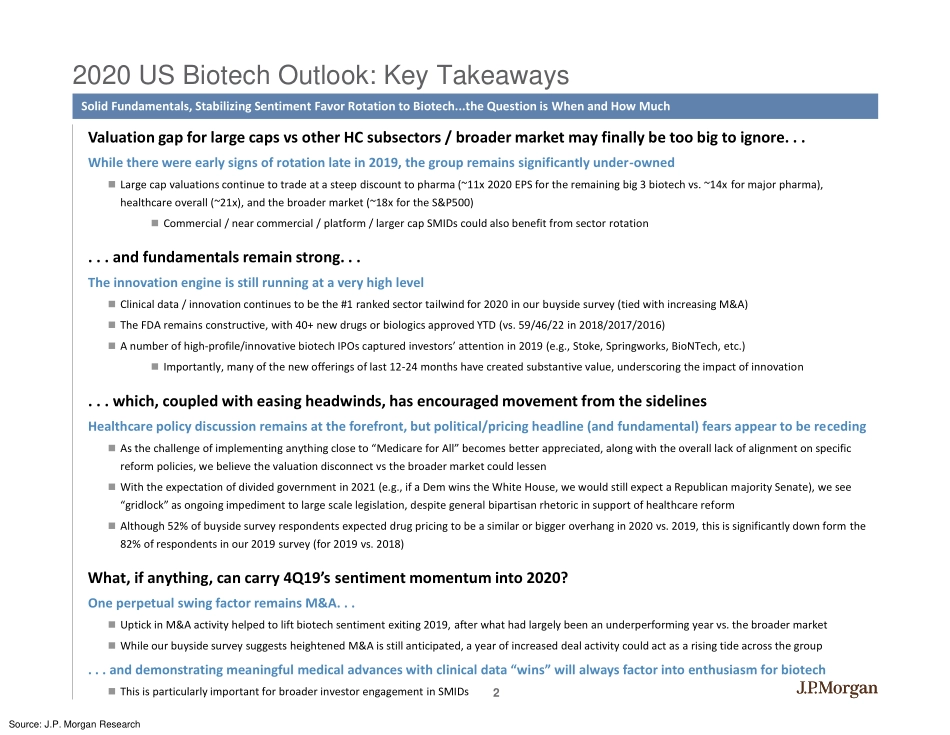

1NorthAmericaEquityResearchDecember2019J.P.MorganUSBiotechnologyResearch2020USBiotechOutlook:RoaringintotheNewYearwith2020VisionConferenceCallDetailsWearehostingaconferencecallonWednesday,December18@11:00amET/16:00UKPleasecontactusoryourJPMsalespersonfordetailsAnupamRamaAC212-622-0900anupam.rama@jpmorgan.comUSLargeCapBiotechnologyCoryKasimovAC212-622-5266cory.w.kasimov@jpmorgan.comUSSMIDBiotechnologyJessicaFyeAC212-622-4165Jessica.m.fye@jpmorgan.comEricJosephAC212-622-0659eric.w.joseph@jpmorgan.comYukoOku212-622-5374yuko.oku@jpmorgan.comTessaTRomero212-622-4484tessa.t.romero@jpmorgan.comGavinScott212-622-0579gavin.scott@jpmorgan.comMatthewHolt,Ph.D.212-622-9602matthew.t.holt@jpmorgan.comDanielWolle212-622-5805daniel.wolle@jpmorgan.comMatthewBannon212-622-0001matthew.bannon@jpmorgan.comTurnerKufe,M.D.212-622-4104turner.kufe@jpmorgan.comSeetheendpagesofthispresentationforanalystcertificationandimportantdisclosures,includingnon-USanalystdisclosures.J.P.Morgandoesandseekstodobusinesswithcompaniescoveredinitsresearchreports.Asaresult,investorsshouldbeawarethatthefirmmayhaveaconflictofinterestthatcouldaffecttheobjectivityofthisreport.Investorsshouldconsiderthisreportasonlyasinglefactorinmakingtheirinvestmentdecision.J.P.MorganSecuritiesLLC22020USBiotechOutlook:KeyTakeawaysSource:J.P.MorganResearchSolidFundamentals,StabilizingSentimentFavorRotationtoBiotech...theQuestionisWhenandHowMuchValuationgapforlargecapsvsotherHCsubsectors/broadermarketmayfinallybetoobigtoignore...Whiletherewereearlysignsofrotationlatein2019,thegroupremainssignificantlyunder-ownedLargecapvaluationscontinuetotradeatasteepdiscounttopharma(~11x2020EPSfortheremainingbig3biotechvs.~14xformajorpharma),healthcareoverall(~21x),andthebroadermarket(~18xfortheS&P500)Commercial/nearcommercial/platform/largercapSMIDscouldalsobenefitfromsectorrotation...andfundamentalsremainstrong...TheinnovationengineisstillrunningataveryhighlevelClinicaldata/innovationcontinuestobethe#1rankedsectortailwindfor2020inourbu...