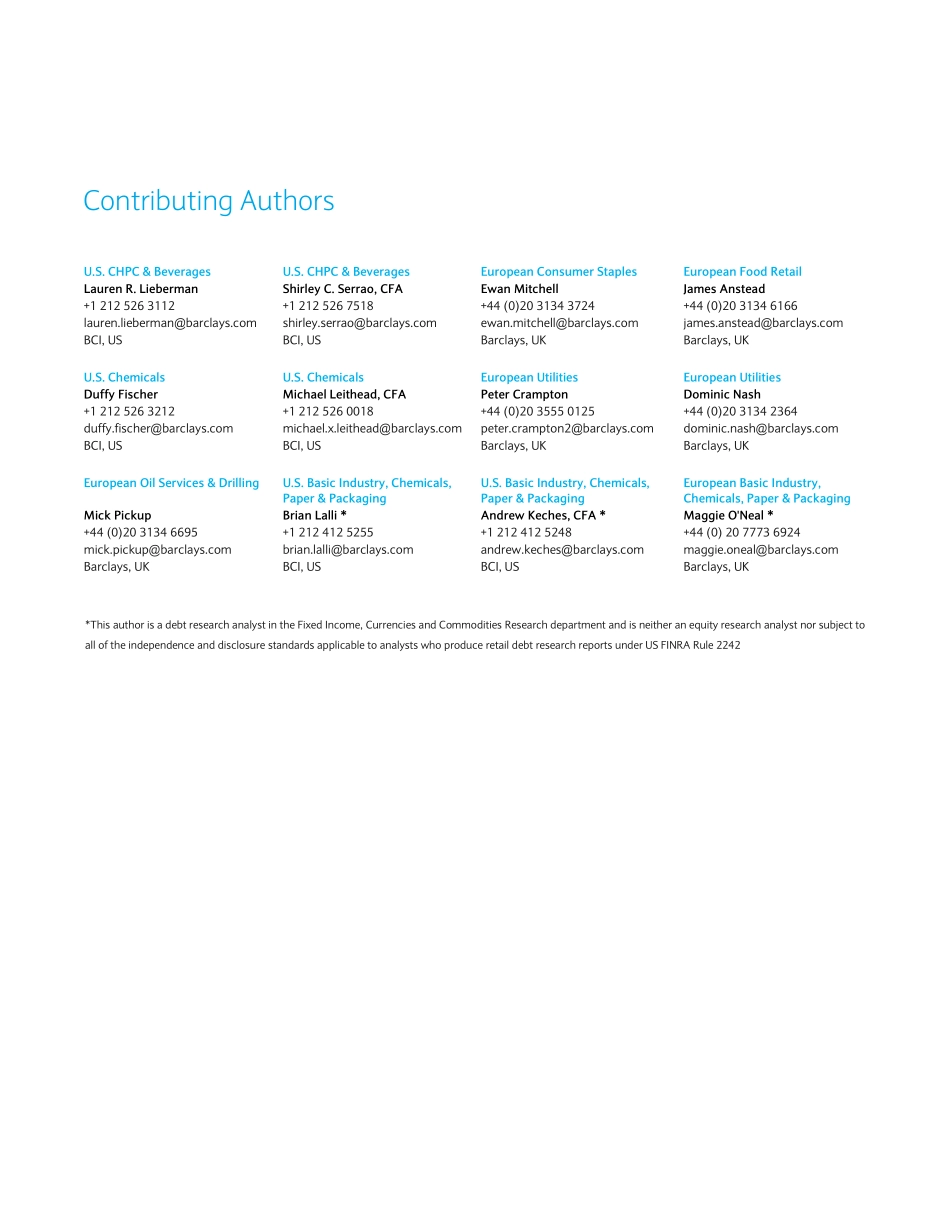

*Forlistofadditionalauthors,seepage2ThisisaSpecialReportthatisnotadebtresearchreportunderU.S.FINRARule2242.Barclaysmakesitsdebtresearchreportsavailabletoeligibleinstitutionalinvestorsonly.BarclaysCapitalInc.and/oroneofitsaffiliatesdoesandseekstodobusinesswithcompaniescoveredinitsresearchreports.Asaresult,investorsshouldbeawarethatthefirmmayhaveaconflictofinterestthatcouldaffecttheobjectivityofthisreport.Investorsshouldconsiderthisreportasonlyasinglefactorinmakingtheirinvestmentdecision.ThisresearchreporthasbeenpreparedinwholeorinpartbyequityresearchanalystsbasedoutsidetheUSwhoarenotregistered/qualifiedasresearchanalystswithFINRA.Pleaseseeanalystcertificationsandimportantdisclosuresbeginningonpage67.SIGNATURE#climatechange#transatlanticSustainable&ThematicInvestingPlasticWaste:Don’tloseyourbottleWithonly16%ofglobalplasticsrecycled,societyisunderpressuretoaddressplasticwaste.WebelievePETbottlesareheretostay,thoughsignificantinvestmentisrequiredinitswastemanagement.WeexpectconsumerdepositschemesandemergingrecyclingtechnologytosupportthetransitiontoacirculareconomyforPET.Sustainable&ThematicInvesting*KatherineOgundiyaHiralPatel+44(0)2031341391+44(0)2031341618katherine.a.ogundiya@barclays.comhiral.patel@barclays.comBarclays,UKBarclays,UKSpecialReportIResearch19June2019ContributingAuthorsU.S.CHPC&BeveragesU.S.CHPC&BeveragesEuropeanConsumerStaplesEuropeanFoodRetailLaurenR.Lieberman+12125263112lauren.lieberman@barclays.comBCI,USShirleyC.Serrao,CFA+12125267518shirley.serrao@barclays.comBCI,USEwanMitchell+44(0)2031343724ewan.mitchell@barclays.comBarclays,UKJamesAnstead+44(0)2031346166james.anstead@barclays.comBarclays,UKU.S.ChemicalsU.S.ChemicalsEuropeanUtilitiesEuropeanUtilitiesDuffyFischer+12125263212duffy.fischer@barclays.comBCI,USMichaelLeithead,CFA+12125260018michael.x.leithead@barclays.comBCI,USPeterCrampton+44(0)2035550125peter.crampton2@barclays.comBarclays,UKDominicNash+44(0)2031342364dominic.nash@barclays.comBarclays,UKEuropeanOilServices&DrillingU.S.BasicIndust...