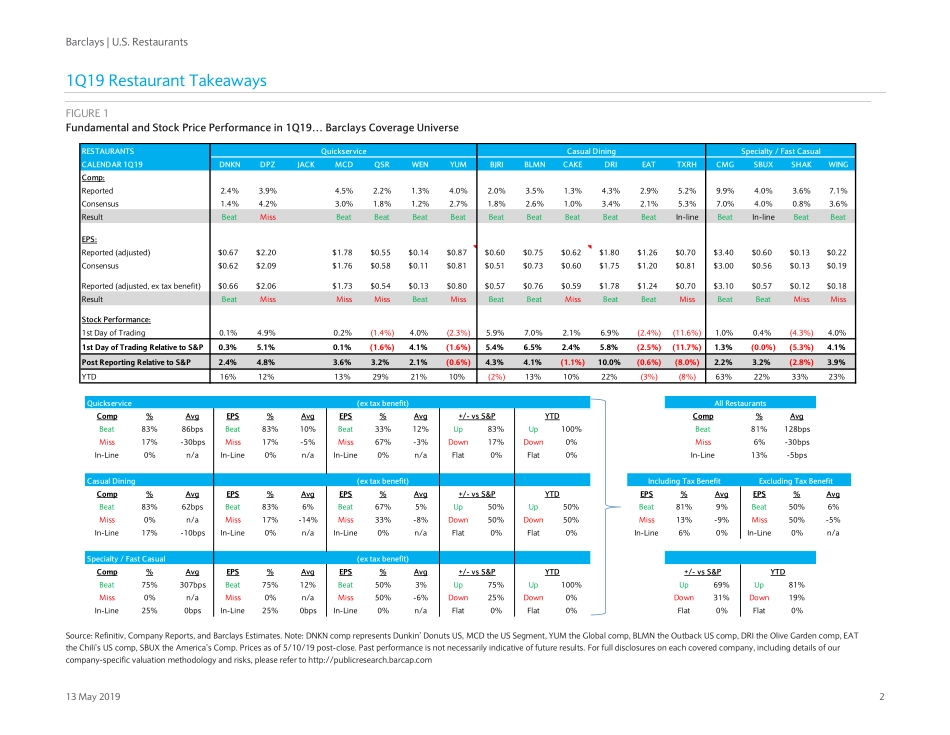

EquityResearch13May2019COREBarclaysCapitalInc.and/oroneofitsaffiliatesdoesandseekstodobusinesswithcompaniescoveredinitsresearchreports.Asaresult,investorsshouldbeawarethatthefirmmayhaveaconflictofinterestthatcouldaffecttheobjectivityofthisreport.Investorsshouldconsiderthisreportasonlyasinglefactorinmakingtheirinvestmentdecision.PLEASESEEANALYSTCERTIFICATION(S)ANDIMPORTANTDISCLOSURESBEGINNINGONPAGE20.Restricted-InternalU.S.Restaurants1Q19CompBeat…ButEPSMissed&AprilCompMixed;‘SellinMay’?DearClient:WeappreciateyourconsiderationintheInstitutionalInvestorAll-America&All-CanadaResearchTeam2019Survey.Toviewouranalysts,pleaseclickhere.Headinginto1Q19restaurantearnings,ourpreviewwasentitled“SurprisinglyResilient”(4/22/19).Thismessageheldtrue,withonlyonecompshortfallrelativetoconsensus,demonstratingbroadconsumerstrength.Withthatsaid,extaxbenefits,~50%missedonEPSandthegroupismodestlyunderperformingtheS&P500YTD.WecontinuetohaveLTcategorycompconcerns,withsupply(i.e.units)exceedingdemand(i.e.sales),ledbycasualdiners.Withthatsaid,’18compmomentumsustainedthrough1Q19(exweather).AndwhileAprileasedrelativetoMarch,itwasstillbetterthanFebruary.ButEPSupsidehasbeenhardtocomeby,pressuredbyongoingoutsizedlaborandarecentreturntocommoditycostinflation.Andwithmultiplesabovehistoricaverages,difficulttojustifysectoroutperformance.The‘SellinMay’adageiswellknown,andouranalysisof~30yearsofsharepriceseasonalitysuggestssectorstocksdotendtounderperforminJuneandJuly.Inthisnote,weanalyzerestaurantcomp&EPSgrowthtrendsincalendar1Q19,aswellascoloron2Q19QTDcomptrends(i.e.,April).Wealsoincludeanin-depthanalysisonrestaurantstockpriceseasonality.1Q19RestaurantTakeaways…~95%met,ormoreoftenbeat,compconsensus.Withthatsaid,~50%missedEPSconsensus(extaxfavorability).Importantly,whilesectorstockperformancehasbeenstrongonanabsolutebasis,ithasmodestlylaggedthebroaderS&P(Figure1).InlookingatEPS,ourtypicallymoredefensive,franchisedQSRshavehadatoughertime(~67%EPSmissrate)relativetoourmorediscretionary,co-opcas...