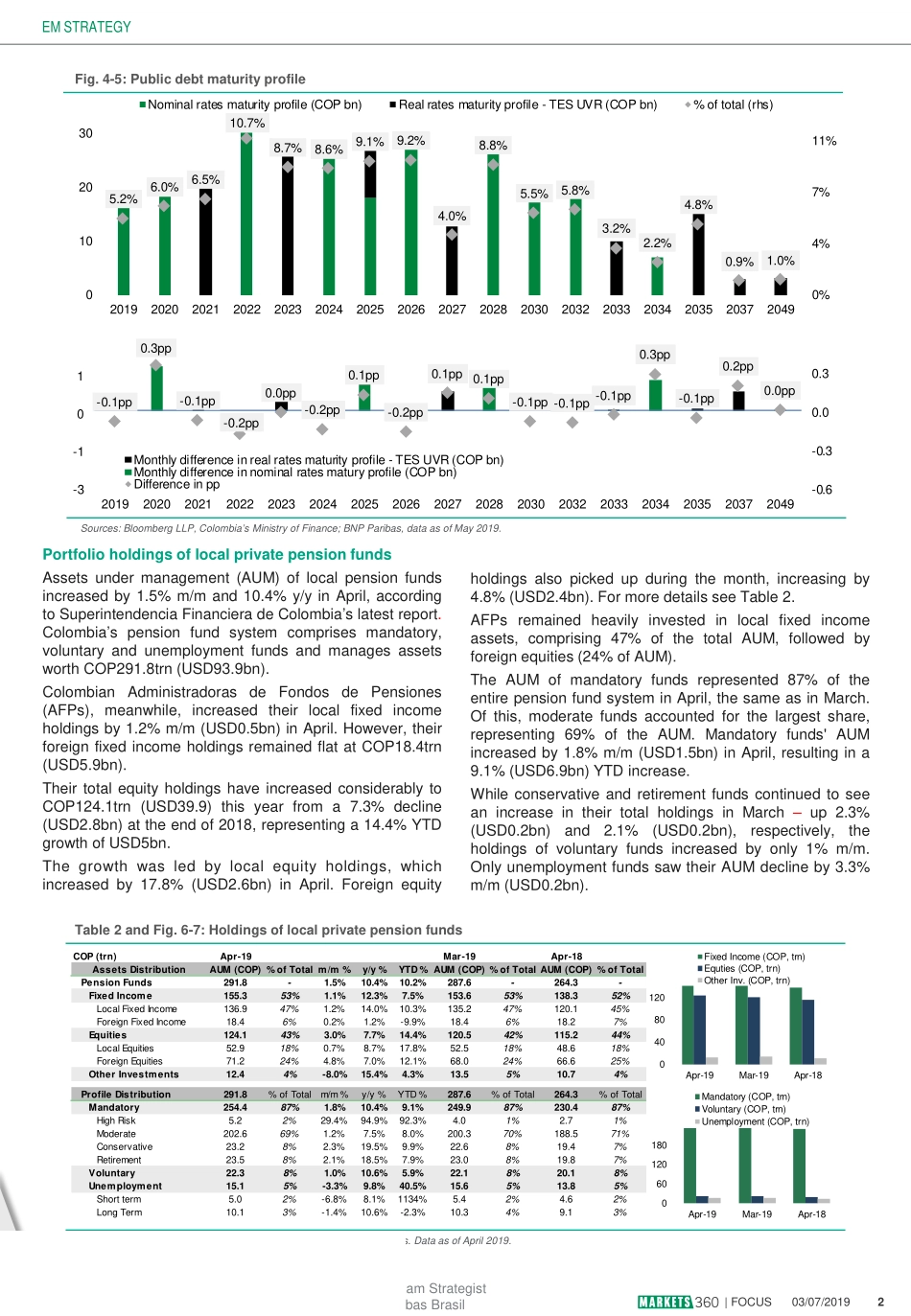

(1.5)0.01.53.04.52013201420152016201720182019Non-residentsmonthlychange(COPtrn)3monthsmovingaverage0.3|FOCUS03/07/20191FOCUS|EM03July2019ColombiaMonitor:AFP’sequityholdingsincreaseconsiderablyKEYMESSAGESColombia’stotalpublicdebtincreasedby1.9%inMaytoCOP314.1trn(USD92.9bn)fromCOP308.3trninMay,accordingtotheMinistryofFinance.Debtholdingsofnon-residentsrepresented44.8%ofinternationalreservesduringthemonth,down8.2ppfromthecorrespondingperiodlastyear.Meanwhile,AUMoflocalpensionfundsincreasedby1.5%m/mand10.4%y/yinApril,accordingtoSuperintendenciaFinancieradeColombia’slatestreport.TotalequityholdingshaveincreasedtoCOP124.1trn(USD39.9)thisyear,representinga14.4%YTDgrowthofUSD5bn.EMSTRATEGYBreakingupAUMvariationsintoflowsandperformancecomponentsColombia’stotalpublicdebtincreasedby1.9%inMaytoCOP314.1trn(USD92.9bn)fromCOP308.3trninMay,accordingtotheMinistryofFinance.Theshareofnon-residentsinthecountry'spublicdebt,meanwhile,increasedinabsolutetermsbyamarginal0.4%m/mtoCOP78.7trn(USD23.3bn).PublicdebtholdingsofforeigninvestorscontinuedtoshowadeclineinrelativetermsinMayaspensionfundshaveincreasinglyraisedtheirparticipationinpublicdebt–by1.8%(USD0.4bn)m/mand22.7%y/y(USD4.9bn).SeeFig.1.Duringthemonth,debtholdingsofnon-residentsrepresented44.8%ofinternationalreserves,down8.2ppfromthecorrespondingperiodlastyear.ThematuritiesinColombia’snominalratesmarketarewell-distributedoverthenextfewyears,withthebiggestmaturitiesintermsofsizebeingthe2022,2025and2026bonds.Whiletherewasasignificantincreaseinallocationsforthe2020andtherecentlyissued2034bonds,fornominalratebondsallocationsdeclinedslightlyinthebellyofthecurve.Forrealratebonds,theallocationscontinuetobebiggerinshortermaturities,withtheexceptionofthe2035bond(seeFig.4and5).Table1andFig.1-3:BreakdownofpublicdebtSources:BloombergLLP,Colombia’sMinistryofFinance;BNPParibas.DataasofMay2019.28.5%25.0%21.4%15.4%9.5%0%8%15%23%30%2013201420152016201720182019Holdingsasa%oftotaldebtNon-residentsPensionFundsCommercialBanksPublicSectorOthersC...