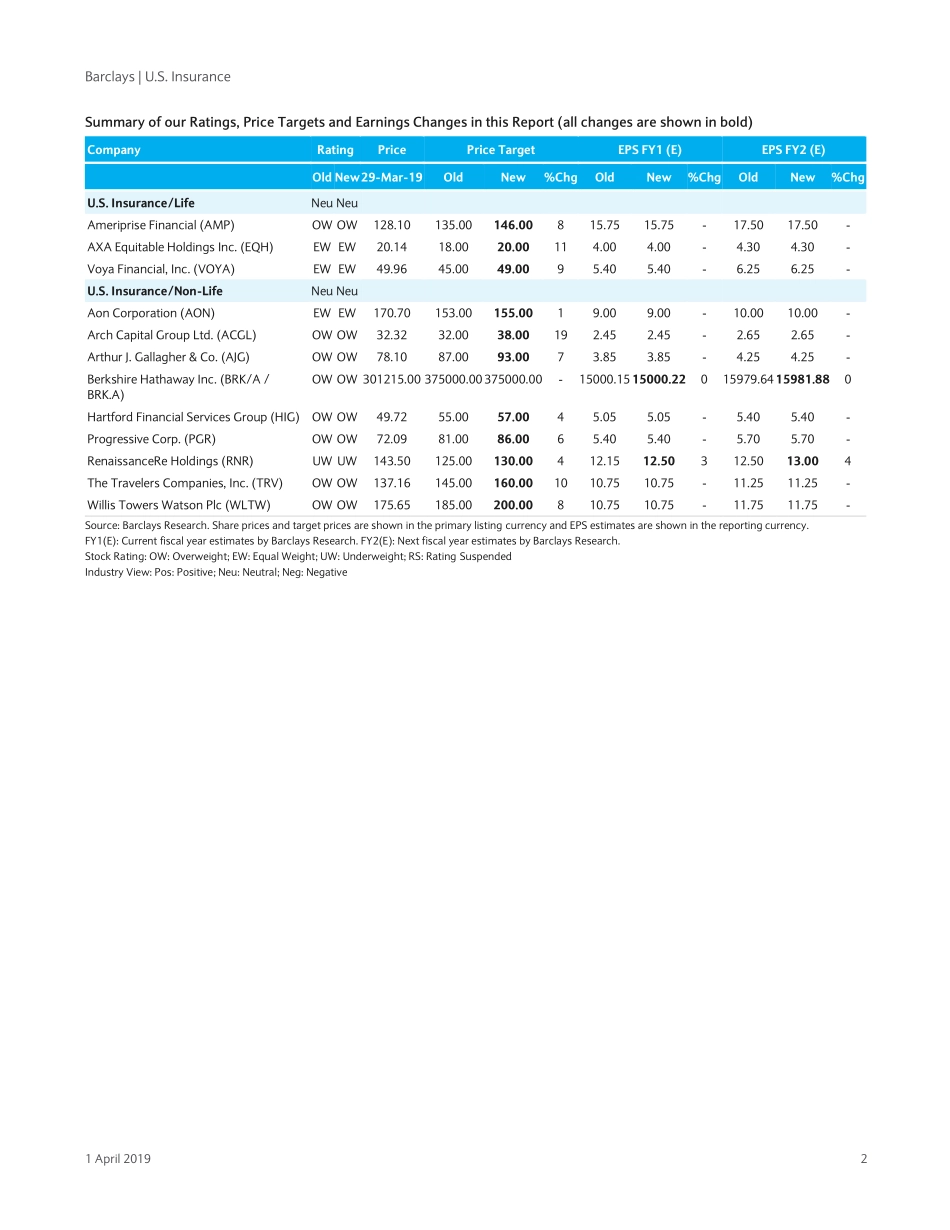

EquityResearch1April2019COREBarclaysCapitalInc.and/oroneofitsaffiliatesdoesandseekstodobusinesswithcompaniescoveredinitsresearchreports.Asaresult,investorsshouldbeawarethatthefirmmayhaveaconflictofinterestthatcouldaffecttheobjectivityofthisreport.Investorsshouldconsiderthisreportasonlyasinglefactorinmakingtheirinvestmentdecision.PLEASESEEANALYSTCERTIFICATION(S)ANDIMPORTANTDISCLOSURESBEGINNINGONPAGE96.Restricted-InternalU.S.Insurance1QPreview:ExpectSolidP&CResults;MixedMacroFactorsinLifeInsuranceP&CResultsShouldbeRobust.1QP&Cinsuranceresultsareexpectedtobefavorable,includinglower-than-normalcatastrophelosses.P&Cmarketconditionsarecurrentlystablealthoughonthecuspoftighteningbythemostinfiveyears,inourview.AlthoughpropertycatastrophereinsurancerateswereflatinJanuary’19,thissituationappearslikelytotightenastheyearprogresses.Meanwhile,personallinesinsurerscontinuetogeneratefavorableunderwritingresultsandthefocusappearstobeshiftingtogrowth.Importantly,AIGhasappearedconfidentitshoulddeliveraP&Cunderwritingprofitin2019aswellasin1Q.OurOW-ratedP&CstocksincludeBerkshireHathaway(favorablepositioningtohighershort-termrates,andpotentialforaccretiveacquisitionsaswellassharebuybacks),AllstateandProgressive(strongearningstrendsinautoandhomeinsurance),AIG(turnaroundopportunitywithtop-tiermanagementteam),andChubb(coreglobalP&Choldingwithsuperiorfranchisevalue).LifeInsurersFaceMacroCross-Currents.LifeInsurersarelikelytobenefitfromtheyear-to-daterecoveryinequitymarkets(whichcouldbeabenefitforearningsifitthesegainshold).However,the10-yearTreasuryyieldhasdeclinedtoa15-monthlow,theyieldcurveisflat,andthereareongoingconcernsregardinglegacylong-termcareinsuranceexposure.BellwetherlifeinsurervaluationsremaincompressedwithamedianP/Eof7x,althoughwedonotenvisionincreasedvaluationsgiventheinterestrateenvironment’sdownwardpressureonearningspower.Weexpect1Q19lifeinsurermedianoperatingEPStoincrease+4%y/y(+5%onacorebasis),althoughtherangewidelyvaries.WeexpectATHandVOYAtogenerateamongthestrongest1...