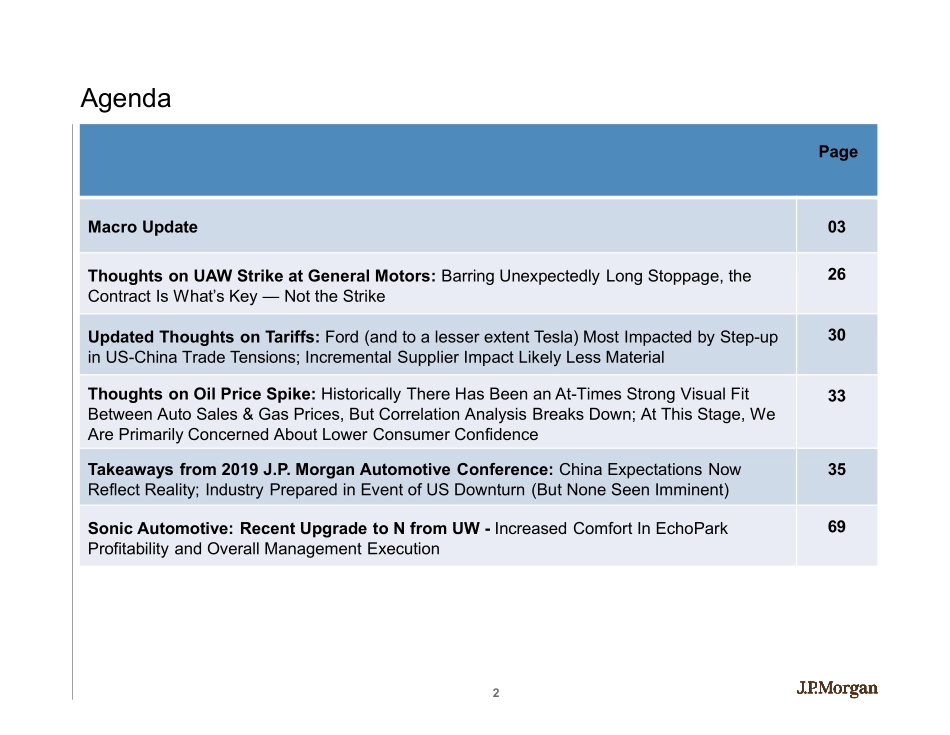

1StateoftheAutoIndustryThoughtsonGM-UAWStrike,OilPriceSpike,&IncreasedUS-ChinaTradeTensions;Takeawaysfrom2019J.P.MorganAutoConference;SAHUpgradetoNeutralUSAutos–EquityRyanBrinkmanAC212-622-6581ryan.j.brinkman@jpmorgan.comJ.P.MorganSecuritiesLLCBloombergJPMABRINKMANSeetheendpagesofthispresentationforanalystcertificationandimportantdisclosures,includingnon-USanalystdisclosures.J.P.Morgandoesandseekstodobusinesswithcompaniescoveredinitsresearchreports.Asaresult,investorsshouldbeawarethatthefirmmayhaveaconflictofinterestthatcouldaffecttheobjectivityofthisreport.Investorsshouldconsiderthisreportasonlyasinglefactorinmakingtheirinvestmentdecision.NorthAmericaEquityResearchSeptember2019USAutos–EquityRajatGuptaAC212-622-6382rajat.gupta@jpmorgan.comJ.P.MorganSecuritiesLLCBloombergJPMAGUPTA21MacroUpdate03ThoughtsonUAWStrikeatGeneralMotors:BarringUnexpectedlyLongStoppage,theContractIsWhat’sKey—NottheStrike26UpdatedThoughtsonTariffs:Ford(andtoalesserextentTesla)MostImpactedbyStep-upinUS-ChinaTradeTensions;IncrementalSupplierImpactLikelyLessMaterial30ThoughtsonOilPriceSpike:HistoricallyThereHasBeenanAt-TimesStrongVisualFitBetweenAutoSales&GasPrices,ButCorrelationAnalysisBreaksDown;AtThisStage,WeArePrimarilyConcernedAboutLowerConsumerConfidence33Takeawaysfrom2019J.P.MorganAutomotiveConference:ChinaExpectationsNowReflectReality;IndustryPreparedinEventofUSDownturn(ButNoneSeenImminent)35SonicAutomotive:RecentUpgradetoNfromUW-IncreasedComfortInEchoParkProfitabilityandOverallManagementExecution69AgendaPage3MacroUpdate4GlobalLightVehicleSAARSource:BureauofEconomicAnalysis,Ward’sAuto,LMCAutomotiveandJ.P.Morganestimates.Italicizednumbersareestimates.U.S.W.EuropeJapanDevelopedMarketChinaBrazilRussiaIndiaBRICMarketCanadaMexico2017Jan17.314.75.037.028.01.81.33.434.5111123Feb17.314.65.136.928.92.01.53.435.8123118Mar16.814.75.136.626.72.31.63.534.1187137Apr16.813.45.535.725.41.91.63.832.7197114May16.814.55.536.826.12.41.63.633.6216123Jun16.814.45.536.728.12.41.73.035.2203127Jul...