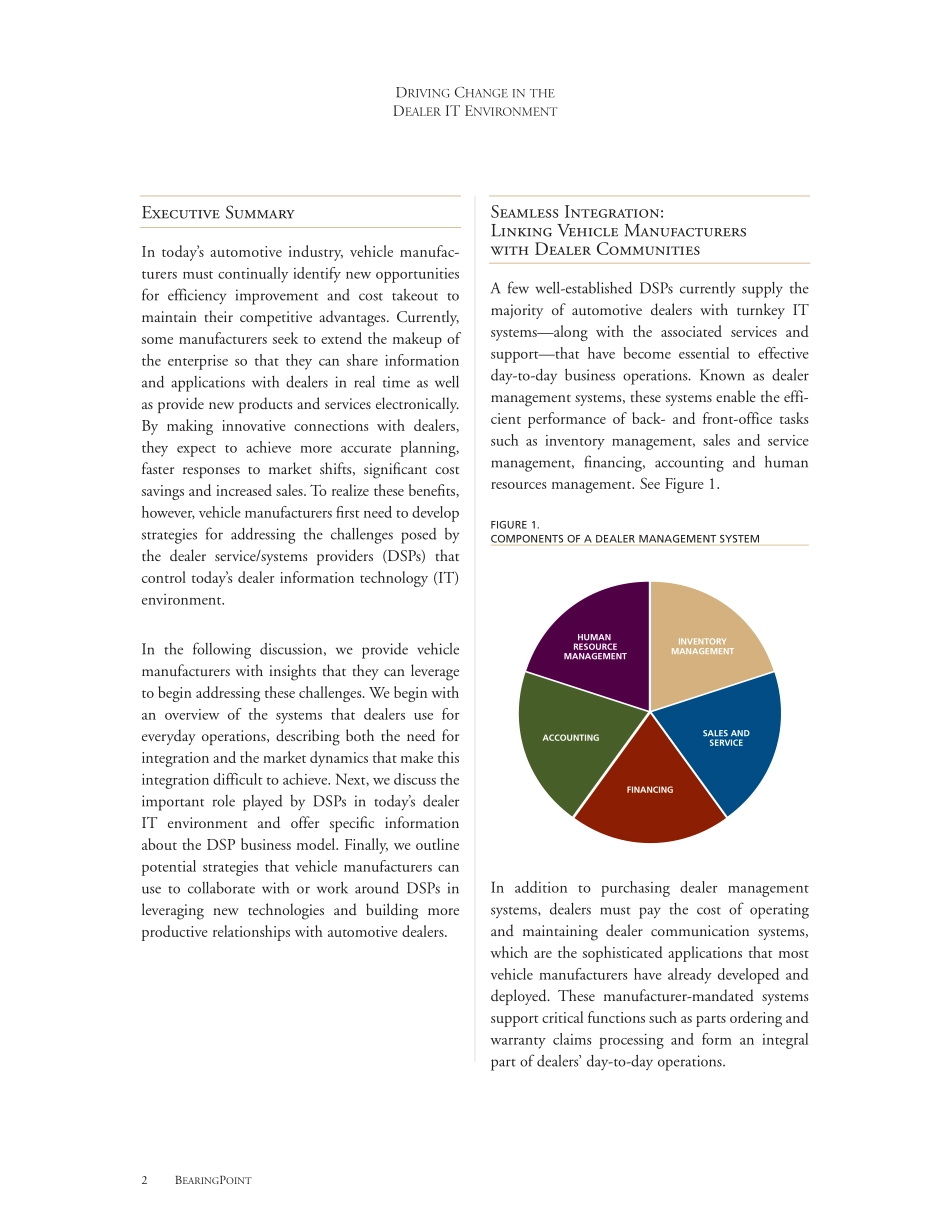

WhitePaper:AUTOMOTIVEANDTRANSPORTATIONDRIVINGCHANGEINTHEDEALERITENVIRONMENTWHITEPAPER1INTHISWHITEPAPER:1.ExecutiveSummary2.SeamlessIntegration:LinkingVehicleManufacturerswithDealerCommunities3.TheCost-DrivenDSPSupportModel•DealershipEnvironment•DealershipInstallation•OngoingSupport•EconomicModel•PricingModels4.AddressingtheChallengesofDSPs:SixStrategiesforVehicleManufacturers•Strategy1:LeveragetheInternet•Strategy2:DrivetheChange•Strategy3:DefineandExecuteaRoadMap•Strategy4:DriveStandards•Strategy5:ReengineerDealerCommunicationSystems•Strategy6:FocusonRevenue5.Conclusion:EstablishingaClearPathofValueDRIVINGCHANGEINTHEDEALERITENVIRONMENTDRIVINGCHANGEINTHEDEALERITENVIRONMENT2BEARINGPOINTExecutiveSummaryIntoday’sautomotiveindustry,vehiclemanufac-turersmustcontinuallyidentifynewopportunitiesforefficiencyimprovementandcosttakeouttomaintaintheircompetitiveadvantages.Currently,somemanufacturersseektoextendthemakeupoftheenterprisesothattheycanshareinformationandapplicationswithdealersinrealtimeaswellasprovidenewproductsandserviceselectronically.Bymakinginnovativeconnectionswithdealers,theyexpecttoachievemoreaccurateplanning,fasterresponsestomarketshifts,significantcostsavingsandincreasedsales.Torealizethesebenefits,however,vehiclemanufacturersfirstneedtodevelopstrategiesforaddressingthechallengesposedbythedealerservice/systemsproviders(DSPs)thatcontroltoday’sdealerinformationtechnology(IT)environment.Inthefollowingdiscussion,weprovidevehiclemanufacturerswithinsightsthattheycanleveragetobeginaddressingthesechallenges.Webeginwithanoverviewofthesystemsthatdealersuseforeverydayoperations,describingboththeneedforintegrationandthemarketdynamicsthatmakethisintegrationdifficulttoachieve.Next,wediscusstheimportantroleplayedbyDSPsintoday’sdealerITenvironmentandofferspecificinformationabouttheDSPbusinessmodel.Finally,weoutlinepotentialstrategiesthatvehiclemanufacturerscanusetocollaboratewithorworkaroundDSPsinleveragingnewtechnologiesandbuildingmoreproductiverelationsh...