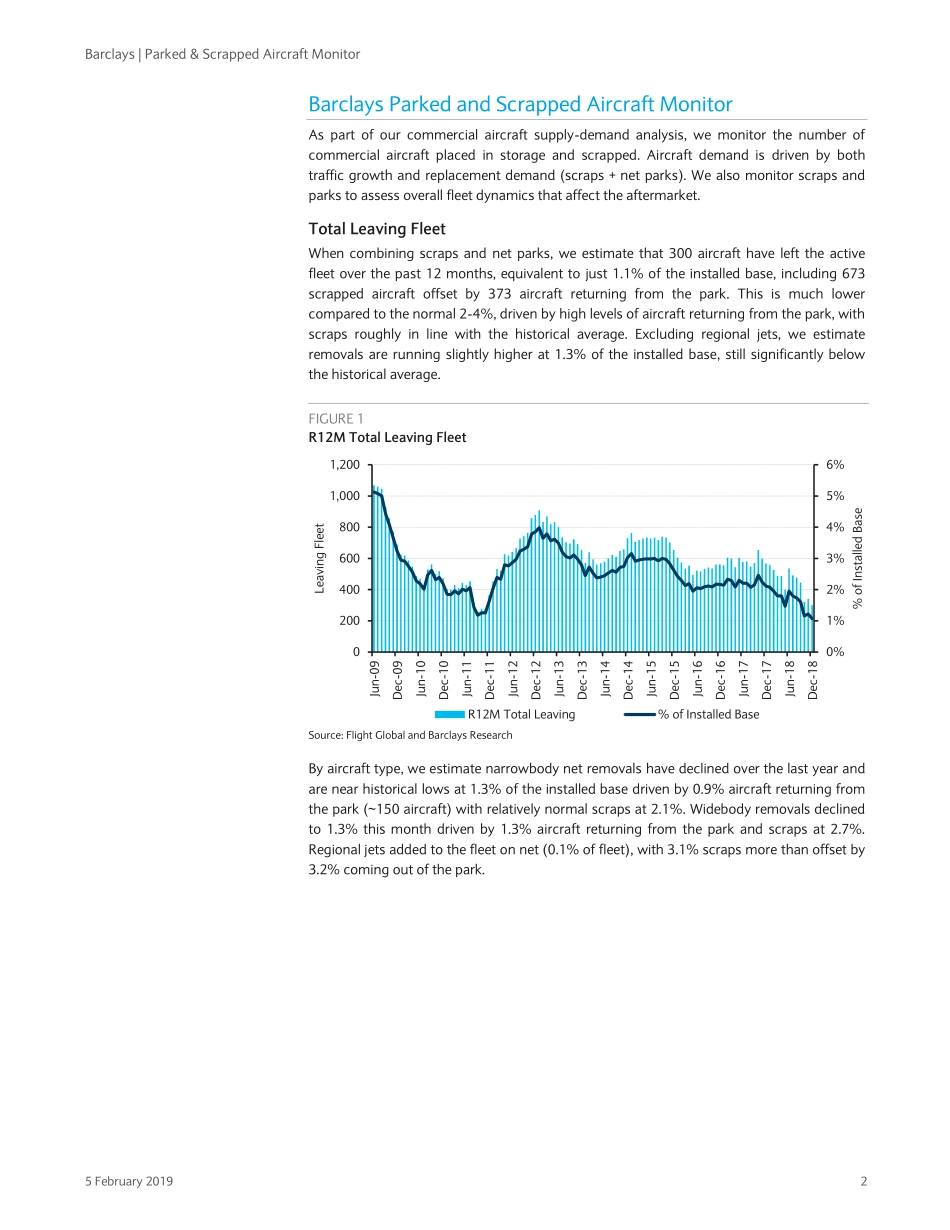

EquityResearch5February2019COREBarclaysCapitalInc.and/oroneofitsaffiliatesdoesandseekstodobusinesswithcompaniescoveredinitsresearchreports.Asaresult,investorsshouldbeawarethatthefirmmayhaveaconflictofinterestthatcouldaffecttheobjectivityofthisreport.Investorsshouldconsiderthisreportasonlyasinglefactorinmakingtheirinvestmentdecision.PLEASESEEANALYSTCERTIFICATION(S)ANDIMPORTANTDISCLOSURESBEGINNINGONPAGE25.Parked&ScrappedAircraftMonitorNetRetirementsContinuetoRunLowasParkReturnsNearlyOffsetScrapsWetrackcommercialaircraftretirements(parksplusscraps)toestimatereplacementdemandaspartofoursupply-demandanalysisandtomonitorfleetdynamicsthataffecttheaftermarket.Parks16%lowerYOY:Wecount1,987parkedcommercialaircraftinDecember,2%lowerfromNovember,and16%lowerYOYincluding14%lowerforparkednarrowbodies,16%lowerforwidebodiesand18%lowerforregionaljets(allYOY).Weestimatethat7%oftheinstalledbaseisnowparked,muchlowerthanthelastseveralyearsasaircrafthavecontinuedtoreturnfromtheparkamidfleetgrowth.Mid-lifeaircraft(aged11-20yearsold)inparticularhaverecentlyreturnedfromtheparkandaccountfor~1/2ofthedrawdown.Historically,periodsthathaveseenadrawdowninmid-lifeaircraftfromstoragehavecorrelatedwithstrongaftermarketgrowth.FewerparkedRR787s:ParkedRolls-RoyceTrent1000-powered787sincreasedsignificantlyafteranairworthinessdirectiverelatingtocompressorbladeswasissuedinApril.Wecount~25parkedTrent787s(~8%ofthefleet),~20belowthepeakinOctober.TheseaircraftarepresumablyparkedpendinginspectionbyRolls-Royce.Scrapsinlinewithhistoricalaverage,forecastingslightincrease:Wecount673scrappedcommercialaircraftoverthelast12months,8%higherfromtheprior12monthsandequivalentto2.4%oftheinstalledbase.Weestimateadjustedscrapsarerunningat~2.8%(adjustedhigherforexpectedscrapsreportedafterthefact),roughlyinlinewiththehistoricalaverage.Ashighlevelsofaircraftproducedinthelate1990s/early2000sbegintoageintoretirement,weforecastscrapsincreasingto~3%(onunits)overthenextseveralyears,includingwidebodiesat3-4%andnarrowbodiesat2-3%.Ne...