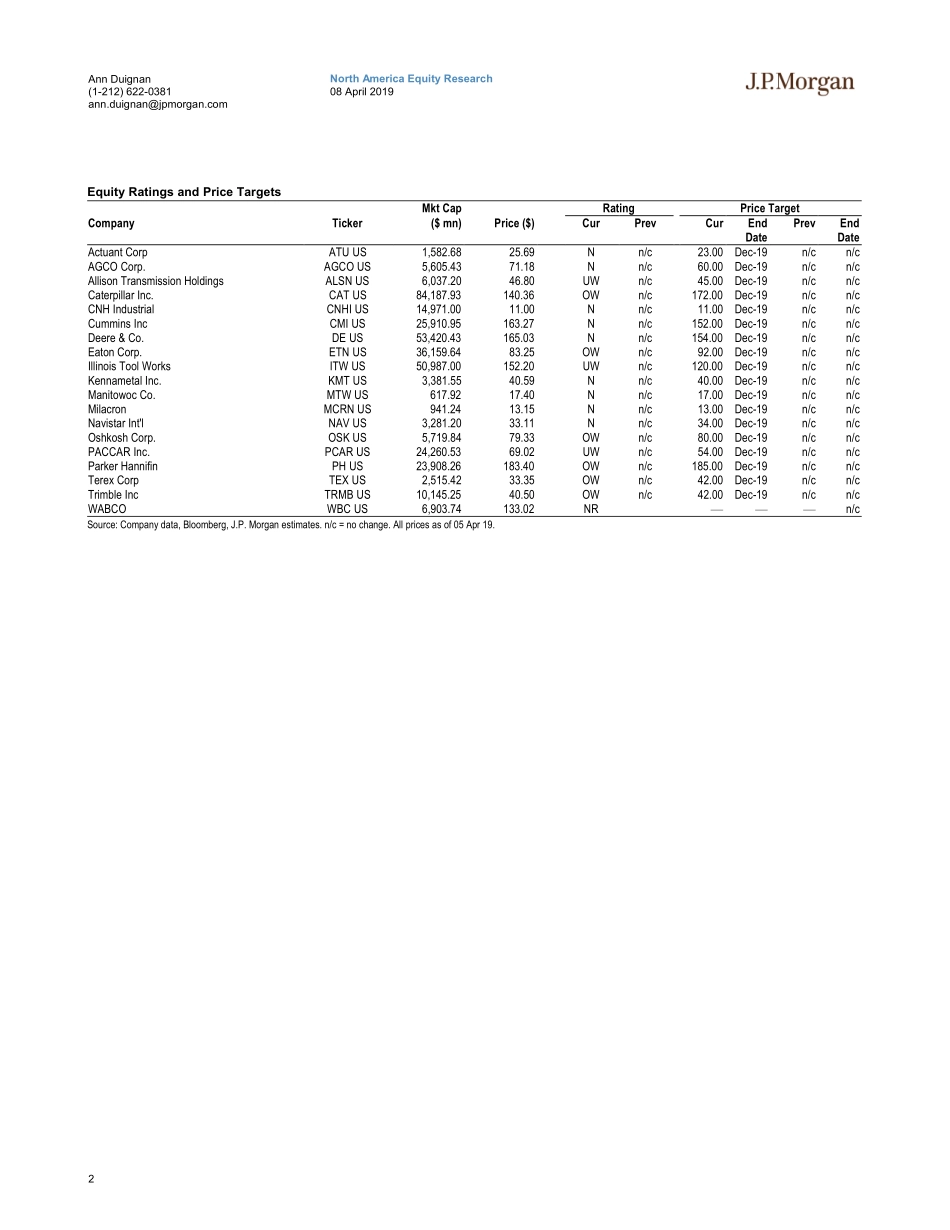

www.jpmorganmarkets.comNorthAmericaEquityResearch08April2019USMachineryQ1'19EarningsPreviewMachineryAnnDuignanAC(1-212)622-0381ann.duignan@jpmorgan.comBloombergJPMADUIGNANJ.P.MorganSecuritiesLLCThomasSimonitsch(1-212)622-2250thomas.simonitsch@jpmorgan.comJ.P.MorganSecuritiesLLCBhanuPKoduru(91-22)6157-3607bhanu.koduru@jpmchase.comJ.P.MorganIndiaPrivateLimitedSeepage59foranalystcertificationandimportantdisclosures,includingnon-USanalystdisclosures.J.P.Morgandoesandseekstodobusinesswithcompaniescoveredinitsresearchreports.Asaresult,investorsshouldbeawarethatthefirmmayhaveaconflictofinterestthatcouldaffecttheobjectivityofthisreport.Investorsshouldconsiderthisreportasonlyasinglefactorinmakingtheirinvestmentdecision.OurMachinerycoverageslightlyoutperformedthebroadermarketinQ1(up15%vs.theS&P500up14%)asinvestorsrotatedbackintointerest-rate-sensitivestocksthatunderperformedinthebackhalfof2018.Additionally,China’sManufacturingPMIimprovedinMarch,suggestingareacceleration,andinvestorsbelievethattheEurozonePMIwillstabilize/improveinthenearterm,supportingtherotationintocyclicals.Beyondthemacro,tradenegotiationscontinuetoaddvolatilitytostocks,andthelaggardsinthegrouphavebeenCATandDEasthefinalresolutioncontinuestogetpushedout.Additionally,USdollarstrength(especiallyvs.theArgentinepesoandBrazilianreal)isweighingonUSagriculturalexports,compoundingthedamageofChinesecounter-tariffsandaddingtothegrowinglistofheadwindsforUSfarmers;weareincrementallymorecautiousonDEandCNHIgoingintoacriticalUSplantingseason.Wewillco-hostacallonWednesday,April17,at10amETwithSteveTusaandourcolleaguesinEuropeandJapan;pleasecontactusoryourJPMsalespersonfordial-indetails.WeremainbullishUSconstruction;privatenon-residentialandpublicspendinggrowthunder-appreciated.TotalconstructionspendingSAARwasup1.0%MoMinFebruarydespiteanupwardrevisiontoJanuaryspending.PrivateresidentialspendingSAARwasup0.7%MoM;privatenon-residentialspendingwasdown0.5%MoM;andpublicspendingSAARwasup3.6%MoM,mainlydrivenbyanincreaseinHig...