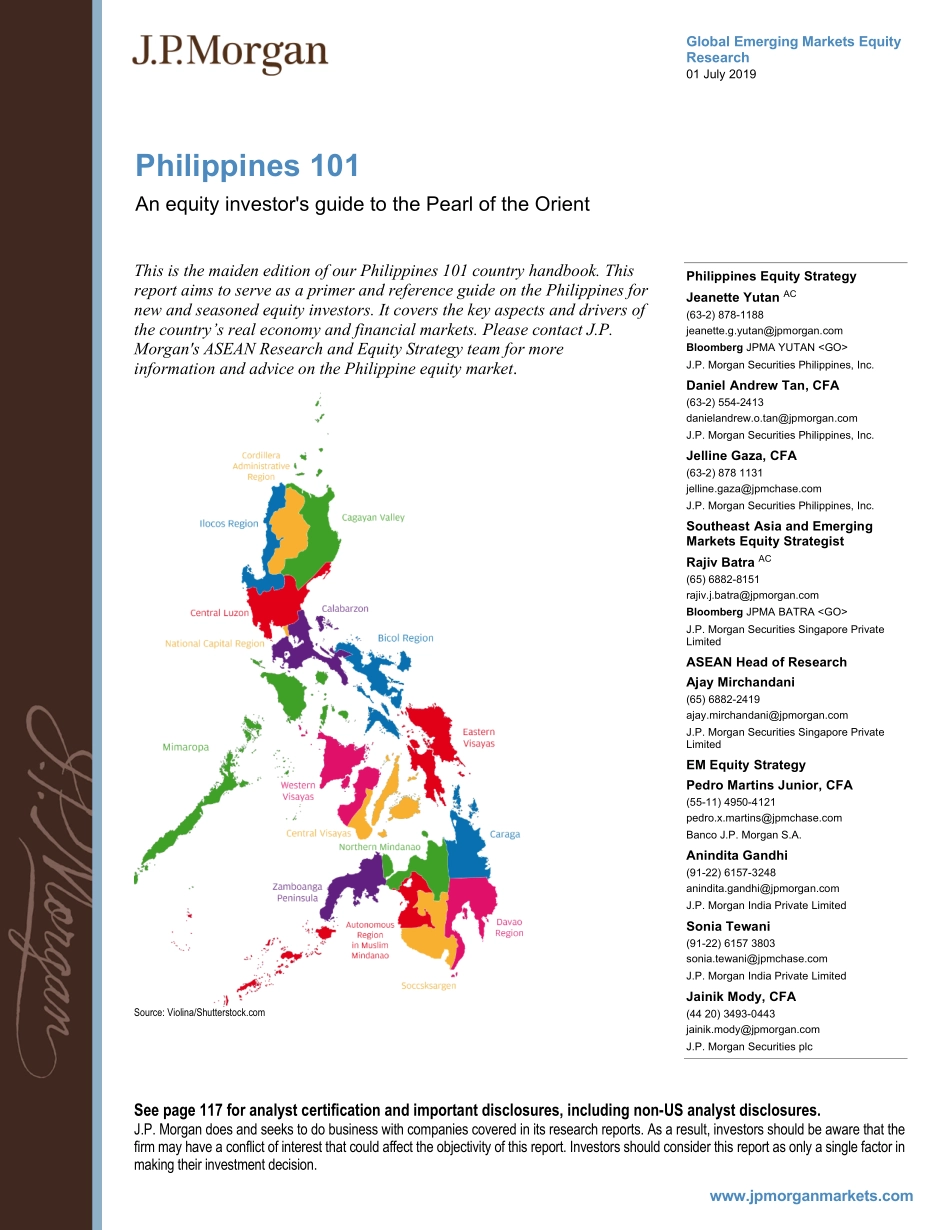

GlobalEmergingMarketsEquityResearch01July2019Philippines101Anequityinvestor'sguidetothePearloftheOrientPhilippinesEquityStrategyJeanetteYutanAC(63-2)878-1188jeanette.g.yutan@jpmorgan.comBloombergJPMAYUTANJ.P.MorganSecuritiesPhilippines,Inc.DanielAndrewTan,CFA(63-2)554-2413danielandrew.o.tan@jpmorgan.comJ.P.MorganSecuritiesPhilippines,Inc.JellineGaza,CFA(63-2)8781131jelline.gaza@jpmchase.comJ.P.MorganSecuritiesPhilippines,Inc.SoutheastAsiaandEmergingMarketsEquityStrategistRajivBatraAC(65)6882-8151rajiv.j.batra@jpmorgan.comBloombergJPMABATRAJ.P.MorganSecuritiesSingaporePrivateLimitedASEANHeadofResearchAjayMirchandani(65)6882-2419ajay.mirchandani@jpmorgan.comJ.P.MorganSecuritiesSingaporePrivateLimitedEMEquityStrategyPedroMartinsJunior,CFA(55-11)4950-4121pedro.x.martins@jpmchase.comBancoJ.P.MorganS.A.AninditaGandhi(91-22)6157-3248anindita.gandhi@jpmorgan.comJ.P.MorganIndiaPrivateLimitedSoniaTewani(91-22)61573803sonia.tewani@jpmchase.comJ.P.MorganIndiaPrivateLimitedJainikMody,CFA(4420)3493-0443jainik.mody@jpmorgan.comJ.P.MorganSecuritiesplcSeepage117foranalystcertificationandimportantdisclosures,includingnon-USanalystdisclosures.J.P.Morgandoesandseekstodobusinesswithcompaniescoveredinitsresearchreports.Asaresult,investorsshouldbeawarethatthefirmmayhaveaconflictofinterestthatcouldaffecttheobjectivityofthisreport.Investorsshouldconsiderthisreportasonlyasinglefactorinmakingtheirinvestmentdecision.www.jpmorganmarkets.comThisisthemaideneditionofourPhilippines101countryhandbook.ThisreportaimstoserveasaprimerandreferenceguideonthePhilippinesfornewandseasonedequityinvestors.Itcoversthekeyaspectsanddriversofthecountry’srealeconomyandfinancialmarkets.PleasecontactJ.P.Morgan'sASEANResearchandEquityStrategyteamformoreinformationandadviceonthePhilippineequitymarket.Source:Violina/Shutterstock.com2GlobalEquityResearch01July2019JeanetteYutan(63-2)878-1188jeanette.g.yutan@jpmorgan.comRajivBatra(65)6882-8151rajiv.j.batra@jpmorgan.comTableofContentsOurviewinanutshell.............