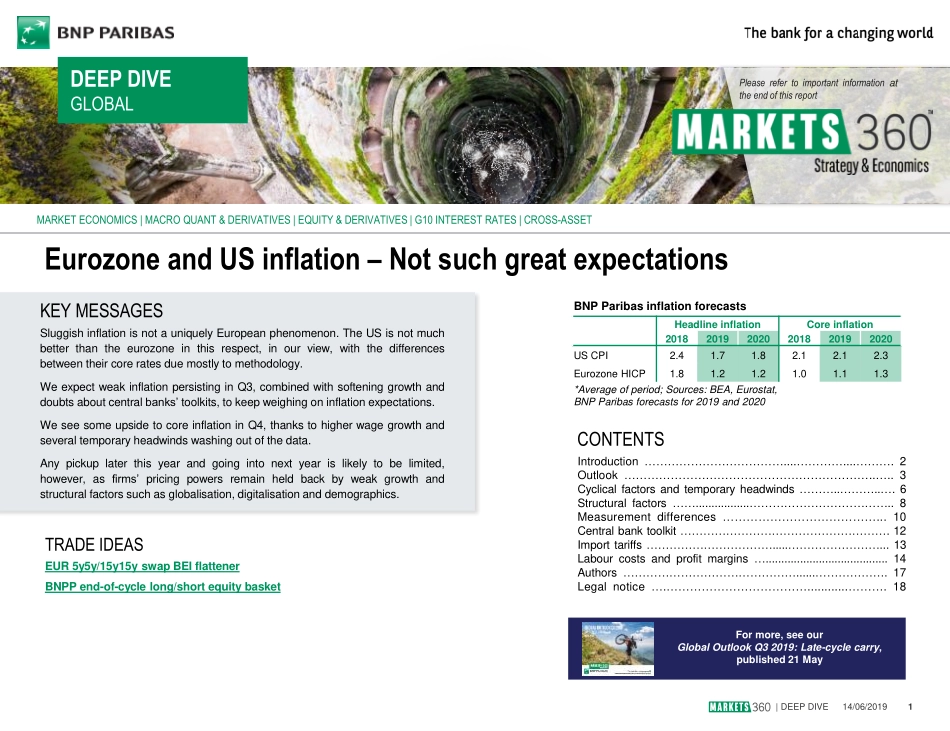

|DEEPDIVE14/06/20191EurozoneandUSinflation–NotsuchgreatexpectationsKEYMESSAGESSluggishinflationisnotauniquelyEuropeanphenomenon.TheUSisnotmuchbetterthantheeurozoneinthisrespect,inourview,withthedifferencesbetweentheircoreratesduemostlytomethodology.WeexpectweakinflationpersistinginQ3,combinedwithsofteninggrowthanddoubtsaboutcentralbanks’toolkits,tokeepweighingoninflationexpectations.WeseesomeupsidetocoreinflationinQ4,thankstohigherwagegrowthandseveraltemporaryheadwindswashingoutofthedata.Anypickuplaterthisyearandgoingintonextyearislikelytobelimited,however,asfirms’pricingpowersremainheldbackbyweakgrowthandstructuralfactorssuchasglobalisation,digitalisationanddemographics.MARKETECONOMICS|MACROQUANT&DERIVATIVES|EQUITY&DERIVATIVES|G10INTERESTRATES|CROSS-ASSETDEEPDIVEGLOBALCONTENTSIntroduction………………………………....…………....……….2Outlook………………………………………………………..…..3Cyclicalfactorsandtemporaryheadwinds………..………..….6Structuralfactors…….................………………………………..8Measurementdifferences…………………………………...10Centralbanktoolkit……………………………………………….12Importtariffs…………………………….....……………………...13Labourcostsandprofitmargins….......................................14Authors………………………………………......……………….17Legalnotice….………………………………............……….18Formore,seeourGlobalOutlookQ32019:Late-cyclecarry,published21MayBNPParibasinflationforecastsHeadlineinflationCoreinflation201820192020201820192020USCPI2.41.71.82.12.12.3EurozoneHICP1.81.21.21.01.11.3*Averageofperiod;Sources:BEA,Eurostat,BNPParibasforecastsfor2019and2020TRADEIDEASEUR5y5y/15y15yswapBEIflattenerBNPPend-of-cyclelong/shortequitybasketPleaserefertoimportantinformationattheendofthisreport|DEEPDIVE14/06/20192InflationmarketstradingatasharpdiscounttocentralbanktargetMARKETECONOMICS|MACROQUANT&DERIVATIVES|EQUITY&DERIVATIVES|G10INTERESTRATES|CROSS-ASSETShahidLadha,HeadofStrategyforG10RatesAmericas|...