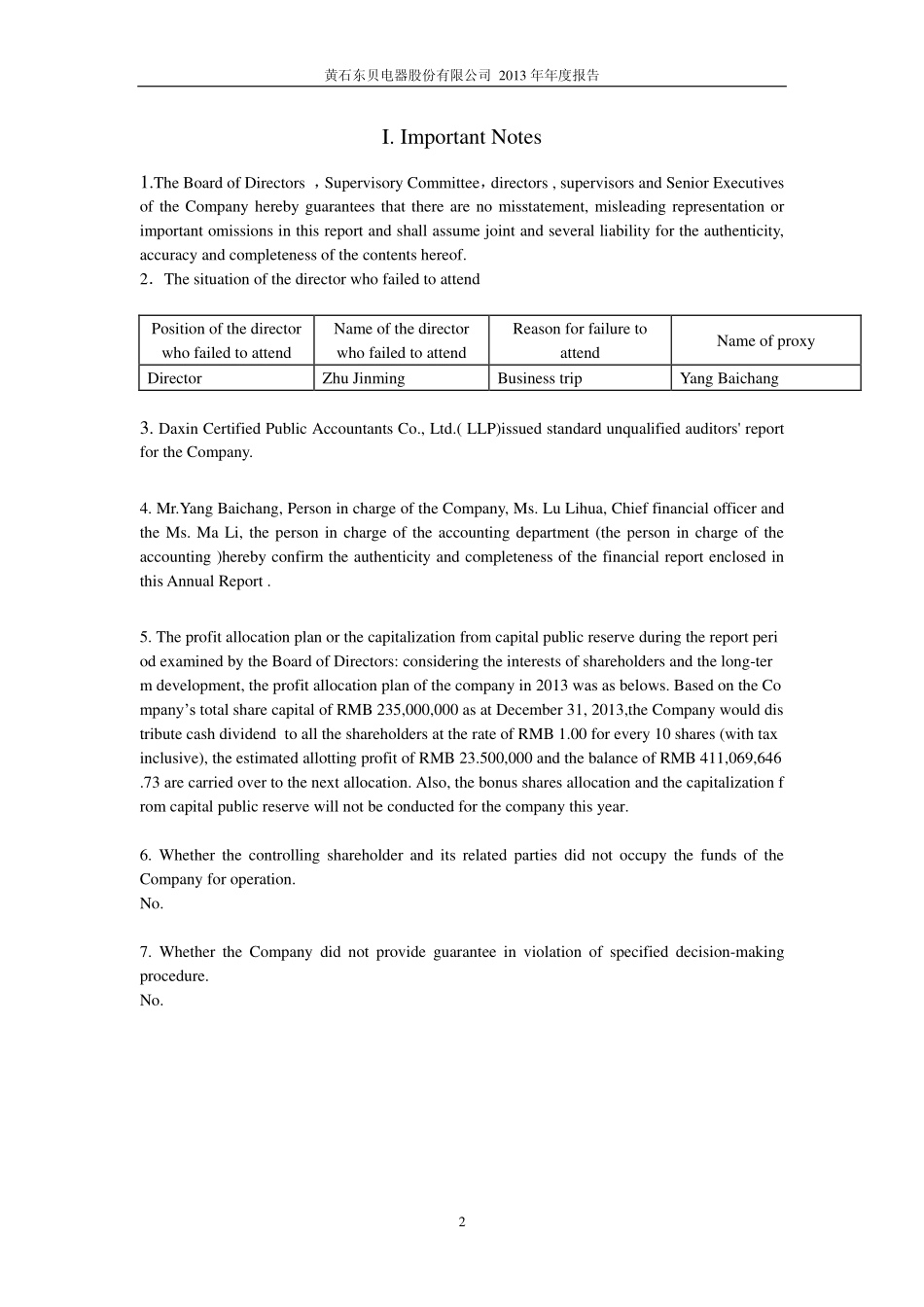

黄石东贝电器股份有限公司2013年年度报告1HuangshiDongbeiElectricalApplianceCo.,Ltd.9009562013AnnualReport黄石东贝电器股份有限公司2013年年度报告2I.ImportantNotes1.TheBoardofDirectors,SupervisoryCommittee,directors,supervisorsandSeniorExecutivesoftheCompanyherebyguaranteesthattherearenomisstatement,misleadingrepresentationorimportantomissionsinthisreportandshallassumejointandseveralliabilityfortheauthenticity,accuracyandcompletenessofthecontentshereof.2.ThesituationofthedirectorwhofailedtoattendPositionofthedirectorwhofailedtoattendNameofthedirectorwhofailedtoattendReasonforfailuretoattendNameofproxyDirectorZhuJinmingBusinesstripYangBaichang3.DaxinCertifiedPublicAccountantsCo.,Ltd.(LLP)issuedstandardunqualifiedauditors'reportfortheCompany.4.Mr.YangBaichang,PersoninchargeoftheCompany,Ms.LuLihua,ChieffinancialofficerandtheMs.MaLi,thepersoninchargeoftheaccountingdepartment(thepersoninchargeoftheaccounting)herebyconfirmtheauthenticityandcompletenessofthefinancialreportenclosedinthisAnnualReport.5.TheprofitallocationplanorthecapitalizationfromcapitalpublicreserveduringthereportperiodexaminedbytheBoardofDirectors:consideringtheinterestsofshareholdersandthelong-termdevelopment,theprofitallocationplanofthecompanyin2013wasasbelows.BasedontheCompany’stotalsharecapitalofRMB235,000,000asatDecember31,2013,theCompanywoulddistributecashdividendtoalltheshareholdersattherateofRMB1.00forevery10shares(withtaxinclusive),theestimatedallottingprofitofRMB23.500,000andthebalanceofRMB411,069,646.73arecarriedovertothenextallocation.Also,thebonussharesallocationandthecapitalizationfromcapitalpublicreservewillnotbeconductedforthecompanythisyear.6.WhetherthecontrollingshareholderanditsrelatedpartiesdidnotoccupythefundsoftheCompanyforoperation.No.7.WhethertheCompanydidnotprovideguaranteeinviolationofspecifieddecision-makingprocedure.No.黄石东贝电器股份有限公司2013年年度报告3TableofContentsI.ImportantNotes,Contents&DefinitionII.CompanyprofileIII.SummaryofAccountingDataandFinancialindexesIV.Rep...