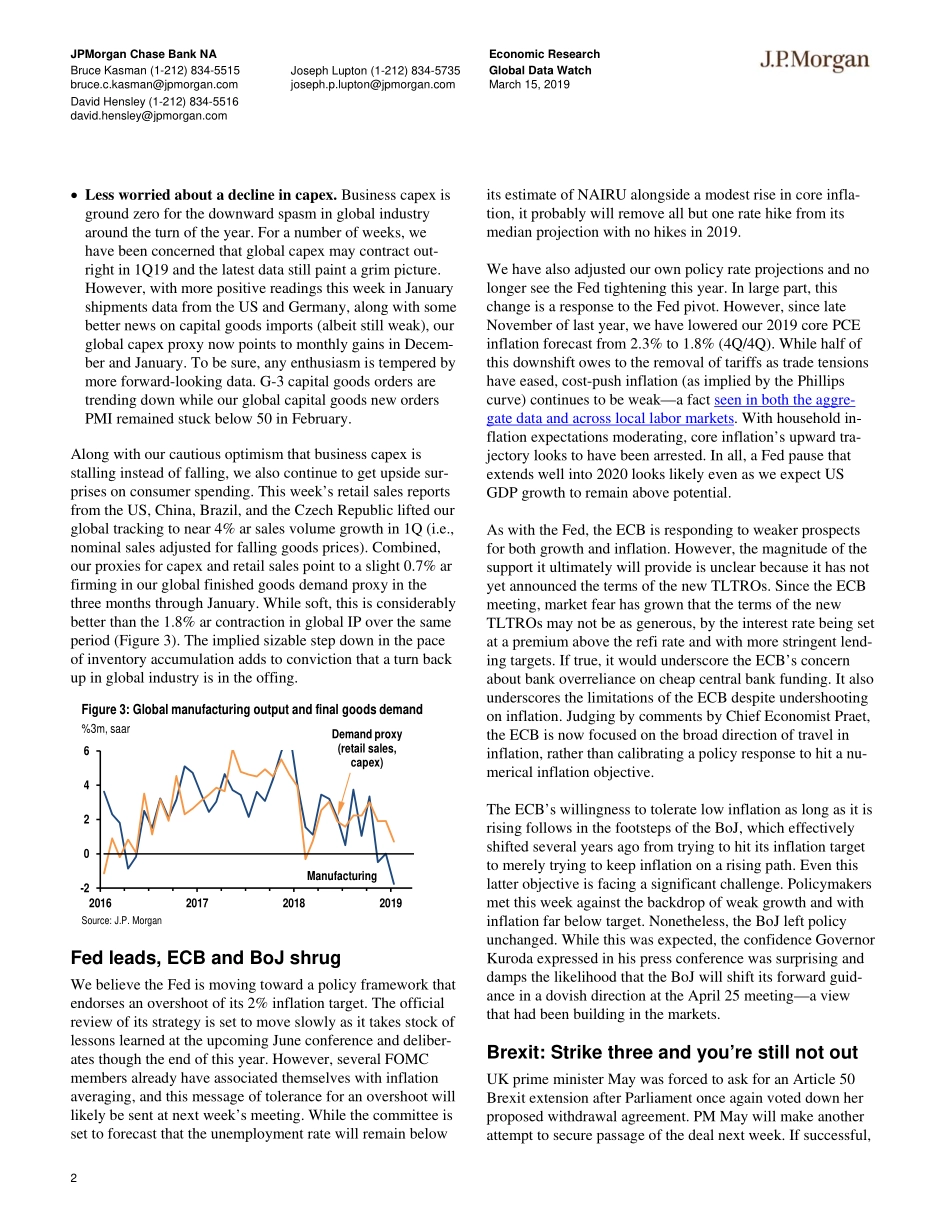

EconomicResearchMarch15,2019GlobalDataWatchPositivesignsofbottominginnoisyglobalsoftpatchFedtosignalextendedpausewhileBoJseesnoneedtoeaseExpectingnarrowpassageofMay’sBrexitplannextweekWeekahead:MixedflashMarchPMIs;FOMC;NorgesBank(+25bp)WeaklinkslooklessweakWhileclocksintheUS“sprangahead”thisweek,datawatchingcontinuestopaintapictureofanoisywintersoftpatch.However,notallisbleak.AlthoughthedatastillpointtoglobalGDPexpandingthisquarterattheweakestpacesincelate2015,weseehintsofbottominginthemonthlytrajectoryasantici-patedsupportsfallintoplace,consistentwithatleastsomeaccelerationin2Q.Theshiftinthepolicybackdrop,whichalreadyhasprovidedanimportantboosttoconfidenceandfinancialmarketriskappetites,enhancesprospectsforthisswing.Asweprocessdata,weareespeciallyfocusedonhintsofsomefirmingintheweakestlinksoftheglobaleconomy:Euroareawakingfrom2H18hibernation.WithGDPhavingexpandedlessthan1%annualizedin2H18,theEuroareahasbeentheweakestlinkintermsofgeography.Wehaveattributedmuchofthisweaknesstotransitoryfactorsbuthaveacquiescedtothenotionthatpartofthedisappointmentowestoslowerunderlyinggrowth.Thegoodnewsisthattransitoryhead-windsarefinallyreversing.ThebounceinJanuaryIP(Figure1),ontheheelsofthepositiverevisiontotheall-industryPMIandabiggaininretailsales,confirmsapickupisunderway.Indeed,recoveriesintheautosectorandinGermany,whichhavelagged,willsoonreinforcetheIPpickup.Chinafindsitsfooting,andthensome.ThegrowthslowdowninChinalastyearwasasourceofconsiderableangsttobusinessesandmarketparticipants,amplifiedbytheescalationintradetensionswiththeUS.Withthetwosidesnowengagedindétenteandasizabledoseoffiscal,monetary,andcreditstimu-lusinthepipeline,China’sgrowthappearstohavefoundabottom.Asreportedthisweek,stronger-than-expectedgrowthinfactoryoutputfromDecemberthroughFebruary,alongwithsurprisingstrengthininfrastructureandrealestateinvestment,ledustoreviseupcurrent-quarterGDPgrowthto6.2%ar—andeventhenthereisarguablystillupsiderisk(Figure2).Whilenominalretailsalesdisappointed,ou...