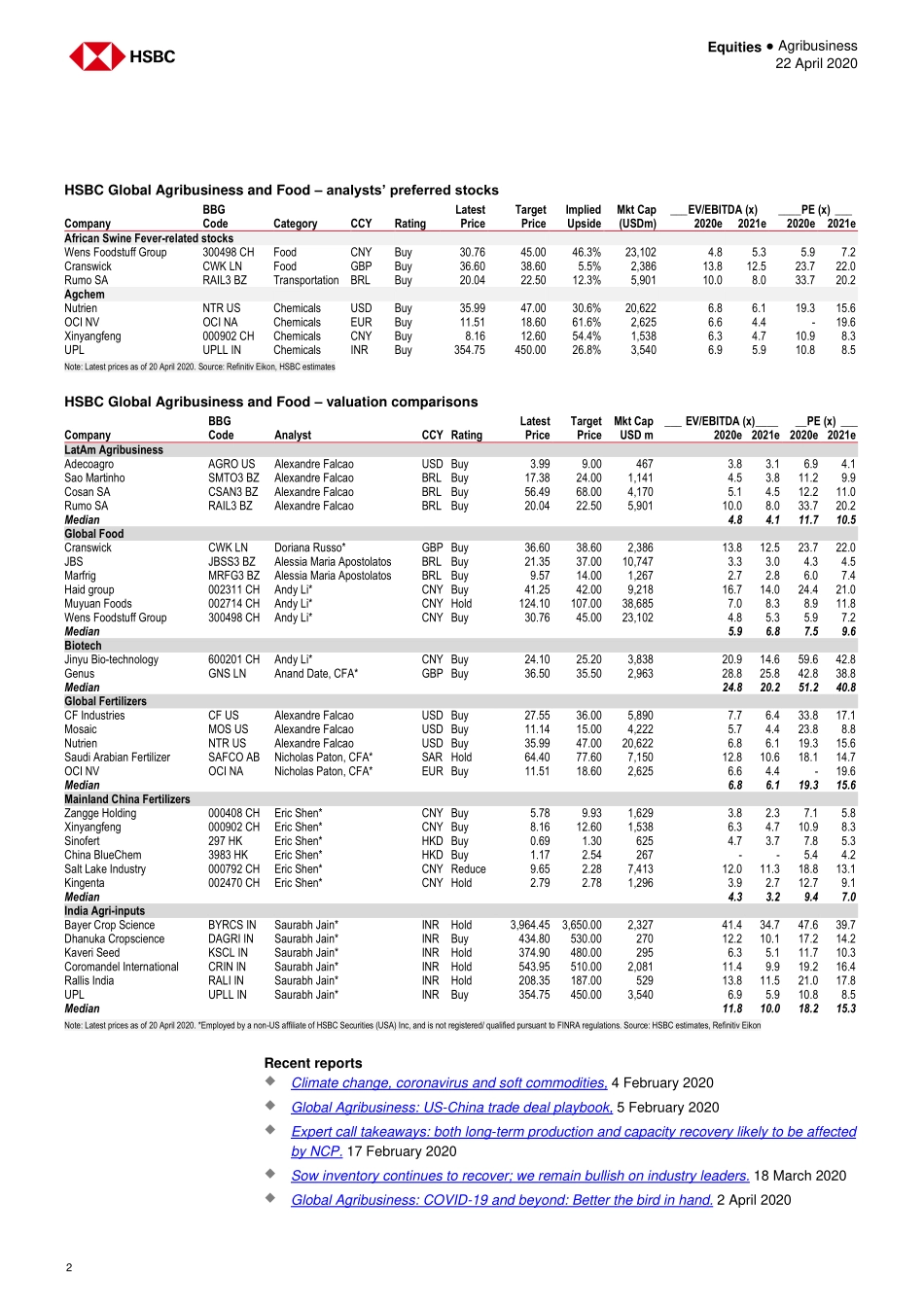

Disclosures&DisclaimerThisreportmustbereadwiththedisclosuresandtheanalystcertificationsintheDisclosureappendix,andwiththeDisclaimer,whichformspartofit.Issuerofreport:HSBCSecurities(USA)IncViewHSBCGlobalResearchat:https://www.research.hsbc.comTHISCONTENTMAYNOTBEDISTRIBUTEDTOMAINLANDCHINACOVID-19disruptionsinagribusinesslooklargelymanageableWehighlightourpreferredstocksinthespace–defensiveand/ordeeplyundervaluednamesWelikeASF-relatedstocks(Wens,Cranswick,Rumo)andoversoldagchemnames(NTR,UPL,OCI,Xinyangfeng)AgribusinessPlaybook:Focusonbottom-upideasCOVID-19hasaffectedsomepartsoftheagriculturevaluechain,buttheessentialnatureofthebusinessappearstohavekeptthedisruptiontomanageablelevels.Asthesituationisfluid,weshiftthespotlighttoabottom-upapproachtoinvestments.Ourpreferredstocksinthespacehaveoneormoreofthesethreefactorsweseeasneededtodeliversharepriceoutperformance:defensivecharacteristics,solidstructuraltrendanddeeplyundervaluedmultiples.Africanswinefever(ASF)remainsacentraltheme;thereisnowstrongevidenceofhogherdrecoveryinmainlandChina,whichshouldbenefitWensFoods,CranswickandRumo.Althoughtheirsharepriceshaverecoveredinthepastmonth,valuationsforoursevenpreferredstocksremainatbelowtheirhistoricalorrecentaverages(Page2).WensFoods,aleadingmeatproducerinmainlandChina,islikelytoseeitsmarketshareinthehogindustrygrowexponentiallythrough2025e,basedonourestimates.Cranswick,UK’sleadingfoodcompany,isbenefittingfromaperiodofhighdemandgivenhigherconsumptionofmealsathomeandexportdemandfrommainlandChina.Rumo,thelargestrailtransportationcompanyinBrazil,isbenefittingfromfavorableFXratesandstrongsoybeandemandfrommainlandChinaduetosignificantlyhighcrushmarginsandlowsoyinventorylevels(lowestsinceNovember2013).Nutrien,theworld’slargestfertilizercompany,isseeingstrongdemandforcropinputproducts.Itsstaple-likeretailoperationcouldmitigatewholesaleweaknesstoalargeextent.UPL,thefifthlargestagchemcompanyglobally,isaconsistentindustryoutperformerwhosevaluationiscompellingwithstro...